Primerica’s Strong Growth Signals Positive Future for Investors

Primerica, a Zacks Rank #1 (Strong Buy), offers financial services targeted at middle-income families in the United States and Canada. The company’s goal is to empower families with informed financial choices that lead to financial independence.

Stock Performance and Market Trends

Currently, PRI stock is showing strong performance, supported by a rally in the overall financial sector. This upward movement indicates a healthy outlook as we enter the new year. Increased trading volume hints at growing investor interest as more buying pressure builds around this top-rated stock.

As part of the Zacks Insurance – Life Insurance industry group, Primerica ranks in the top 36% out of over 250 industries. Given the group’s upper-tier ranking, it is anticipated to outperform the market over the next three to six months, similar to its past performance.

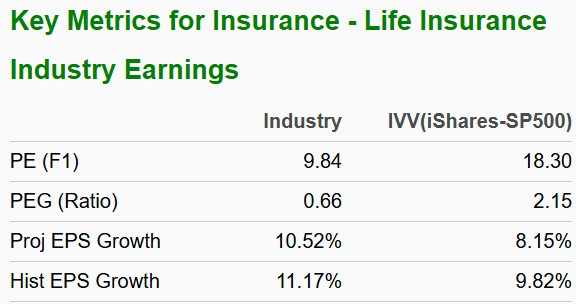

The metrics for the life insurance industry group are encouraging:

Image Source: Zacks Investment Research

Historical research shows that around half of a stock’s price growth is influenced by its industry classification. In fact, top-rated industries outperform others by more than a ratio of 2 to 1. Investing in stocks from leading industry groups enhances the chances of market success.

Understanding Primerica’s Business Model

Primerica provides a variety of products, including term life insurance, mutual funds, retirement plans, and variable annuities. Its representatives utilize a unique financial needs analysis (FNA) tool to show potential clients how their offerings could help them achieve their financial goals.

Furthermore, Primerica extends its offerings to mortgage loans, homeowners’ insurance, prepaid legal services, and identity theft protection. Established in 1927 and based in Duluth, Georgia, the company markets its products through licensed sales representatives.

The growth in issued policies and rising equity markets have contributed positively to its performance. Recently, Primerica has sold off non-core assets to enhance its profitability.

With a strong demand for protective financial products, Primerica is well-situated to meet the needs of middle-income consumers seeking financial security in today’s market.

Earnings Performance and Projections

Primerica has a solid track record of earnings, having beaten estimates in two of its last three quarters, with an average earnings surprise of 4.89% over the last four quarters.

In November, the company announced third-quarter earnings of $5.68 per share, surpassing the consensus estimate of $4.78 by 18.83%. Its revenues for the quarter reached $770.1 million, exceeding expectations by 4.1%.

Analysts remain optimistic about the stock, raising fourth-quarter earnings estimates by 1.02% over the past two months. The Q4 Zacks Consensus Estimate now stands at $4.96 per share, representing an expected growth of 16.7% compared to the same period last year, on revenue growth of 5.9% (estimated at $767.2 million).

Image Source: Zacks Investment Research

Analyzing Technical Trends

Over the last nine months, Primerica’s stock has appreciated nearly 35%. Such a performance is typical for stocks experiencing strong upward trends. This pattern suggests that Primerica is a stock worth considering for those looking to enhance their portfolios.

Image Source: StockCharts

The 200-day moving average is showing a rising trend, indicating a series of higher highs throughout the year. With strong fundamentals and encouraging technical indicators, PRI stock is well-positioned for continued performance.

Research indicates a solid connection between short-term stock performance and the trend in earnings estimates. As Primerica sees positive revisions, and if it continues to exceed earnings expectations, it can maintain its upward trajectory.

Final Thoughts

Supported by a strong industry position and a history of exceeding earnings expectations, PRI stock emerges as an appealing investment option. The combination of solid fundamentals and favorable technical trends makes a compelling case for adding shares to investment portfolios.

Additionally, Primerica offers a dividend of $3.60 (1.24%), adding further appeal for potential investors. Recent positive revisions to earnings estimates should also help mitigate any sudden downturns in the stock price. If you haven’t already, consider adding PRI to your investment watchlist.

Explore Future Energy Opportunities

The demand for electricity continues to rise dramatically while the world shifts away from fossil fuels like oil and natural gas. Nuclear energy is emerging as a key solution.

Recently, leaders from the United States and 21 other countries committed to tripling global nuclear energy capacities. This transition could yield significant profits for companies in the nuclear sector, especially for early investors.

Our report, Atomic Opportunity: Nuclear Energy’s Comeback, identifies critical players and technologies that drive this opportunity, highlighting three standout stocks ready to take advantage.

Download Atomic Opportunity: Nuclear Energy’s Comeback for free today.

For more recommendations from Zacks Investment Research, download our report, 7 Best Stocks for the Next 30 Days.

Primerica, Inc. (PRI): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.