The AI Revolution: Uncovering Robotics Investment Opportunities

Subheading: A Brief History of Market Trends and the Tech Comeback

Many investors on Wall Street are now aware of how artificial intelligence is reshaping the market. Remember the challenging bear market of 2022? Stock prices were plummeting, inflation hit 40-year highs, and the Federal Reserve was raising interest rates. Amid this uncertainty, tech stocks began to rebound dramatically, largely fueled by the groundbreaking launch of OpenAI and Microsoft’s (MSFT) ChatGPT AI Chatbot.

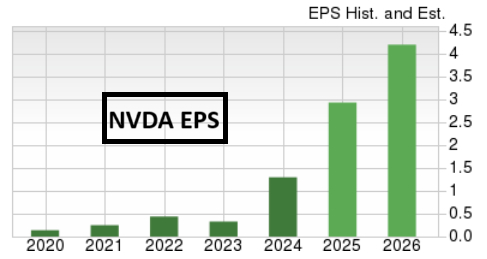

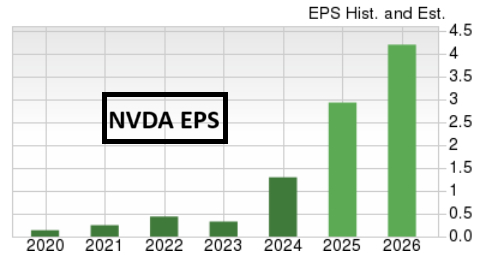

No company has thrived during this AI boom quite like Nvidia (NVDA), which reported triple-digit earnings increases for six consecutive quarters, solidifying its position as one of the world’s largest corporations.

Image Source: Zacks Investment Research

While Wall Street is captivated by large language models (LLMs) such as ChatGPT and Alphabet’s (GOOGL) Gemini, it’s important to acknowledge that AI’s impact extends far beyond these applications. Investors should watch three emerging robotics stocks:

Serve Robotics: Innovating Food Delivery

In cities like Miami, it’s common to encounter small Serve Robotics (SERV) robots making food deliveries. This company creates AI-driven, low-emission sidewalk delivery robots that aim to make deliveries more sustainable and affordable. Founded in 2021 as a spinoff from Uber (UBER), Serve has successfully completed thousands of deliveries with partners like Uber Eats and 7-Eleven.

By leveraging its Uber connection, Serve has formed a partnership with Shake Shack (SHAK) and Uber Eats for food delivery. Their innovative approach eliminates the need for human couriers; instead, a small robot autonomously transports meals to your doorstep, enhancing both cost-effectiveness and efficiency.

Customers receive real-time updates via the Uber app, allowing them to track the robot’s arrival. Once the robot reaches its destination, users enter a passcode to unlock the delivery box and retrieve their orders. Analysts forecast a 51.35% increase in earnings next quarter and a 38.01% rise for the full-year 2025 for SERV.

Image Source: Zacks Investment Research

Palladyne AI: Advancing Workplace Safety and Efficiency

Palladyne AI (PDYN), previously known as Sarcos Robotics, focuses on creating AI software that allows robots to perceive, learn, and respond to their environment with minimal input. Their technology spans various sectors, including manufacturing, logistics, and defense.

While PDYN may lack strong fundamentals currently, it represents a speculative but potentially lucrative opportunity in robotics. Over the last year, the stock has soared nearly 2,000%. At present, PDYN is experiencing a pullback towards its 50-day moving average, creating a favorable risk-reward scenario, reminiscent of its previous surge that tripled its stock value in just weeks.

Image Source: TradingView

Tesla Optimus: Unlocking Multi-Trillion Dollar Potential

In the realm of AI and robotics, training is key, and Tesla (TSLA) stands at the forefront with the most substantial real-world AI training data. Tesla vehicles have accumulated millions of miles using full self-driving technology, and the company operates the largest AI training cluster globally. Optimus, Tesla’s humanoid robot, is already engaged in tasks on production floors and is set for mass production in 2025, with deliveries projected for 2026.

Elon Musk, Tesla’s CEO, known for ambitious predictions, believes that Optimus could generate over $10 trillion in revenue, making it the company’s most significant product to date.

Conclusion

The rapid advancement of AI technology indicates the best investment opportunities lie in real-world applications and robotics. As these machines enhance efficiency and disrupt traditional businesses, they will reshape industries in the near future.

Free Today: Profiting from The Future’s Brightest Energy Source

With the growing demand for electricity and a push to reduce reliance on fossil fuels, nuclear energy represents a promising alternative. Leaders from the US and 21 other nations have recently committed to tripling global nuclear energy capacity.

This bold transition may present significant profits for nuclear-related stocks for investors who act swiftly. Our report, Atomic Opportunity: Nuclear Energy’s Comeback, investigates the key players and technologies in this sector, spotlighting three standout stocks poised to benefit the most.

Download Atomic Opportunity: Nuclear Energy’s Comeback for free today.

For the latest stock recommendations from Zacks Investment Research, you can also download 7 Best Stocks for the Next 30 Days. Click to obtain this free report.

Microsoft Corporation (MSFT): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Tesla, Inc. (TSLA): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Serve Robotics Inc. (SERV): Free Stock Analysis Report

Shake Shack, Inc. (SHAK): Free Stock Analysis Report

Uber Technologies, Inc. (UBER): Free Stock Analysis Report

Palladyne AI Corp. (PDYN): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.