DeepSeek’s AI Model: A Cost Analysis Shakes Up the Tech Sector

Did DeepSeek’s artificial intelligence (AI) model really cost less than $6 million to create? If true, it raises questions about why major tech companies plan to spend tens of billions of dollars this year, alongside President Trump’s recent announcement of the massive $500 billion Stargate project.

However, a recent report casts doubt on DeepSeek’s claims, suggesting the company may have actually spent over $500 million on hardware alone. Investors will need time to understand the implications of DeepSeek’s AI development for the tech industry.

Start Your Mornings Smarter! Wake up with Breakfast News in your inbox every market day. Sign Up For Free »

One prominent stock facing challenges due to these developments is Nvidia (NASDAQ: NVDA). Known for its essential chips in AI development, Nvidia has seen significant losses in market capitalization following the news surrounding DeepSeek. Is this just the beginning of a larger decline?

Why DeepSeek’s Claims Should Be Taken with Caution

In the U.S., top tech talent works for leading companies like Nvidia, Microsoft, Apple, and others. It seems unlikely that a Chinese start-up that launched in 2023 could outperform these established giants.

It is probable that DeepSeek has significantly underestimated the costs of developing its AI model. Investors don’t have audited financial statements to clarify expenses. Additionally, OpenAI, the company behind ChatGPT, has claimed that DeepSeek may have improperly used its AI models in developing its chatbot. This could explain the lower development costs and similar results.

For now, it’s premature to assume that DeepSeek operates with significantly greater efficiency than the major players who invest billions.

Nvidia’s Stock Faces Uncertain Future

Should DeepSeek’s AI model turn out to be more illusion than reality, it might not lead to a substantial recovery in Nvidia’s share value. The situation highlights concerns about AI-related expenditures and whether companies are investing too aggressively in this sector.

This could prompt businesses to reassess their tech strategies, especially as concerns over possible tariffs loom large. Companies might feel compelled to adjust their AI spending due to the unpredictable economic climate.

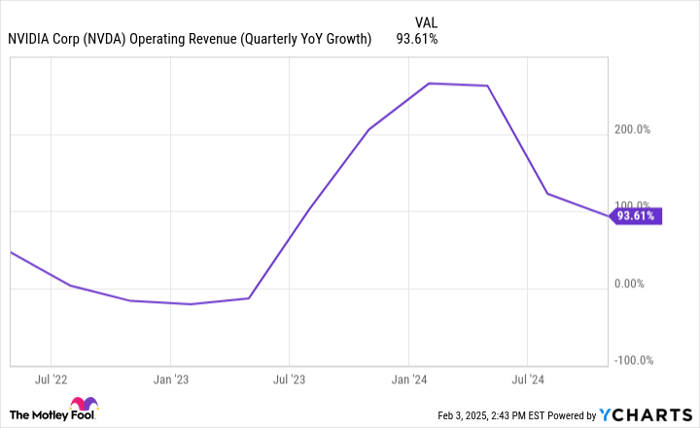

For a rapidly growing company like Nvidia, any slowdown in demand could expose its stock to further corrections.

NVDA Operating Revenue (Quarterly YoY Growth) data by YCharts

Evaluating Nvidia as a Investment Opportunity

As of Monday, Nvidia’s stock opened the year down 12%. Currently, based on analyst estimates, it trades at 28 times its anticipated profits, which remains reasonable for a leading tech firm. However, if estimates decline, its current valuation may not appear as favorable.

For long-term investors, today could be a good opportunity to purchase Nvidia stock. The company boasts strong profit margins, a solid market position, and the current lower valuation suggests it may be an ideal time to consider this investment.

Don’t Miss Out on a Potential Investment Opportunity

Have you ever felt you missed your chance to invest in successful stocks? Here’s your opportunity.

Occasionally, our expert analysts recommend a “Double Down” stock that they believe is poised for rapid growth. If you think you’ve missed your opportunity, now might be the perfect time to invest before prices rise. Consider these past performance results:

- Nvidia: if you had invested $1,000 when we doubled down in 2009, it would be worth $333,669!*

- Apple: if you had invested $1,000 when we doubled down in 2008, it would be worth $44,168!*

- Netflix: if you had invested $1,000 when we doubled down in 2004, it would be worth $547,748!*

Right now, we’re issuing “Double Down” alerts for three promising companies, and another chance may not come again soon.

Learn more »

*Stock Advisor returns as of February 3, 2025

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Microsoft, and Nvidia. The Motley Fool also recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. For more details, please refer to our disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.