Super Micro Computer Set to Post Strong Q2 Results amid AI Boom

Super Micro Computer, Inc. (SMCI) will release its second-quarter fiscal 2025 report on February 11.

Get the latest updates from all quarterly reports: Check Zacks Earnings Calendar.

Revenue Expectations and Earnings Forecast

For its fiscal second quarter, Super Micro anticipates revenues between $5.5 billion and $6.1 billion. The Zacks Consensus Estimate stands at $5.8 billion, reflecting an impressive growth rate of 58.3% compared to the same quarter last year.

The company expects non-GAAP earnings per share to fall between 56 cents and 65 cents. The Zacks Consensus Estimate for earnings is 62 cents per share, which indicates a 10.7% increase from last year’s performance. Notably, this figure has been adjusted upward by a penny in the past 60 days.

Image Source: Zacks Investment Research

Performance Review of Past Earnings

Super Micro Computer has successfully beaten the Zacks Consensus Estimate three out of the last four quarters but did miss one time. The average surprise in earnings is 0.6%.

Insights on Price and EPS Surprise

Prospects for Upcoming Earnings

Currently, our model does not guarantee a positive earnings surprise for Super Micro. A combination of a positive Earnings ESP and a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold) improves chances of an earnings beat, which is not applicable here. Super Micro holds a Zacks Rank of #3 but has an Earnings ESP of 0.00%. Access our Earnings ESP Filter to find top stock picks.

Key Factors Influencing SMCI’s Q2 Performance

The company has benefitted from the growing demand for its server and storage solutions due to the ongoing artificial intelligence (AI) boom. An increase in original equipment manufacturer (OEM) orders has heightened the demand for its AI servers, which is expected to positively impact results for the quarter.

SMCI’s investment in high-quality, optimized Direct Liquid Cooling solutions is anticipated to enhance quarterly performance. The firm is enhancing its manufacturing capabilities to fulfill the growing needs for AI and enterprise rack-scale liquid-cooled solutions.

Moreover, strong traction with major data centers and cloud service providers, thanks to its advanced AI platforms, is likely to benefit SMCI. Their innovative production systems offer efficient rack-scale solutions that provide a competitive edge to customers.

These elements are expected to positively influence the performance of the Server & Storage Systems segment. Additionally, Super Micro’s ongoing partnership with NVIDIA Corporation (NVDA) is helping expand its infrastructure solutions for 5G and telecom workloads, contributing to overall growth.

The Subsystems & Accessories segment is projected to perform well due to strong demand for its H100-based systems and AI inferencing technologies.

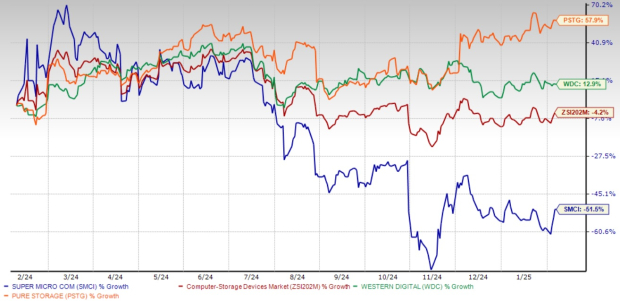

Analyzing SMCI Stock Performance

Over the past year, Super Micro Computer’s shares have decreased by 51.5%, significantly underperforming against the Zacks Computer – Storage Devices industry, which declined by 4.2%. Comparatively, its competitors, Western Digital (WDC) and Pure Storage (PSTG), have seen gains of 12.9% and 57.9%, respectively.

Overview of One-Year Price Trends

Image Source: Zacks Investment Research

Currently, SMCI presents a value opportunity for investors, trading at a forward price-to-earnings (P/E) ratio of 11.75X compared to the industry average of 16.06X.

Current Valuation Metrics

Image Source: Zacks Investment Research

Investment Outlook for SMCI Stock

Super Micro Computer is positioning itself as a key player in AI infrastructure, with the aim of driving sustained growth through its advancements in liquid cooling technology and manufacturing capabilities.

The announcement to enhance production of its new AI data server, featuring NVIDIA’s Blackwell platform, is expected to boost revenue in the future. The company’s firm cash flows, improving margins, and rising AI demand solidify its position as an attractive investment.

Conclusion: Recommended Hold on SMCI Stock

Considering its solid fundamentals, favorable valuation metrics, and promising prospects in the AI infrastructure sector, holding Super Micro Computer shares appears to be a sound strategy for investors. The company is well-equipped to continue its growth trajectory as demand for AI solutions persists.

Discover the Future of Energy Investments

Electricity demand is skyrocketing while global efforts to reduce reliance on fossil fuels are gaining momentum. Nuclear energy emerges as a strong candidate for replacement.

Recently, leaders from the U.S. and 21 other nations committed to tripling the world’s nuclear energy capacity. This ambitious strategy could present lucrative opportunities for early investors in nuclear-related stocks.

Our report, Atomic Opportunity: Nuclear Energy’s Comeback, highlights key players and technologies to watch, including three standout stocks ready to capitalize on this trend. Download the report for free today.

Stay informed with Zacks Investment Research’s latest recommendations. Get your free report on the 7 Best Stocks for the Next 30 Days.

Western Digital Corporation (WDC): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Super Micro Computer, Inc. (SMCI): Free Stock Analysis Report

Pure Storage, Inc. (PSTG): Free Stock Analysis Report

For the full article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.