The jobs report comes in light but still healthy … how Mexican/Canadian tariffs could affect your portfolio … a leg down in the S&P? … Bitcoin is headed to $120K

This morning, we learned that the U.S. economy added 143,000 jobs in January, less than the 169,000 jobs forecasted by economists.

However, the unemployment rate edged down from 4.1% to 4.0% due to an increase in job seekers.

The big question is “how will this influence the Fed and its interest rate policy?”

In short, there’s nothing in today’s reading that suggests the Fed needs to move quickly to cut rates. We are seeing slight cooling in the labor market, but no real weakness.

In fact, when we dig deeper into the report to look at wages, there are hints of inflation. Whereas the expectation was for hourly earnings to climb 0.3% for the month and 3.7% on the year, the numbers came in at 0.5% and 4.1%.

And in other inflation news from this morning, the University of Michigan’s consumer sentiment report contained data that the Fed is sure to notice.

Here’s MarketWatch:

Americans’ expectations for overall inflation over the next year jumped to 4.3% in February from 3.3% in the prior month. That’s highest since November 2023 and only the fifth time in 14 years there was such a large one-month gain.

Bottom line: An employment report that was “solid” at worst, along with growing inflation concerns, means we shouldn’t be looking for any imminent rate cuts from the Fed.

There is one eyebrow-raising detail from this morning’s report just to put on your radar

An enormous downward revision to the 2024 payrolls level.

The government reduced the jobs count by 589,000.

Not that you need the reminder, but we should take whatever the government tells us with an enormous grain of salt.

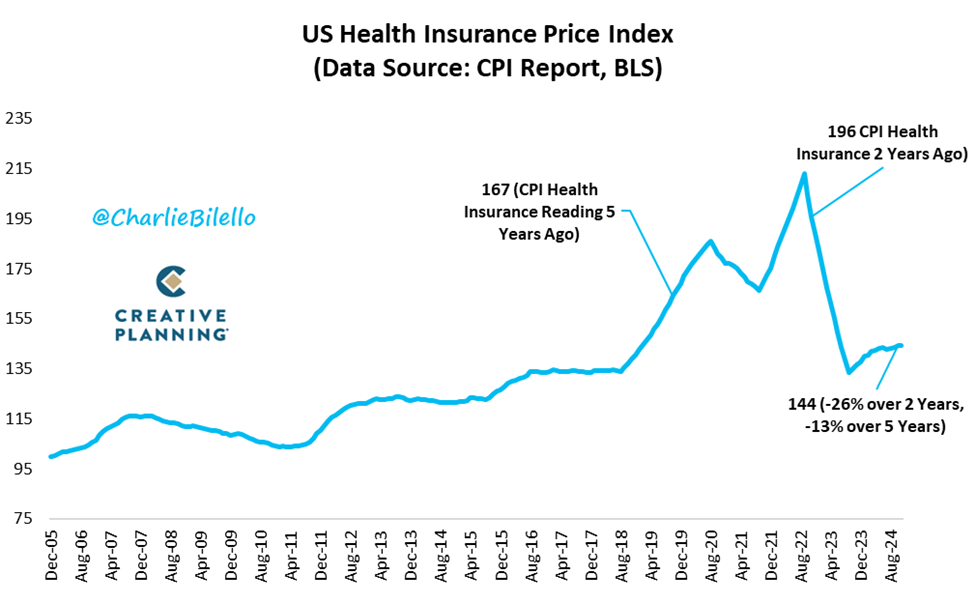

As another quick illustration of this point, consider the government’s data on U.S. health insurance prices.

As you can see below, they would have us believe that insurance costs have pulled back 26% over the last two years. We’re looking at the U.S. Health Insurance Price Index.

Source: @CharlieBilello

But as this next chart shows us, what’s been happening with the average family’s health insurance premium?

Here you go…

Source: @CharlieBilello

At the end of the day, the truth is found inside your wallet.

The threat of tariffs on Mexican/Canadian goods is temporarily off the table, but what’s the potential fallout if they return?

For insights, let’s turn to Thomas Yeung, the lead analyst in Eric Fry’s flagship newsletter, Investment Report.

In Tuesday’s Weekly Update, Thomas dug into the details; here’s how the export numbers shake out for our two neighbors:

Canada’s exports to the U.S. ($438 billion in 2022) …

- Petroleum, petroleum products, and electricity: 37.4%

- Motor vehicles and parts: 10.4%

- Machinery: 6.7%

- Wood products: 3.9%

- Plastics: 3.7%

Mexico’s exports to the U.S. ($421 billion in 2022) …

- Machinery: 40.0%

- Motor vehicles and parts: 22.8%

- Petroleum, petroleum products, and electricity: 6.4%

- High-end electronics: 4.8%

- Beverages: 2.5%

That means across-the-board tariffs on Canada and Mexico (if enacted in a month) will have a significant stagflationary effect on consumers, where prices rise without an increase in productivity or demand.

Natural gas and electricity prices will move fastest, followed by goods like groceries, gasoline, and vehicles.

Thomas outlines how the proposed tariffs could affect specific stocks. Here’s an abbreviated summation of his analysis.

For oil companies:

American-focused producers will benefit at the cost of Canadian ones, assuming no retaliatory tariffs.

For commodities plays:

Tariffs will have an uneven effect.

On the one hand, potash makers like The Mosaic Co. (MOS) could face higher costs since five of the company’s six potash mines are located in Canada.

On the other hand, firms like timberland owner Rayonier Inc. (RYN) will benefit as they are the U.S. alternative to Canadian imports.

For metals miners:

Again, we see mixed effects.

Aluminum producers could see some negative impacts, since some will need to reroute their Australian production to America.

However, gold miners will benefit from a rush to the safe-haven metal.

Firms like Freeport-McMoRan Inc. (FCX) will also gain, as it is the largest American miner and refiner of copper.

Now, Thomas and Eric believe there’s a good chance that we avoid tariffs. And if some are imposed, they’re likely to be heavily watered down.

This is why their takeaway – for now – is to hold onto your stocks that have tariff exposure. “Wait and see” is your best play today.

To learn about joining Thomas and Eric in Investment Report, click here.

For short-term traders, the broad market’s next move is likely lower

The reason, according to master trader Jeff Clark, is too much bullish enthusiasm.

For newer Digest readers, Jeff is a market veteran with more than four decades of experience. In his service, Jeff Clark Trader, he profitably trades the markets regardless of direction – up, down, or sideways. He uses a suite of momentum indicators and moving averages to provide clues about where stocks are going next.

A few days ago, one of Jeff’s favorite broad market indicators pointed toward “down” as our next move.

After highlighting the market’s steep selloff in the wake of last week’s DeepSeek now, Jeff added:

Stocks would not have been so vulnerable to a large decline if investor sentiment hadn’t been so overwhelmingly optimistic.

For example, last Friday, the CBOE Put/Call ratio (CPC) closed at 0.76. That’s an indication of investor exuberance, which often warns of a potential decline.

The CBOE Put/Call (CPC) ratio measures investor sentiment (a contrary indicator) by taking the total volume of put options traded on a given day and dividing it by the total number of call options.

Whenever the ratio spikes above 1.20, it indicates traders are rushing to buy put options and make bearish bets – which is bullish from a contrarian standpoint.

When the ratio drops below 0.80, traders are aggressively buying call options and betting on an upside move – which is ultimately bearish.

As you can see below, the Put/Call Ratio clocks in at 0.775 as I write Friday morning.

Source: TradingView

Back to Jeff for his bottom line on what this indicator’s level means today:

Despite all the volatility this week, traders were still jumping over themselves to buy call options.

It’s rare for the stock market to sustain any sort of a rally when the CPC is this low.

So, while investors might be breathing a sigh of relief that the market has rallied back from the DeepSeek decline, traders ought to be looking over their shoulders right here.

Before you bail on the market, let’s remember context

Pullbacks are going to play a greater role in 2025’s market than they did in 2024. That’s usually what happens when valuations are elevated, more households have been lured into a late-cycle market, and “risk on” mode rules the day.

But our hypergrowth expert Luke Lango still believes we’re in for a bullish outcome this year…with a caveat.

Let’s jump to his Daily Notes in Innovation Investor from earlier this week:

More volatility is coming. We’re not sure when. But it is coming.

That’s why we’re trimming on rips. But we will also plan to buy again on the next dip.

Remember: That’s the dance we’re going to do this year. Two steps forward. One step back. Buy on dips. Trim on rips.

Follow that strategy, and we think we’ll actually have a lot of fun – and score a lot of profits – this year.

This is a good reminder to check your expectations and tolerance for risk.

Are you prepared for any of your positions (and/or broader portfolio) to dip?

What if that dip is 2X larger than your expectations? Do you have a plan if that happens?

Specifically, will you ride through such pullbacks and/or accumulate more shares…or are you in some speculative trades that will require stop-losses to protect your capital?

Knowing what you’re going to do ahead of time is the single best way to avoid making a kneejerk decision you’ll later regret.

On that note, here are some wise words from far greater minds than mine:

- “The time to repair the roof is when the sun is shining.” – President John F. Kennedy

- “By failing to prepare, you are preparing to fail.” – Benjamin Franklin

- “A good plan today is better than a perfect plan tomorrow.” – General George S. Patton

- “Risk comes from not knowing what you’re doing.” – Warren Buffett

Before we sign off, a quick note on crypto and altcoins

Last week, we highlighted analysis from Jeff suggesting Bitcoin’s next move would be down.

It was – but Jeff is telling short-term traders that the set-up is now bullish:

We got that pullback [that my indicators suggested] last weekend…

Bitcoin tumbled all the way down to $92,000, tagging its support line, and hitting my initial downside target.

Since then, the tariff headlines have mostly been resolved – at least temporarily. And, Bitcoin has bounced…

Energy is building for a bigger move. And, since the tariff scare last weekend couldn’t cause a breakdown, my guess is that “bigger move” is now going to be to the upside.

Jeff believes we’ll see Bitcoin make a run back up to its resistance line at $106,000. And if it can push through, we’re likely moving to $120,000.

If that prediction sounds familiar, it’s because you also heard it from our crypto expert Luke Lango.

From yesterday’s Digest:

Luke predicts Bitcoin will soon resume its march higher, hitting $120K without much resistance.

And he sees our current crypto supercycle strengthening through 2025, with Bitcoin potentially hitting $200K by year-end.

But as we also noted yesterday, Luke believes smaller altcoins could see the greatest returns in 2025.

In fact, in his Great American Crypto Project presentation yesterday, Luke made the case for why select altcoins could explode 100x over the next several months, thanks to new White House policies.

You can catch a free replay of the event right here.

Have a good evening,

Jeff Remsburg