Nvidia’s AI Dominance Faces Challenges: Two Competitors on the Rise

Nvidia (NASDAQ: NVDA) has seen its shares skyrocket nearly eightfold since the release of OpenAI’s ChatGPT on November 30, 2022, culminating in a market cap of about $2.9 trillion today. For a time, Nvidia ranked as the world’s most valuable company, and its strong performance is expected to continue into 2025. Major tech firms are investing tens of billions in AI data centers that utilize Nvidia’s GPUs. However, recent insights suggest that Nvidia may face increased long-term risks that investors must recognize.

Start Your Mornings Smarter! Wake up with Breakfast News in your inbox every market day. Sign Up For Free »

New AI Rivals Emerge

Two AI competitors have recently enhanced their long-term outlooks, positioning them to potentially surpass Nvidia’s valuation in the next few years. Let’s explore these companies that could become more valuable than the semiconductor powerhouse within three years.

Image source: Getty Images.

1. Meta Platforms: A Key Customer of Nvidia

Meta Platforms (NASDAQ: META) ranks among Nvidia’s largest clients, with plans for $60 to $65 billion in capital expenditures in 2025. This includes a significant data center in Louisiana stocked with Nvidia GPUs. Meta’s ongoing focus on AI reflects its commitment to enhancing its platforms, including Facebook and Instagram, which are already benefiting from improved content algorithms based on principles from large language models.

The results indicate increased user engagement and effective ad targeting, evident in a 6% rise in ad impressions and a 14% increase in average ad prices last quarter. Moreover, generative AI holds promise for Meta by making content creation easier for users, which could boost overall engagement. The introduction of AI-enhanced marketing tools has already driven $5 billion in ad spending during the fourth quarter, with rapid adoption.

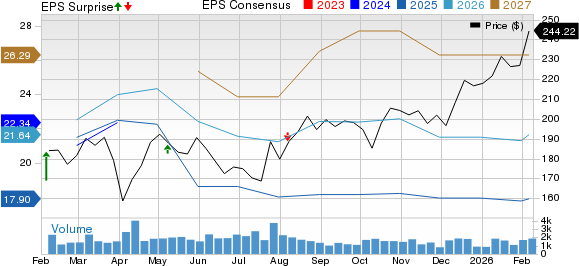

Long-term, Meta has substantial prospects with AI chatbots for WhatsApp and plans to integrate Meta AI into all its services, including its Ray-Ban Meta glasses. If Meta AI achieves 1 billion users, it may represent a new revenue stream. Currently, Meta’s stock trades at 27.8 times forward earnings estimates, making it look promising when evaluated against its enterprise value-to-forward EBITDA ratio of merely 15x. If the company’s significant investments yield expected returns, the current valuation seems justified.

By sustaining a price-to-earnings ratio in the mid-20s while achieving high-teen earnings growth, Meta could reach a valuation of $3 trillion in the next three years, possibly outpacing Nvidia if its stock stagnates.

2. Amazon: Rapidly Increasing Profitability

Amazon (NASDAQ: AMZN) has dramatically improved its profitability over the last two years, turning from negative free cash flow of $19.7 billion to a positive $47.7 billion recently. This trend shows no signs of slowing down.

The driving force behind this growth is Amazon Web Services (AWS), the largest public cloud platform. AWS is developing tools that support generative AI applications, strengthening its market position. Although Amazon faced challenges in 2023, it rebounded in 2024 with a staggering 60% increase in operating income, primarily due to improved margins as investments began to pay off.

Amazon is also enhancing profitability in its core e-commerce business. The popularity of its Prime membership continues fueling strong subscription revenue. Additionally, advertising revenue across its marketplace and Prime Video is rising, providing high-margin income. Improved logistics have further lowered shipping costs, pushing Amazon’s North American operating margin to 5.9%, while its International segment turned a profit by mid-2024.

Management plans to invest approximately $75 billion in capital expenditures for 2024, with even higher amounts slated for 2025. Amazon typically ramps up these investments before reducing spending to enjoy the fruits of its labor, leading to growth in free cash flow potential down the road.

At present, Amazon’s stock trades at about 59 times trailing free cash flow, slightly above its historical average of 50. This indicates that investors expect accelerated cash flow growth moving forward. As that surge materializes, a valuation of $3 trillion for Amazon in the next few years seems feasible, potentially surpassing Nvidia.

Should You Invest $1,000 in Nvidia Right Now?

Before deciding to invest in Nvidia, consider this:

The Motley Fool Stock Advisor team has identified what they believe to be the 10 best stocks for investors to buy now, and Nvidia was not included. Those recommended stocks could yield substantial returns in the upcoming years.

For context, had you invested $1,000 in Nvidia on April 15, 2005, following their recommendation, that investment would have grown to approximately $788,619!*

Stock Advisor offers a clear path to investment success, providing guidance on building a portfolio, consistent analyst updates, and two new stock picks each month. Since 2002, this service has more than quadrupled the return of the S&P 500.*

Learn more »

*Stock Advisor returns as of February 7, 2025

Randi Zuckerberg, a former marketing director at Facebook, and John Mackey, former CEO of Whole Foods Market, serve on The Motley Fool’s board of directors. Adam Levy has shares in Amazon and Meta Platforms. The Motley Fool also holds positions in and recommends Amazon, Meta Platforms, and Nvidia. For detailed disclosure, refer to The Motley Fool’s policy.

The opinions expressed here are solely those of the author and do not necessarily represent the views of Nasdaq, Inc.