Citigroup Upgrades Hershey: A Look at Investor Sentiment

On February 7, 2025, Citigroup revised its outlook for Hershey (WBAG:HSY) from Sell to Neutral.

Current Fund Sentiment Towards Hershey

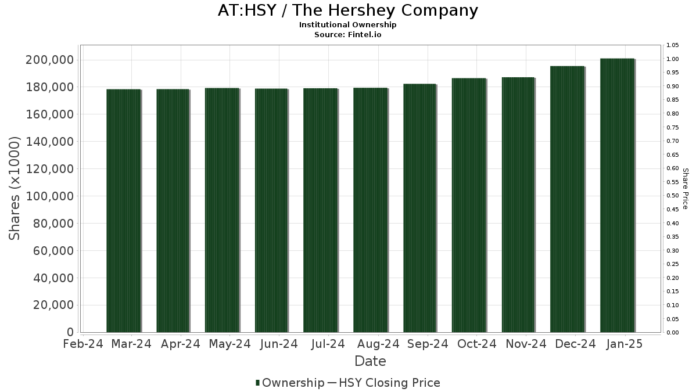

Currently, 2,164 funds and institutions hold shares in Hershey. This indicates a decrease of 23 fund owners or 1.05% compared to the previous quarter. The average portfolio weight for all funds invested in HSY stood at 0.29%, reflecting an increase of 0.83%. Over the last three months, total shares owned by institutions rose by 5.05% to reach 199,795K shares.

The Hershey Trust remains the largest shareholder, holding 54,612K shares, which represents 36.96% of the company. This ownership percentage has remained steady over the last quarter.

Capital International Investors has also increased its stake significantly, now owning 9,479K shares (6.42% ownership), up from 699K shares in its previous filing. This marks an impressive 92.62% increase. Their allocation in HSY grew by an astounding 1,218.86% in the last quarter.

JPMorgan Chase holds 4,701K shares (3.18%), a rise from 3,919K shares previously, which is a 16.64% increase. Their portfolio allocation in HSY also saw an extraordinary boost, rising by 1,204.28% last quarter.

The Vanguard Total Stock Market Index Fund (VTSMX) holds 4,678K shares, representing 3.17% ownership, showing a slight increase of 0.16% from its previous holdings (4,670K shares). However, this firm reduced its allocation in HSY by 1.86% last quarter.

Charles Schwab Investment Management increased its shares from 4,388K to 4,635K shares (3.14% ownership), marking a 5.34% increase. Conversely, they reported a significant decrease of 28.36% in their allocation to HSY during the last quarter.

Fintel offers one of the most complete investing research platforms for individual investors, financial advisors, traders, and small hedge funds.

The platform provides extensive data, including fundamentals, analyst reports, ownership information, fund sentiment, and insights into insider trading and unusual options trades.

This article first appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.