Exploring AppLovin: A Game-Changer in Digital Advertising

For many, the ultimate goal of investing is achieving financial independence. A million dollars may not hold the purchasing power it once did, but reaching this milestone still signifies a significant achievement. The path to this goal often involves buying and holding the right stocks.

In this context, investors keen on wealth accumulation may want to consider a rising player in the market: AppLovin (NASDAQ: APP). This company has the capacity to transform a modest investment today into considerable returns down the line.

Looking to invest $1,000 today? Our analysts have identified what they believe are the 10 best stocks to purchase right now. Learn More »

Understanding AppLovin

If AppLovin is unfamiliar to you, you’re not alone. However, you may have encountered its impact without realizing it. AppLovin specializes in helping businesses advertise on mobile devices and via ad-supported streaming services. Companies like Experian, DealDash, and SmartNews have successfully utilized AppLovin’s expertise to navigate the complexities of today’s advertising landscape.

Historically, advertising was simpler. Businesses often relied on broad tactics like TV commercials, billboards, and print ads to engage a general audience. This approach was satisfactory but left small businesses creatively constrained with limited budgets.

The arrival of the internet changed everything. Smaller companies now find themselves in a more flexible environment, allowing them to purchase targeted ad space according to consumer behavior. Notably, the Interactive Advertising Bureau reported that U.S. spending on digital video advertising surpassed spending on cable TV for the first time last year. Meanwhile, mobile advertising has continued to outpace traditional web advertising for some time.

This increase in flexibility and accuracy has led to intense competition among advertisers, highlighting the need for a technical edge. AppLovin aims to provide this advantage.

How AppLovin Operates

AppLovin offers varied services to help companies broaden their advertising reach economically. Its best-known service, AppDiscovery, uses artificial intelligence to find potential app downloaders, ensuring that marketing efforts focus on the most likely customers. This approach maximizes the return on advertising spending.

Another service, MAX, is designed for companies eager to monetize their existing apps. This tool allows app owners to auction their ad space in real-time to the highest bidder, enhancing monetization strategies.

SparkLabs is another tool that enables advertisers to create high-quality animated and video ads that achieve optimal install rates per impression.

The mobile advertising sector, while no longer new, presents substantial growth opportunities. According to Technavio, the mobile advertising industry is expected to grow over 14% annually through 2028. Omdia has similarly forecasted that the connected-TV ad market will double by 2029.

AppLovin’s Risks and Rewards

The growth trajectories suggested by these statistics don’t necessarily make AppLovin an easy investment choice. The company’s shares have surged over 300% since September, as investors began recognizing its potential in the evolving digital advertising market.

This rapid rise has led to a market valuation exceeding 60 times last year’s earnings and roughly 50 times this year’s expected earnings. The stock is also approaching an analysts’ consensus price target of nearly $383, which presents a challenging valuation to justify.

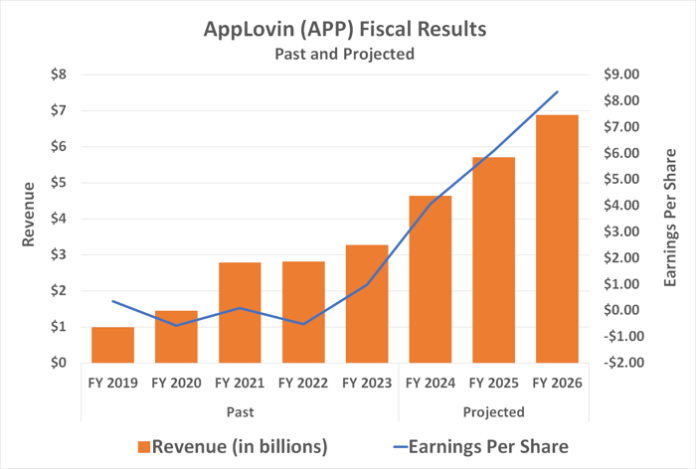

A broader perspective is essential here. While the company’s valuation may seem high, AppLovin is showing significant growth, exceeding the optimistic market predictions from Omdia and Technavio.

Data source: StockAnalysis.com. Chart created by the author.

Investors have previously supported even higher valuations for compelling narratives. While AppLovin has the potential to significantly impact your investment portfolio, it also carries increased risks and volatility. It could serve as an aggressive growth option but may not be suitable for a long-term foundational investment.

Should You Invest $1,000 in AppLovin Now?

Before deciding to invest in AppLovin, consider this:

The Motley Fool Stock Advisor team recently identified their picks for the 10 best stocks to invest in, and AppLovin did not make the list. The companies chosen may offer higher potential returns in the future.

For context, when Nvidia was first recommended on April 15, 2005… if you had invested $1,000, you’d have $795,728 now!*

Stock Advisor provides a roadmap for investors, featuring guidance on portfolio management, consistent updates, and two new stock recommendations each month. Since 2002, Stock Advisor has delivered returns more than quadrupling that of the S&P 500.*

Learn more »

*Stock Advisor returns as of February 7, 2025

James Brumley holds no positions in any of the mentioned stocks. The Motley Fool has positions in and recommends AppLovin. The Motley Fool follows a disclosure policy.

The opinions expressed here represent the author’s own views and do not necessarily reflect those of Nasdaq, Inc.