Cleveland-Cliffs Inc. Stock Surges Amid Tariff Talks

Shares of Cleveland-Cliffs Inc. CLF have risen on Monday following President Trump’s announcement of a proposed 25% tariff on steel and aluminum imports.

Market Sentiment Shifts in Favor of Cleveland-Cliffs

Investors see this move as beneficial for U.S.-based companies, including Cleveland-Cliffs, which could gain a competitive edge in the market.

A Potential Breakout on the Horizon?

The stock’s upward trend raises hopes that the prolonged downtrend over the past year might be coming to an end. This positive movement is why Cleveland-Cliffs is considered our Stock of the Day.

Understanding Buyer’s Remorse and Market Behavior

In the stock market, a decline often leads to ‘buyer’s remorse’, where investors regret their purchases when a stock’s price falls below their purchase price. In such cases, many choose to hold onto losing shares, waiting for the stock to rebound to their buy price, hoping to sell at a breakeven point.

Resistance Levels and Sell Orders Form

When a stock does start to recover, a surge of sell orders can develop at previous support levels, which then may turn into resistance levels on the way back up.

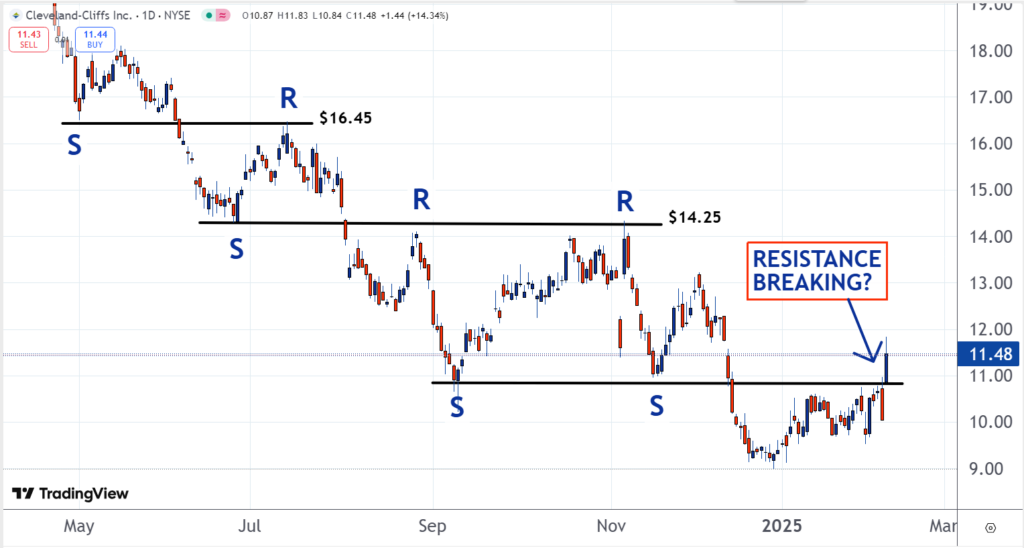

Such patterns are apparent in Cleveland-Cliffs’ stock chart. In late April, the shares experienced a significant drop but found support at approximately $16.45, prompting buyers to step in. However, this support was later broken, leading to more regret among investors who had bought at that price.

Resistance Emerges at Key Price Points

Investors who purchased shares around $16.45 vowed to sell if the stock returned to that level, adding to the pressure as the previously supportive price became a new resistance point. A similar dynamic has been observed at the $14.25 level, once a support in June, which also transformed into resistance in subsequent months.

Could Tariff News Change the Trend?

Currently, the stock seems poised for potential change. The $10.85 level, which has acted as support in the past, has recently become resistance. However, the new tariff news may enable the stock to break through this barrier.

A Changing Tide? Signs of a New Bull Market

When markets begin to recover from a bottom, the sense of buyer’s remorse tends to dissipate. As support levels fade into resistance, the situation for Cleveland-Cliffs suggests that the stock’s year-long decline may be nearing an end, indicating the possible beginning of a new bull market.

Read Next:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs