Ford Releases Q4 2024 Earnings: Stock Trades Lower Amid Challenges U.S. auto giant Ford F released its fourth-quarter 2024 earnings last Wednesday. The company’s EPS and revenues surpassed expectations and increased year over year, but shares have dropped due to cautious guidance.

Stay updated with quarterly releases: See Zacks Earnings Calendar.

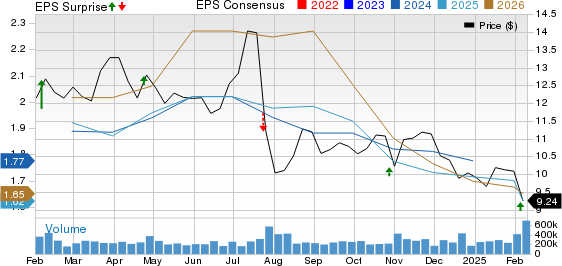

Analyzing Ford’s Price, Consensus, and EPS Surprise

Ford Motor Company price-consensus-eps-surprise-chart | Ford Motor Company Quote

Wall Street analysts are becoming more pessimistic about the stock, as shown by recent estimate reductions. Over the past week, the Zacks Consensus Estimate for 2025 and 2026 EPS has decreased by 5 cents and 3 cents, respectively.

Image Source: Zacks Investment Research

Looking back over the past year, Ford has encountered significant challenges, especially in the electric vehicle (EV) sector, along with high warranty costs. In 2024, Ford shares fell approximately 19% compared to a 19% growth within the industry. In contrast, its major competitor, General Motors GM, experienced a notable 48% surge in the same period.

Comparing F’s 2024 Price Performance to GM & Industry

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

So far in 2025, Ford has dropped over 6% and is currently trading below $10. While some investors might see this as a chance to buy, questions arise regarding if the stock holds any real value at this price. Let’s examine the details.

A couple of factors demonstrate potential for Ford. Firstly, the Ford Pro unit has shown resilience, being the only segment to report year-over-year sales and EBIT growth last year, with revenues increasing by 15% to $67 billion in 2024. EBIT rose from $7.2 billion to $9 billion, reflecting a margin of 13.5%. The strong order books for Ford Pro and the popularity of the new Super Duty trucks could signal a bright future.

Demand remains strong for Super Duty trucks and Transit vans, and the segment’s software and service subscriptions have rapidly expanded. Ford Pro software subscriptions increased by 27% year over year, nearing 650,000. For this year, Ford anticipates $7.5-$8 billion EBIT from the Pro segment. Although this indicates a decline, it is still projected to be a key profit driver for the company.

Secondly, Ford’s dividend yield, which is over 6%, adds allure. The company aims for dividends to represent 40-50% of free cash flow (FCF) moving forward, highlighting its commitment to returning value to shareholders. This generous yield provides some cushion against the stock’s ups and downs.

Lastly, Ford reduced net costs by $500 million in the latter half of 2024 and has outlined $1 billion in product design cost savings for 2025.

However, these advantages may not outweigh the mounting difficulties facing Ford’s broader operations.

Struggles in the Model E Segment Persist

The Model E division, dedicated to EVs, is encountering ongoing challenges from both internal and external pressures. Ford is grappling with fierce competition, pricing pressures, and considerable expenses tied to developing new-generation EVs.

Last year, volumes and revenues from the EV sector fell by 9% and 35%, respectively. After suffering $4.7 billion in losses in its EV sector in 2023, those losses increased to $5.07 billion in 2024, worsened by ongoing pricing pressures and higher investments in next-gen EVs.

This year may not offer much respite, despite a $1.4 billion reduction in the cost structure for the EV business. The company anticipates losses within the range of $5-5.5 billion. In contrast, General Motors is actively working to cut EV losses, achieving “variable profit positive” status in the fourth quarter of 2024 and estimating a $2 billion reduction in EV losses this year, while Ford struggles with scaling and efficiency.

Dimming Outlook for Ford Blue Segment

The Ford Blue division appears to be losing traction. The company forecasts 2025 EBIT of $3.5-4 billion from the Blue segment, down from $5.3 billion generated in 2024. The muted outlook arises from expectations of lower sales of internal combustion engine (ICE) vehicles compared to last year. Furthermore, a changing product mix and foreign exchange challenges will negatively impact profits.

Q1 Outlook Presents Significant Challenges for Ford

For the first quarter of 2025, adjusted EBIT is expected to break even, a stark decline from the $2.7 billion and $2.1 billion recorded in the first and last quarters of 2024, respectively. Reduced production volumes, expected to drop by around 20%, along with unfavorable product mix and launch activities in Kentucky Truck and Michigan Assembly Plants will impact the results.

Muted Full-Year Expectations for Ford

For the entire year, Ford foresees adjusted EBIT in the range of $7-$8.5 billion, down from $10.2 billion in 2024. While Ford Pro and Credit units may help counterbalance the weaknesses in Model E and Blue units, adjusted free cash flow is expected to fall between $3.5 billion and $4.5 billion, down from $6.7 billion reported in 2023.

Although Ford anticipates a decrease in warranty costs this year, they will still hinder overall profits. Margins are also expected to decline due to increased incentives, which the company has already highlighted as a concern.

Most critically, the guidance does not consider any policy updates from the Trump administration. While the current 25% tariffs on imports from Mexico and Canada are paused, there is a significant risk that they could be reinstated. Such tariffs could disrupt supply chains, elevate raw material costs, and ultimately lead to higher vehicle prices, negatively impacting demand, sales, and profits for Ford.

Strategizing with Ford Stock

While Ford’s valuation may seem appealing, it is not as inexpensive as it appears. The stock trades at a higher P/E ratio compared to GM.

Image Source: Zacks Investment Research

Ongoing EV losses, decreasing profitability in the ICE sector, falling wholesale volumes and average selling prices, along with rising risks stemming from trade policies remain significant concerns for Ford. Unless the company can notably enhance its EV strategy and improve margins in its traditional business, the stock poses considerable risk and should be approached with caution. Currently, Ford holds a Zacks Rank of #5 (Strong Sell).

The Zacks Consensus Estimate for Ford’s 2025 automotive sales and EPS suggests a decline of 2% and 12%, respectively, year over year.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Just Released: Zacks Top 10 Stocks for 2025

Don’t miss out—get in early on our top 10 stock picks for 2025. Curated by Zacks Director of Research Sheraz Mian, this portfolio has proven to be remarkably successful. Since its inception in 2012 through November 2024, the Zacks Top 10 Stocks portfolio has achieved a staggering +2,112.6%, significantly surpassing the S&P 500’s +475.6%. Sheraz has sifted through 4,400 companies covered by the Zacks Rank to select the best 10 to buy and hold in 2025. You can catch a glimpse of these just-released stocks with impressive potential.

See New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Download today’s report highlighting the 7 Best Stocks to watch for the next 30 days.

Ford Motor Company (F) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.