“`html

Amazon’s Bold AI Investment Strategy Wows Investors but Raises Questions

Amazon (AMZN) made headlines during Thursday’s earnings call with an ambitious capital spending plan that left investors surprised. The company reported quarterly earnings that exceeded expectations and showed a 10% year-over-year sales increase, which matched analyst forecasts.

However, the significant news was Amazon’s commitment to artificial intelligence (AI). In the last quarter, the company invested an impressive $26.3 billion in capital expenditure, signaling its intention to continue this trend. This investment amounts to more than $100 billion annually, primarily focused on expanding AI infrastructure.

Amazon is aligning itself with a trend seen among major technology firms, where large companies are making substantial investments in AI infrastructure. Meta Platforms (META) plans to spend $65 billion, Microsoft (MSFT) is dedicating $85 billion, and Alphabet (GOOGL) aims for $75 billion. A report from BlackRock highlights that the combined capital expenditures of these firms, often referred to as the Magnificent 7, now exceed the research and development budget of the US government.

Despite this strong performance by Amazon, curiosity arises about how shareholders will react to this significant increase in spending. Will they view this unprecedented investment positively, or will fears around capital allocation hinder stock performance? Understanding the implications of Amazon’s AI investment decisions is key.

Image Source: Zacks Investment Research

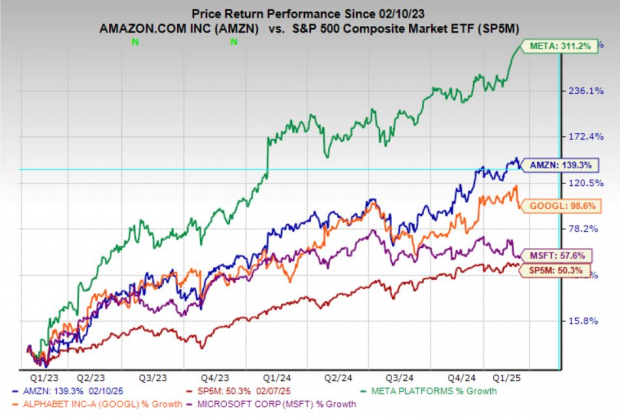

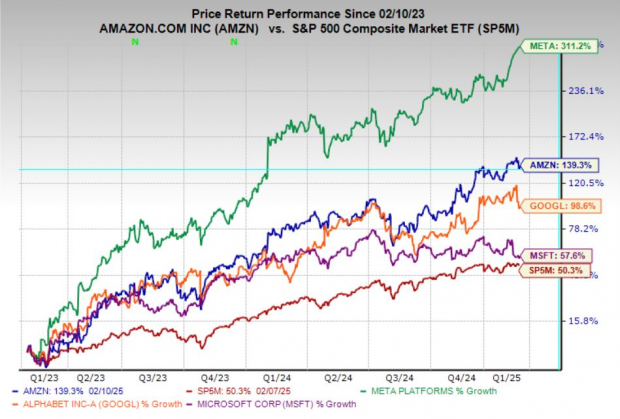

Impact on Stocks: AMZN, GOOGL, MSFT, and META

I strongly believe in the AI boom and its potential to transform industries. As an early user of large language models (LLMs), I have seen their utility increase rapidly. For skeptics, OpenAI’s recent ‘Deep Research’ release, which can conduct high-level, multi-step analysis, serves as proof of AI’s capabilities.

My optimistic view on the AI sector may surprise some, especially regarding Amazon and the broader Magnificent 7 investment. While I believe that such a large capital expenditure will yield significant returns, the path to those returns may not be straightforward. Spending $100 billion each year is a massive commitment, and immediate profitability could remain unclear in the near future.

Over the past two years, leaders like Amazon, Alphabet, Microsoft, and Meta have generated strong returns. Yet, this new wave of spending invites a crucial question: Will Wall Street favor or penalize these companies for their investment in AI infrastructure over short-term earnings gains?

For investors with concerns about this spending, a glimmer of hope exists. These investments in AI and cloud technologies align with the fundamental business models of Amazon, Microsoft, Alphabet, and Meta, all of which significantly rely on cloud computing and AI-driven services. Even if AI doesn’t transform their businesses as planned, these firms will still hold greater data center capacity.

Additionally, despite their eye-popping numbers, this capital expenditure represents about one year’s worth of profits for these massive companies. This illustrates the incredible cash flow capacity of major tech firms. They are making these bold investments because they have the means to do so, confident that it will pay off in the long run.

In conclusion, Amazon, Microsoft, Alphabet, and Meta are placing a significant long-term bet that could reshape their futures. However, the immediate stock market reactions may be unpredictable. Investors should brace for fluctuations, but history shows that those who remain patient with these tech giants often reap significant rewards.

Alternative Stock Picks: (MRVL and AVGO)

Two stocks poised to benefit significantly from the ongoing AI investment trend are Marvell Technology (MRVL) and Broadcom (AVGO). While Nvidia often steals the spotlight in AI hardware, substantial investments from major tech will also flow to complementary AI solutions, especially customized application-specific integrated circuits (ASICs) created by Marvell and Broadcom. These ASICs don’t directly compete with GPUs but enhance AI capabilities, thereby improving cost efficiency for specialized workloads.

Marvell has formed a significant alliance with AWS to deliver custom AI chips that enhance performance and lessen GPU dependency in hyperscale data centers. Broadcom, on the other hand, is solidifying its partnership with Apple, providing custom AI and networking chips as Apple expands its AI functionalities. Both companies are instrumental in the move toward specialized AI hardware, supporting tech giants in building more efficient AI infrastructure.

Both stocks also maintain Zacks Rank #2 (Buy) ratings, highlighting positive earnings revisions as AI investments ramp up. Moreover, they have emerged among the best performers.

“`

Investing in AI: Key Players and Emerging Opportunities

AI Investments: A Look at Industry Leaders

Amazon, the retail giant, has made headlines with a staggering $100 billion investment in artificial intelligence (AI). This initiative, along with similar efforts from other major players in the tech sector, presents both exciting prospects and challenges. History tells us that when big tech companies invest heavily, the potential long-term benefits can be significant. However, in the short term, stock market reactions may be unpredictable as investors assess the implications of such extensive spending. Patience will be essential for shareholders as they navigate these waters.

For investors seeking to minimize risks amid this transition, companies like Marvell Technologies and Broadcom could represent viable opportunities. These firms stand to gain from the expanding infrastructure required for AI, positioning themselves as key contributors to the technological evolution ahead.

Just Released: Zacks Top 10 Stocks for 2025

Act fast—there’s still a chance to invest in Zacks’ top 10 stocks for 2025. Handpicked by Zacks Director of Research Sheraz Mian, this selection has proven to be remarkably successful. Since its inception in 2012 through November 2024, the Zacks Top 10 Stocks portfolio has achieved an impressive gain of +2,112.6%, significantly outperforming the S&P 500, which posted a gain of +475.6%. With careful analysis from over 4,400 companies, Sheraz has identified the ten best stocks to buy and hold for 2025. Don’t miss your chance to discover these newly released stocks with high growth potential.

Explore New Top 10 Stocks >>

Interested in the latest stock recommendations from Zacks Investment Research? Download our exclusive report on the 7 Best Stocks for the Next 30 Days. Click here to access this free resource.

Featured Stocks:

- Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

- Microsoft Corporation (MSFT) : Free Stock Analysis Report

- Marvell Technology, Inc. (MRVL) : Free Stock Analysis Report

- Broadcom Inc. (AVGO) : Free Stock Analysis Report

- Alphabet Inc. (GOOGL) : Free Stock Analysis Report

- Meta Platforms, Inc. (META) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.