Amazon (AMZN) reported strong fourth-quarter results that outpaced expectations, with revenues climbing 10% from the previous year to $187.8 billion and a remarkable 61% increase in operating income, reaching $21.2 billion. Despite these achievements, the stock experienced a decline in after-hours trading, as investors reacted to management’s cautious outlook for the first quarter of 2025, which hints at challenges to growth in the months ahead.

Concerns Arise from AMZN’s Q1 2025 Guidance

For the first quarter of 2025, Amazon forecasts revenues between $151 billion and $155.5 billion, reflecting a growth rate of 5-9% compared to the same period last year. This forecast includes a notable foreign exchange impact, estimated at around $2.1 billion, or 150 basis points. Furthermore, first-quarter 2024 benefited from an additional day due to a leap year, contributing approximately $1.5 billion in net sales. Considerations like these suggest a possible deceleration in growth heading into the new year.

The Zacks Consensus Estimate anticipates first-quarter 2025 net sales at $154.86 billion, indicating an 8.06% increase from the previous year’s figures. Additionally, earnings for the same quarter are expected at $1.38 per share, representing a 22.12% rise from the year-ago period. However, this estimate has decreased by 3.5% over the past month.

Image Source: Zacks Investment Research

Find the latest earnings estimates and surprises on Zacks Earnings Calendar.

Mixed Signals in Segment Performance

Amazon Web Services (AWS), the company’s cloud sector, generated revenues of $28.8 billion in the fourth quarter, marking a 19% increase year over year. Although this represents an improvement, analysts remain unsure whether this growth can continue under competitive pressures and customer efficiency strategies. The AWS operating margin of 36.9% declined slightly from 38.1% in the prior quarter. CEO Andy Jassy has pointed to supply chain constraints, such as chip shortages and power infrastructure issues, which may affect AWS’s growth in the near future.

In North America, revenue grew by 10%, and operating income surged 43% to $9.3 billion, demonstrating solid performance. Internationally, Amazon reported profitability with $1.3 billion in operating income, a change from the losses of the previous year, showing improved efficiency in global markets. The company’s advertising sector maintained robust growth, increasing 18% to reach $17.3 billion in quarterly revenues.

Valuation Challenges and Competitive Landscape

With a forward 12-month Price-to-Sales (P/S) ratio of 3.44X, Amazon’s valuation appears high compared to the Zacks Internet – Commerce industry average of 1.91X. This premium reflects Amazon’s leading position and diverse revenue sources, but also sets high expectations for future performance.

Amazon’s P/S Ratio Indicates High Valuation

Image Source: Zacks Investment Research

In the cloud industry, Microsoft (MSFT) Azure and Alphabet (GOOGL) Google Cloud continue to capture market share, with Microsoft reporting 30% growth last quarter and Google Cloud growing by 26%, surpassing AWS’s 19% growth. This intensifies competition in a critical area, especially as both companies invest heavily in AI infrastructure.

Looking Ahead: Considerations for 2025

Amazon’s fourth-quarter capital investments totaled $26.3 billion, and management expects similar spending levels in 2025. This investment will primarily enhance technology infrastructure for AWS and AI initiatives, including custom chip development like Trainium 2. Though these investments will support long-term growth, they may exert pressure on free cash flow and profit margins in the short term.

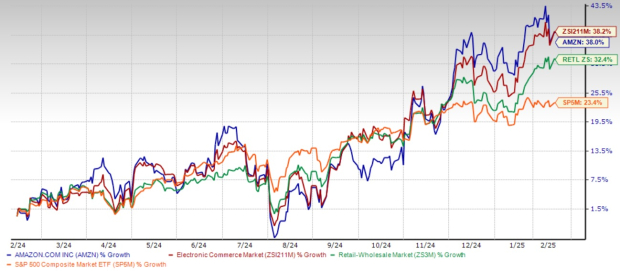

Operating margins across all segments have been improving as the company focuses on operational efficiency. Over the past year, Amazon’s stock has increased by 38%, outpacing the Zacks Retail-Wholesale sector’s 32.4% growth, due to strong business execution and advances in AI. The launch of the Amazon Bedrock platform further positions the company as a leader in enterprise AI development.

Performance Over the Last Year

Image Source: Zacks Investment Research

Nevertheless, management has identified several risks for 2025, including foreign currency fluctuations, uncertain economic conditions, and shifts in consumer spending. Heavy investments in AI and data center capacity also pose potential execution challenges.

Investment Stance: Hold for Now

While Amazon shows strong long-term growth potential due to its dominant position in e-commerce and cloud computing, combined with its AI advancements, current valuations and foreseeable challenges suggest that investors may want to wait for a better buying opportunity in 2025. The company’s substantial capital plans could restrain short-term stock growth, especially alongside a cautious first-quarter forecast and foreign exchange issues that may yield better buying opportunities later.

Current shareholders might consider maintaining their positions, as Amazon’s solid market presence and ongoing operational enhancements warrant confidence. The focus on efficiency and strategic investments in vital areas such as AI and fast delivery systems display thoughtful long-term planning. New investors, however, might prefer to wait for a decline in share price or clearer indications of growth acceleration before investing.

Key elements to watch include the growth trajectory and margin performance of AWS, the success of AI strategies (notably custom chip integration), COs then regional economic conditions’ effects on consumer spending, advancements in operational efficiency, and fluctuations in foreign currency rates. Observing Amazon’s capacity to sustain margin increases while funding ambitious growth plans will be critical.

Conclusion

In summary, while Amazon offers a promising long-term investment given its industry position and strategic priorities, current market dynamics, elevated valuation, and cautious guidance imply that patience may yield favorable buying conditions. Investors should diligently analyze quarterly performance and management insights in 2025 to identify opportune moments for investment as the year unfolds. AMZN currently holds a Zacks Rank #3 (Hold). You can access the full list of Zacks’s #1 Rank (Strong Buy) stocks here.

Zacks Highlights #1 Semiconductor Stock

It’s significantly smaller at only 1/9,000th the value of NVIDIA, which has surged over +800% since our recommendation. While NVIDIA remains strong, our new top chip stock has even more growth potential.

Thanks to impressive earnings growth and a growing customer base, it is well positioned to meet the soaring demand for Artificial Intelligence, Machine Learning, and the Internet of Things. The global semiconductor market is anticipated to grow from $452 billion in 2021 to $803 billion by 2028.

Get This Stock Now for Free >>

Looking for the latest insights from Zacks Investment Research? Today, you can download the 7 Best Stocks for the Next 30 Days. Click here to get this free report.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.