Inflation Surprises Investors: A Chance to Buy Amid Stock Market Dips

So much for that soft inflation optimism…

A few days ago, we previewed this ‘Inflation Week’ by mentioning:

“According to real-time estimates from the Cleveland Fed, this week’s Consumer Price Index (CPI) data is expected to show a 4-basis-point decline in January’s headline inflation rate and an 11-basis-point decline in the core rate. It should be the first report since July 2024 that includes a decline in both the headline and core CPI inflation rates.”

However, today’s report revealed a much different story.

The latest CPI data indicated that inflation was significantly higher than expected last month, which dims the possibilities for Federal Reserve rate cuts aimed at bolstering the U.S. economy and the stock market. Consequently, stocks have reacted by slipping lower.

Despite the initial alarming figures, January’s CPI report may not be as dire as it appears.

This is why we view today’s inflation-led stock decline as a buying opportunity.

Key Insights from January’s Inflation Data

It’s true that the headline numbers from January’s inflation report were troubling.

Consumer prices increased by 0.5% month-over-month, surpassing the expected 0.3% rise predicted by economists. The core consumer prices, which exclude the often-volatile food and energy prices, also rose by 0.4%, above the anticipated 0.3% increase.

Looking year-over-year, the consumer price inflation rate jumped from 2.9% in December to 3.0% in January, while the core inflation rate went from 3.1% to 3.3%.

This marked the first time since October 2024 that both the headline and core consumer price inflation rates rose concurrently.

In short, it was a rather bleak report.

However, we believe this negativity is temporary.

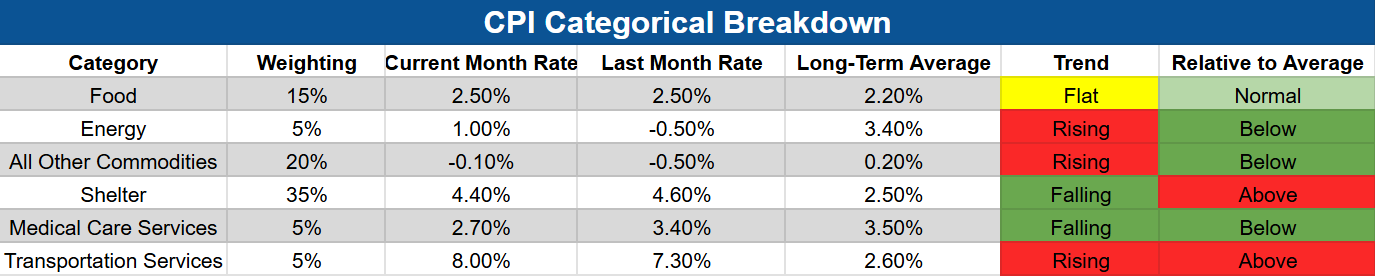

A deeper examination of key categories within the CPI reveals more positive trends. The largest contributor, shelter—making up about 35% of the consumer price index—is on the decline. The second largest category, all commodities excluding food and shelter (approximately 20% of the index), is showing negative growth. Food prices, accounting for 15% of the index, remain steady and align with long-term averages.

Overall, inflation trends appear promising. Most major categories either indicate falling inflation or are currently low relative to their historical averages.

The only significant category witnessing inflation above normal levels is Transportation Services. This rise may have been influenced by recent wildfires in California, suggesting that it may not persist.

Additionally, oil prices—a crucial factor in inflation—have been lower thus far in February compared to January.

In January, oil prices averaged over $75 per barrel, whereas early February saw averages around $72 per barrel, with other commodity prices generally on the decline as well.

These factors lead us to conclude that January’s inflation spike is likely an anomaly…

Making today’s stock market dip particularly attractive.

Conclusion

Inflation trends are already turning more favorable in February.

Real-time estimates from the Cleveland Fed indicate that February’s CPI is running at 2.8%, decreasing from January’s 3%. The core CPI rate is also down, currently at 3.16% compared to January’s 3.26%.

This suggests that for the first time since July 2024, both headline and core inflation rates are declining in February.

Market Selloff Presents Unique Buying Opportunities in Autonomous Vehicle Sector

Current inflation concerns appear exaggerated.

This market dip could be a prime buying opportunity.

When considering investments, the autonomous vehicle sector stands out as a remarkable area to explore.

This year could see self-driving cars achieve mainstream adoption.

For instance, Waymo is already providing driverless robotaxi rides in locations like San Francisco, Los Angeles, and Phoenix, averaging about 150,000 rides weekly. The company is set to expand its services to ten additional cities by 2025, which include Las Vegas, San Diego, Atlanta, Austin, and Miami.

On another front, Tesla plans to roll out its own robotaxi service in Austin by June, while Lyft has expressed intentions to start a similar service in Dallas in 2026.

The Age of Autonomous Vehicles has officially begun, bringing significant potential for gains in AV stocks.

Stay informed about this exciting megatrend as it unfolds during the Trump administration’s second term.

As of the publication date, Luke Lango neither held any positions, directly or indirectly, in the securities mentioned in this article.

P.S. Keep up with Luke’s market insights through his Daily Notes! Don’t miss the latest updates on your Innovation Investor or Early Stage Investor subscription site.