PayPal’s Financial Update: A Year of Change and Future Potential

A lot has changed at PayPal Holdings (NASDAQ: PYPL) recently. Chief Executive Officer Alex Chriss took over a year and a half ago and launched new strategies, leading to a stock price increase of more than 30% over the past year. However, following the release of its fourth-quarter earnings report last week, the shares saw a decline, disappointing investors who had been hopeful for a turnaround.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Steady Revenue Growth

PayPal’s revenue growth has not been a concern, even though it has slowed since the early pandemic days when online shopping surged. In the last quarter, revenue grew by 4% compared to the previous year, with a 7% increase for the full year.

A key indicator of PayPal’s performance lies in its active accounts and monthly active users.

| Metric | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 |

|---|---|---|---|---|

| Active accounts | 427 million | 429 million | 432 million | 434 million |

| Active accounts % change (YOY) | (1%) | 0% | 1% | 2% |

| Monthly active accounts | 220 million | 222 million | 223 million | 229 million |

| Monthly active accounts % change (YOY) | 2% | 3% | 2% | 2% |

Data source: PayPal. YOY = year over year.

PayPal reached a peak of 435 million active customers in the fourth quarter of 2022. The loss of customers in the following periods indicated a slowdown. Fortunately, the company has seen growth in this metric again, moving closer to its peak levels. Engaging customers remains key to unlocking further value from the platform.

In the near term, revenue growth may continue to slow as PayPal focuses on increasing higher-margin services rather than overall revenue gains.

Profitability: A Rebound in Sight

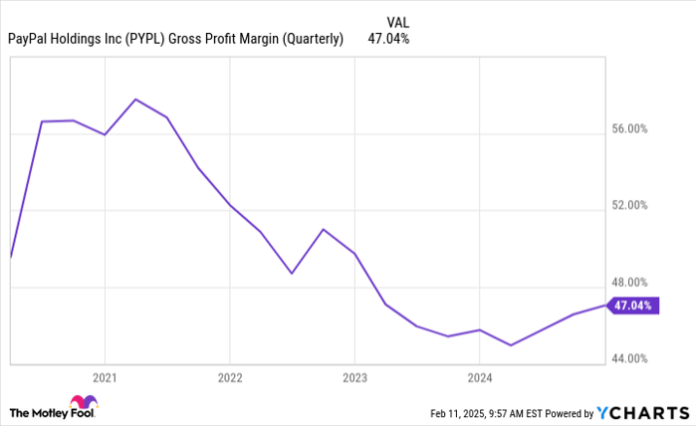

Investors have been concerned about PayPal’s narrowing profit margins despite revenue growth. A significant factor is the growth from its Braintree business, which PayPal acquired. This division offers unbranded financial services and has lower gross margins than its branded checkout services.

PYPL Gross Profit Margin (Quarterly) data by YCharts.

Recently, signs of recovery have emerged. Chriss aims to implement a pricing strategy based on perceived customer value rather than service costs. This approach will adjust Braintree prices to reflect their true worth, potentially improving margins while possibly affecting sales volume.

The fourth-quarter results did not satisfy investors. Management reported a 7% year-over-year increase in transaction margin dollars, with a 5% adjustment. However, operating income dropped by 17%, and earnings per share (EPS) fell to $1.11—a 15% decline from the previous year. For the full year, EPS increased by 4% to $3.99.

Management anticipates substantial EPS increases for both the first quarter of 2025 and the full year. As PayPal’s changes take effect, higher profits are expected.

Adapting to Market Changes

Although PayPal’s active account numbers haven’t yet reached their peak, the company boasts a substantial customer base exceeding the combined populations of the U.S. and Canada. Re-engaging lost customers and enhancing current relationships can significantly boost its business. The strategy includes a complete overhaul of its checkout options, which has already shown promising results.

Anticipating gradual engagement increases over the next year aligns with innovation and improved features to stay competitive. Chriss has demonstrated skill in navigating the tech landscape, crucial for unlocking more value from the active user base.

Prior to Chriss’s leadership, PayPal focused on quantity over quality, prioritizing new customer acquisition over active user maintenance. Now, with active users increasing, the deceleration in the average number of transactions per customer is a point to watch, especially since total transaction numbers fell year over year in the fourth quarter. Management cites pricing increases in Braintree as the reason, predicting improved margins and profitability over time. Investors should monitor this situation closely in the coming year.

Stock: A Promising Outlook for Investors

Currently, PayPal’s stock trades at a price-to-earnings (P/E) ratio of about 19, nearing a 10-year low. This low price may present a strong buying opportunity for potential investors.

While the future stock price is uncertain, PayPal’s outlook appears complex due to ongoing changes. However, steady progress seems likely, with the new CEO instilling confidence. Although PayPal stock may not be ideal for conservative investors, it could prove to be rewarding for those willing to be patient over the next year and beyond.

Don’t Miss This Second Chance at a Potentially Lucrative Opportunity

Have you ever felt like you missed out on the chance to invest in successful stocks? If so, this could be your moment.

On rare occasions, our analytical team issues a “Double Down” stock recommendation for companies they believe are on the verge of significant growth. If you’re worried you’ve already lost your chance to invest, now might be the perfect time.

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $350,809!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $45,792!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $562,853!*

We are currently issuing “Double Down” alerts for three outstanding companies, and this opportunity may not come again soon.

Learn more »

*Stock Advisor returns as of February 3, 2025

Jennifer Saibil has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends PayPal. The Motley Fool recommends the following options: long January 2027 $42.50 calls on PayPal and short March 2025 $85 calls on PayPal. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.