Could Warren Buffett Ever Consider Investing in XRP?

Warren Buffett, known for his value investing approach, has made notable purchases in companies like American Express and Apple. But could he ever be interested in a money transfer fintech like XRP (CRYPTO: XRP), potentially reversing his well-documented aversion to cryptocurrencies?

While it’s uncertain if Buffett would invest in this coin, several aspects of XRP might appeal to him, provided he were to consider the idea. Let’s explore how XRP aligns with Buffett’s investment principles.

Where should you invest $1,000 right now? Our analysts have identified the 10 best stocks to consider purchasing at this moment. Learn More »

Why Value Investors Might Favor XRP

To understand the investment potential of XRP, let’s recap its primary benefits, which might attract Buffett.

XRP is designed to provide low-cost, quick, and dependable international money transfers. Its main users are financial institutions, such as banks and currency exchange houses, which currently face high fees—up to $50—and long settlement times, sometimes taking over five days. In comparison, XRP transaction settlements take just minutes and cost fractions of a penny on average, with fees being reinvested into technology upgrades and marketing.

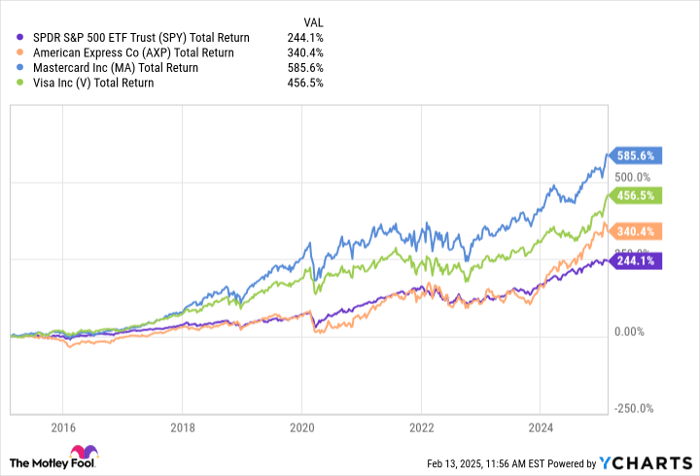

Buffett typically shows interest in financial technology firms and payment processors—as long as they are attractively priced. He holds substantial investments in Visa and Mastercard, which have both revolutionized payment processing.

These companies exemplify Buffett’s investment strategy. Instead of directly selling products to consumers, they facilitate payments, earning a small percentage from each transaction. The goal is not quick revenue but to gradually expand their networks, capturing a growing number of payments and fees that enhance profit margins after initial costs are recouped.

This strategy has proven successful for Buffett, as reflected in the performance of his investments over the last decade:

SPY Total Return Level data by YCharts

Now, let’s look at XRP’s current standing.

XRP offers a more efficient alternative to traditional international money transfer methods. The minimal processing cost allows for long-term fee collection from users. Its price has surged over 800% in the past five years, and with the potential for onboarding many more global users, XRP may possess a promising growth trajectory.

Essentially, XRP demonstrates characteristics of a Buffett-style investment, despite Buffett not currently owning it.

Investing: A Personal Decision

While it’s unlikely that Buffett will add XRP to his portfolio, it’s essential to recognize that many view XRP favorably. Advocates argue that investing now could yield significant future returns as it continues to gain users for cross-border transactions. Additionally, XRP faces competition that relies on outdated technology, offering it a relative advantage.

Nevertheless, there are no guarantees regarding XRP’s short-term price movements. If you opt to invest in XRP for the long term—similar to how Buffett approaches investments—chances of substantial profits may be favorable.

Is it Time to Invest $1,000 in XRP?

Before committing your funds to XRP, keep this in mind:

The Motley Fool Stock Advisor analysts recently highlighted their selection of the 10 best stocks to invest in… and XRP isn’t on that list. These chosen stocks could deliver significant returns in the coming years.

Consider the example of Nvidia, which was recommended on April 15, 2005… had you invested $1,000 then, it would be valued at $850,946 today!!

Stock Advisor offers investors an easy-to-follow strategy for success, including portfolio development guidance, ongoing analyst updates, and two new stock recommendations monthly. The Stock Advisor service has more than quadrupled the S&P 500 return since 2002*.

Learn more »

*Stock Advisor returns as of February 7, 2025

American Express is a promotional partner of Motley Fool Money. Alex Carchidi has positions in Apple. The Motley Fool has positions in and recommends Apple, Mastercard, Visa, and XRP. The Motley Fool has a disclosure policy.

The views and opinions expressed in this article are those of the author and do not necessarily reflect those of Nasdaq, Inc.