Apple AAPL has introduced the iPhone 16 family, adding a more affordable model, the iPhone 16e. This version is powered by the latest A18 chip and integrates Apple Intelligence, along with the new Apple C1 cellular modem and a 48MP Fusion camera offering a 2x Telephoto option.

Available in a 6.1-inch display, the iPhone 16e boasts the longest battery life seen in this size range from Apple. The device will launch on Feb. 28 at a price of $599, significantly lower than the iPhone 16 at $799 and the iPhone 16 Pro at $999.

Will the iPhone 16e Improve Apple’s Position in Key Markets?

The introduction of the iPhone 16e aims to enhance Apple’s presence in budget-conscious markets such as China and India. Historically, Apple has faced declining demand in China, amid fierce rivalry from companies like Huawei and Xiaomi. The iPhone 16e’s higher price compared to alternatives like the Google Pixel 8A and OnePlus 12R—both under $500—poses a challenge, but its integration of Apple Intelligence could be transformative.

During the first quarter of fiscal 2025, Apple reported a 0.8% year-over-year decrease in iPhone sales, totaling $69.14 billion. However, sales of the iPhone 16 improved in regions where Apple Intelligence was accessible. The brand’s active installed base hit a record, with substantial upgrade activity reported. According to Kantar, the iPhone emerged as the best-selling model in the United States, Urban China, India, the U.K., France, Australia, and Japan.

Apple initially launched Apple Intelligence features in U.S. English for the iPhone, iPad, and Mac. By December, the features expanded to more countries, including Australia, Canada, New Zealand, South Africa, and the U.K.

Apple’s Growth in Emerging Markets Shows Promise

Despite a 11.1% decline in sales in Greater China, Apple witnessed considerable success in emerging markets, particularly in India. For the first quarter of fiscal 2025, the iPhone was the top-selling model there, with a double-digit increase in the installed base in these markets.

According to Canalys, Apple’s strong performance in the Asia-Pacific region in 2024 has allowed it to surpass Samsung for the second consecutive year, capturing a 23% market share compared to Samsung’s 16%. Xiaomi trails with a 13% share. Moreover, global smartphone shipments increased by 7% year-over-year, reaching 1.22 billion units in 2024.

Can Apple’s Services Ensure Continued Growth?

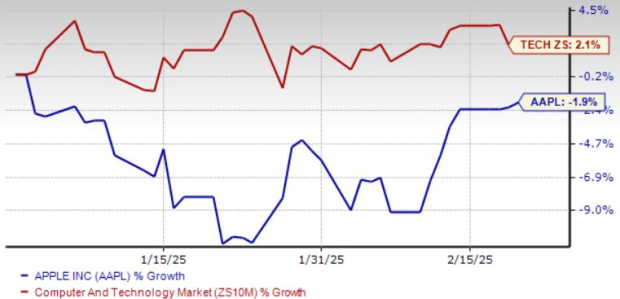

Year to date, Apple shares have fallen by 2.3%, while the broader Zacks Computer & Technology sector has seen a modest gain of 2.1%.

Apple Stock Performance Overview

Image Source: Zacks Investment Research

As Apple Intelligence continues to roll out, it is likely to encourage more iPhone adoption. In April, further language updates will be introduced, including French, German, Italian, Portuguese, Spanish, Japanese, Korean, simplified Chinese, and localized English for Singapore and India.

The Services sector is increasingly vital for Apple, with current subscriptions surpassing 1 billion, which is more than double the count from four years ago. Growth in Apple TV+, Apple Music, and Apple Arcade, along with the rise in Apple Pay users, contributes to this upward trend.

The demand for Apple TV+ content and the wider implementation of Apple Pay through Tap to Pay are exceptionally promising. Apple Pay has expanded to new countries, including Egypt and Uruguay, and the content offerings on Apple TV+ are also noteworthy.

Apple expects revenues for the quarter ending March to rise in low double digits compared to the previous year.

Declining Earnings Estimates Signals Challenges Ahead

Over the past month, the Zacks Consensus Estimate for Apple’s second-quarter fiscal 2025 earnings has decreased by 4.2% to $1.61 per share, marking an anticipated growth of 5.23% from last year’s reported figure.

Historically, Apple has surpassed the Zacks Consensus Estimate across all four trailing quarters, achieving an average earnings surprise of 4.39%.

Apple Inc. Price and Consensus Chart

Apple Inc. price-consensus-chart | Apple Inc. Quote

For the latest EPS estimates and surprises, visit Zacks Earnings Calendar.

Currently, AAPL stock shows a Value Score of D, indicating potential overvaluation. The stock trades at a forward 12-month P/E ratio of 30.45X compared to 26.88X for the sector and 29.85X for the median, suggesting it may be overpriced.

Price/Earnings (F12M)

Image Source: Zacks Investment Research

Apple’s focus on AI with Apple Intelligence is noteworthy, although it still has much ground to cover compared to competitors like Microsoft MSFT, Alphabet GOOGL, and Amazon AMZN.

Even though the Services sector has proven valuable for Apples with its growing range of Apple TV+ content, mainstream adoption of Apple Intelligence may take time.

Consequently, Apple’s short-term growth prospects may not fully justify its current high valuation. Presently, AAPL holds a Zacks Rank #3 (Hold), suggesting that investors may consider waiting for a better entry point into the stock.

5 Stocks Poised for Significant Gains

These five stocks are identified by Zacks experts as having the potential to increase by 100% or more in 2024. While not every pick will succeed, previous recommendations have seen gains of +143.0%, +175.9%, +498.3%, and +673.0%.

Many of these stocks are currently flying under Wall Street’s radar, presenting an ideal opportunity for early investment.

Today, learn more about these 5 potential winners >>

For your latest investment recommendations from Zacks Investment Research, download the 7 Best Stocks for the Next 30 Days report today.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.