Palantir vs. Netflix: Analyzing Growth Potential and Investment Value

Palantir Technologies has been a standout growth stock on Wall Street recently. Since January 2023, its share price has skyrocketed by over 1,700%. Although this impressive performance catches attention, it might not be the entire story. With its advanced artificial intelligence (AI) software, Palantir appears poised for further growth as it aids government and business clients in optimizing operations.

On the other hand, Netflix (NASDAQ: NFLX) has struggled to maintain the same level of excitement. While it was a pioneer in streaming video, that innovation dates back years.

Where should you invest $1,000 today? Our analysts recently unveiled their choices for the 10 best stocks to buy right now. Discover Details »

Both companies highlight the challenges that arise when a stock garners excessive hype. I analyzed their fundamentals to see which stock emerges as the better growth investment moving forward. The results were clear but may come as a surprise.

Market Leadership and Unique Advantages

Both companies boast commendable success stories.

Palantir, which went public in 2020, initially served the U.S. government. Its specialized software utilizes AI, machine learning, and data analytics for tasks like tracking terrorist activities, optimizing supply chains, and identifying financial fraud. Revenue growth has accelerated since launching the Palantir Artificial Intelligence Platform (AIP). The company is now a key player in AI software, with a customer base that grew by 43% year-over-year in Q4, reaching 711 clients. However, this is just a small fraction of the 377,000 enterprises globally that might adopt AI technology in the coming years.

In contrast, Netflix is a more established player in the market. As a leader in streaming, it now serves over 301 million paid subscribers worldwide. Though competition in the streaming sector has intensified, Netflix continues to thrive due to its extensive catalog and consistent release of new content. Its paid subscriber count increased by 15.9% year-over-year in Q4, indicating there’s still ample room for growth in the global market of over 8 billion people. Both companies maintain significant competitive advantages.

Financial Analysis: Netflix Shows Stronger Fundamentals

As we dive into the financials, Netflix shows a distinct advantage.

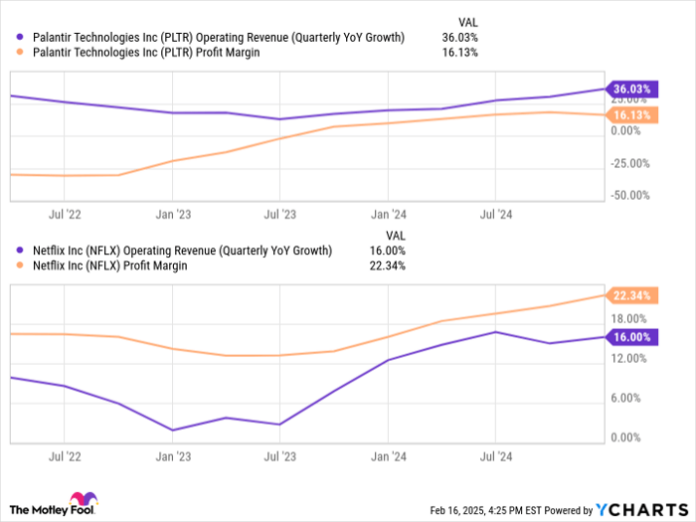

Palantir may be experiencing faster revenue growth, reflecting its younger age. This rapid growth, however, contrasts with Netflix’s higher profit margins (net income as a percentage of revenue). As Palantir matures, improving its margins will be key.

PLTR Operating Revenue (Quarterly YoY Growth) data by YCharts.

One challenge for Palantir is that while its profit margin has plateaued, Netflix’s has continued to improve. As its subscriber base expands, Netflix benefits from spreading its costs over a larger user base. Investors will want to see Palantir demonstrate better profit margin improvements over time.

Additionally, Netflix’s valuation appears more attractive. Palantir has a price-to-earnings (P/E) ratio exceeding 620, with an expected long-term earnings growth rate of nearly 26%, leading to a high price/earnings-to-growth (PEG) ratio of more than 23. Conversely, Netflix trades at 53 times earnings, with an estimated 24% long-term growth rate, resulting in a PEG ratio of 2.2. While not overly cheap, this ratio remains below my threshold for a reasonable investment.

This illustrates that the more profitable company is also the better-valued stock at present.

Concerns Regarding Palantir’s Compensation Strategy

The most pressing concern regarding Palantir as an investment is its significant stock-based compensation. This strategy increases cash flow for the company but negatively impacts net income, contributing to Netflix’s higher profit margins. The following chart shows this disparity. Palantir’s stock-based compensation has consistently comprised over 20% of quarterly revenue, while Netflix’s has diminished to a small fraction.

NFLX Stock Based Compensation (% of Quarterly Revenues) data by YCharts.

Even with anticipated growth for Palantir, ongoing heavy stock-based compensation may dilute investors, diminishing each share’s relative value. While Palantir holds long-term potential, significant investment justification is lacking at this time. That positions Netflix as a stronger choice for growth-oriented investors.

Should You Invest $1,000 in Netflix Now?

Before purchasing Netflix stocks, consider this:

The Motley Fool Stock Advisor team recently identified the 10 best stocks for investors at the moment, and Netflix did not make the list. The selected stocks have the potential for remarkable returns in the next few years.

For reference, consider Nvidia, which made this list on April 15, 2005… an investment of $1,000 at that time would have grown to $858,668!!

Stock Advisor offers investors a straightforward approach to success by providing portfolio-building strategies, regular analyst updates, and two new stock picks each month. Since 2002, Stock Advisor has achieved returns more than quadrupling that of the S&P 500.*

Learn more »

*Stock Advisor returns as of February 7, 2025

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Netflix and Palantir Technologies. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.