Evaluating AMD and Nvidia: Which Semiconductor Stock is the Best AI Investment?

Artificial intelligence (AI) has emerged as a prime sector for investment, contributing to record highs in the stock market as we step into 2024. Among the major players gaining from this trend are semiconductor leaders Advanced Micro Devices (NASDAQ: AMD) and Nvidia (NASDAQ: NVDA).

Both companies manufacture graphics processing units (GPUs), which are essential for data centers to support AI technology. These GPUs enable AI systems to process vast amounts of data effectively.

Looking to invest $1,000? Discover the 10 best stocks our analysts recommend for the present. Learn More »

Strong GPU sales have driven AMD and Nvidia to record revenues. Both companies are well-positioned for continued growth, as tech firms expand data centers to facilitate AI operations. For example, Meta Platforms, the parent company of Facebook, is currently constructing a large-scale data center.

The extensive hardware needs for such data centers suggest that sales for AMD and Nvidia are likely to remain robust. While investing in both might be optimal, determining which semiconductor company provides the best long-term investment in AI is crucial. Let’s analyze both companies for a clearer picture.

Why Invest in AMD

AMD has experienced impressive sales growth, driven by the current excitement around AI. In its fiscal fourth quarter, which ended on December 28, sales to the data center sector soared by 69% year over year, totaling a record $3.9 billion. Overall, AMD’s Q4 revenue climbed 24% compared to the previous year, reaching $7.7 billion.

The company also posted a strong balance sheet for Q4, with total assets amounting to $69.2 billion compared to liabilities of $11.7 billion.

Despite these positive results, AMD’s stock has faced recent declines. This downward trend began when the market reacted to the emergence of the Chinese AI startup DeepSeek on January 27. DeepSeek reportedly developed an AI chatbot for under $6 million, significantly less than the billions that U.S. companies invest in AI, raising concerns over potential sales impacts for AMD.

In response, AMD’s CEO, Lisa Su, commented on DeepSeek, emphasizing that lower-cost AI solutions could actually drive broader adoption and create increased demand for AMD products in the long run.

Reasons to Favor Nvidia

Nvidia’s stock also felt the effects of DeepSeek’s announcement but has since rebounded. This is supported by the company’s strong performance metrics that indicate an ongoing upward trend.

In its fiscal third quarter ending October 27, Nvidia reported record revenue of $35.1 billion, a staggering 94% increase year-over-year. Like AMD, this surge in sales was primarily driven by its data center division, which alone generated $30.8 billion in revenue, reflecting a remarkable growth of 112% compared to the previous year.

Nvidia’s revenue projections remain optimistic, with forecasts indicating a Q4 revenue around $37.5 billion—up 70% from last year’s $22.1 billion. Their Q4 results will be released on February 26.

Additionally, Nvidia is part of the U.S. government’s Stargate initiative, which aims to inject half a trillion dollars into AI infrastructure. This could further enhance Nvidia’s already robust revenue growth.

Financially, Nvidia reported total assets of $96 billion against $30 billion in liabilities for Q3, showcasing a strong balance sheet. Its Q3 gross margin of 75% also outshines AMD’s Q4 margin of 51%, indicating superior cost management and profitability.

AMD vs. Nvidia: Investment Valuation

Both AMD and Nvidia present compelling investment opportunities due to their healthy business models and rising sales. To differentiate between the two, it’s essential to consider their valuations.

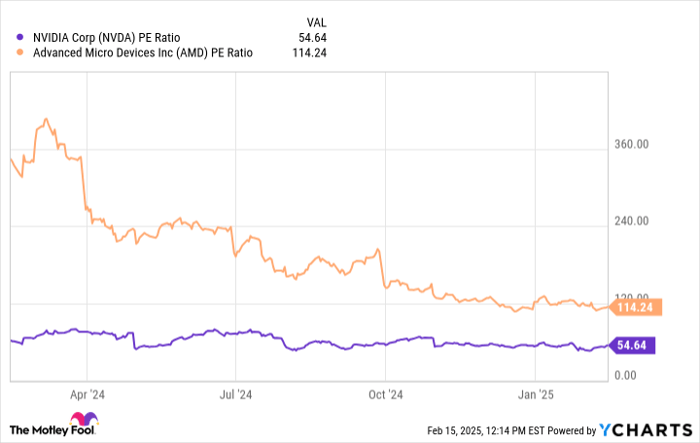

Using the price-to-earnings (P/E) ratio, which indicates how much investors are prepared to pay for a dollar of earnings, we can analyze their relative value.

Data by YCharts.

Over the past year, AMD’s P/E ratio has significantly decreased, suggesting it is now a more attractive value than before. This reduction correlates with AMD’s stock price decline, which stemmed from the impact of DeepSeek and underwhelming Q4 data center results compared to analyst expectations.

However, even with this decline, AMD’s P/E ratio remains more than double that of Nvidia, making Nvidia’s stock the more valuable choice at this point.

It’s important to note the visionary leadership of Nvidia’s CEO and founder, Jensen Huang, who recognized the demand for GPUs as early as 1999, positioning Nvidia as the frontrunner in the sector. Currently, the company holds an estimated 90% share of the GPU market for AI.

Huang also identified the application of GPUs for AI back in 2016, providing the first dedicated supercomputer to OpenAI, which eventually produced ChatGPT, igniting today’s AI enthusiasm.

Combining Huang’s insightful leadership, Nvidia’s successful history in AI, and its advantageous stock valuation leads to the conclusion that Nvidia is a stronger investment choice for the future in AI.

Is Now the Right Time to Invest $1,000 in Nvidia?

Before buying Nvidia stock, consider the following:

The Motley Fool Stock Advisor analyst team has recently identified the 10 best stocks for investors to consider, and Nvidia isn’t one of them. The stocks that made the list could potentially yield significant returns in the upcoming years.

Looking back, if you had invested $1,000 in Nvidia on April 15, 2005 (when it was recommended), that investment would have grown to around $858,668 today!*

The Stock Advisor service offers an accessible approach for investing, featuring guidance on portfolio building, regular analyst updates, and two new stock picks each month, boasting returns that have outpaced the S&P 500 by over four times since 2002*.

Learn more »

*Stock Advisor returns as of February 21, 2025.

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook, and sister to Meta Platforms CEO Mark Zuckerberg, holds a seat on The Motley Fool’s board of directors. Robert Izquierdo has positions in Advanced Micro Devices, Meta Platforms, and Nvidia. The Motley Fool has positions in and endorses Advanced Micro Devices, Meta Platforms, and Nvidia.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.