Nvidia Stock: Is It Time to Buy Before Upcoming Earnings?

The DeepSeek dip seems to be nearing its end for Nvidia (NASDAQ: NVDA). Last month, the company’s share price took a notable hit as investors worried about competition from the Chinese AI firm DeepSeek. Nvidia’s stock fell as much as 21% from its peak, but most of that decline has since recovered.

While it may be too late to purchase Nvidia at a discounted price from the DeepSeek scare, a critical event is on the horizon. Nvidia is set to announce its fiscal 2025 fourth-quarter and full-year results later this week. Should investors consider buying Nvidia stock before February 26?

Where should you invest $1,000 right now? Our analyst team has identified the 10 best stocks to consider at this moment. Learn More »

Understanding the Situation

Investors who are weighing whether to buy Nvidia stock in the upcoming days are likely concerned about the possibility of a price jump following its Q4 update, which will be released after market close on February 26.

Historical trends suggest that Nvidia might see a post-earnings jump. Following the release of OpenAI’s ChatGPT in November 2022, Nvidia has consistently exceeded Wall Street’s earnings expectations, which has often led to positive share price movements afterward.

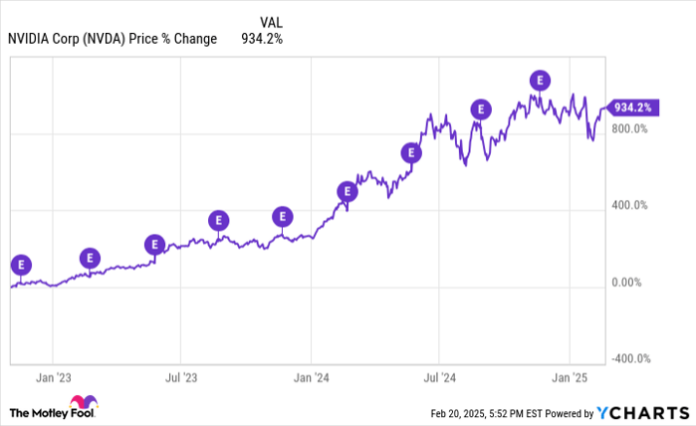

NVDA data by YCharts

The “E’s” on the chart indicate when Nvidia reported its quarterly earnings. Notably, after six out of the nine reports, the stock experienced an uptick. Readers should note, however, that Nvidia’s shares did not rise immediately after its last two quarterly announcements.

What to Expect from the Q4 Update

Determining whether Nvidia stock will jump after its Q4 update is not straightforward, but we can provide some insights.

Analysts surveyed by LSEG expect Nvidia to report average Q4 revenue of $38.13 billion, with earnings per share (EPS) pegged at $0.85. To meet these forecasts, Nvidia must achieve approximately 72.5% year-over-year revenue growth and 63.5% EPS growth.

In its third quarter, Nvidia reported a substantial 94% revenue growth and a remarkable 103% EPS growth. However, management’s guidance for Q4 projects revenue around $37.5 billion, with a margin of error of 2%. To impress Wall Street, Nvidia will need to be close to the higher end of that estimate.

In order for the stock price to rise significantly, benefiting investors who buy right before the earnings report, Nvidia needs more than just a minor revenue and earnings beat. The company will need to exceed estimates significantly or provide a very optimistic outlook for fiscal 2026. Three key points support a positive outlook for Nvidia.

First, CFO Colette Kress mentioned during the Q3 earnings call that “Blackwell demand is staggering,” indicating that Nvidia is on track to exceed its revenue estimates for new GPU chips despite challenges in meeting demand.

Second, key customers like Amazon, Microsoft, Alphabet, and Meta Platforms have all indicated plans to continue significant investments in AI infrastructure, which is favorable for Nvidia.

Lastly, Nvidia’s competitors, particularly Advanced Micro Devices, have not seen the same level of investment. Although AMD reported healthy Q4 revenue growth, it fell short of expectations.

The Long-Term Outlook

It would not be surprising if Nvidia surpasses Wall Street’s Q4 estimates, causing a spike in shares when the market opens on February 27. However, successful investing requires a long-term perspective rather than short-term speculation. The critical question is whether Nvidia can sustain its momentum.

Some analysts predict that Nvidia’s growth may stall, citing its current valuation at 32.6 times forward earnings. They express concerns that demand for AI chips might diminish, potentially influenced by more efficient models like DeepSeek’s that use fewer GPUs.

Despite these cautionary views, I remain cautiously optimistic. Advances in AI likely will drive increased demand for Nvidia’s chips, rather than decrease it. I also anticipate that Nvidia will continue to outperform its competition.

While a slowdown in growth is inevitable, purchasing Nvidia stock before February 26 could be a prudent decision. Even if you choose not to invest by then, the stock might still have significant potential for appreciation afterward.

A Second Chance at a Promising Investment

Have you ever felt you missed the opportunity to invest in the most successful stocks? If so, pay attention here.

Our expert analysts occasionally issue a “Double Down” stock recommendation for companies they believe are on the verge of significant growth. If you’ve missed earlier chances to invest, now may be the best time to consider buying before it’s too late. Here are the numbers:

- Nvidia: Investing $1,000 when we first recommended in 2009 would now be worth $348,579!*

- Apple: A $1,000 investment in 2008 would be worth $46,554!*

- Netflix: If you had invested $1,000 in 2004, it would now hold $540,990!*

Currently, we’re issuing “Double Down” alerts for three exceptional companies, and this opportunity may not arise again soon.

Learn more »

*Stock Advisor returns as of February 21, 2025

John Mackey, former CEO of Whole Foods Market, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director at Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is also on the board. Suzanne Frey, an executive at Alphabet, is part of the board as well. Keith Speights holds positions in Alphabet, Amazon, Meta Platforms, and Microsoft. The Motley Fool has investments in and recommends Advanced Micro Devices, Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Fool also promotes these options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool’s disclosure policy is available for review.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.