Emerging Players in Nuclear Power: A Closer Look at Investment Opportunities

The nuclear power industry is often viewed as a slow-growing market, primarily controlled by major corporations such as NextEra Energy and Duke Energy. According to Markets and Markets, from 2024 to 2029, the nuclear power market is projected to grow at a modest compound annual growth rate (CAGR) of 2.9%. This suggests limited prospects for high-growth investments.

Diving deeper, however, unveils smaller companies that are challenging the traditional nuclear landscape with innovative reactor designs. Two notable names are NuScale Power (NYSE: SMR) and Oklo (NYSE: OKLO). Though these stocks carry volatility and speculation, a modest investment of $500 in either could yield significant returns.

Looking for smart investments right now? Our analysts reveal the 10 best stocks to consider. Learn More »

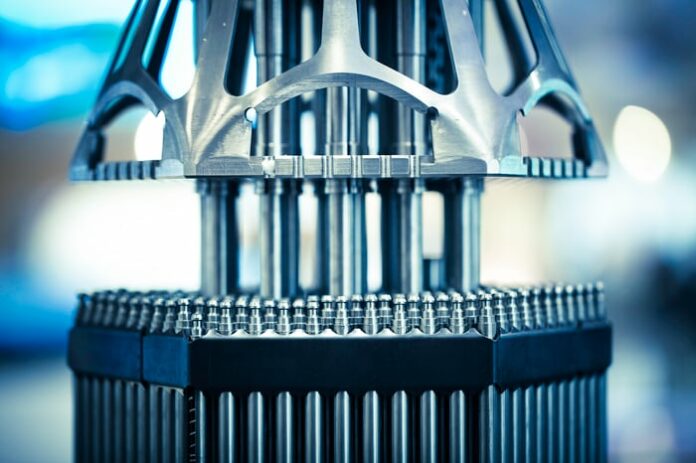

Image source: Getty Images.

1. NuScale Power: A Leader in Small Modular Reactors

NuScale specializes in small modular reactors (SMRs), which are compact, provide ease of assembly, and are delivered on-site. This prefabricated design significantly cuts costs and reduces the time required to build a functional nuclear reactor. Measuring only 9 feet (2.7m) wide and 65 feet (20m) tall, these reactors are easier to install compared to traditional, larger models, making them suitable for locations that can’t accommodate larger plants.

NuScale has a commanding presence in the emerging SMR market, being the only company to have received a Standard Design Approval (SDA) for its reactors from the U.S. Nuclear Regulatory Commission (NRC). Presently, the NRC approves its SMR clusters to produce a maximum of 55 megawatts of electricity.

However, to be more competitive than coal plants, its reactors need to generate at least 77 megawatts. NuScale anticipates receiving NRC certification for its 77-megawatt reactors soon.

The broader SMR landscape offers additional growth potential. The U.S. Department of Energy (DOE) recently allocated up to $900 million in funding for nuclear SMR development, and Amazon is also looking to invest in more SMR projects for its energy needs.

Despite the promising outlook, NuScale has faced difficulties. In 2023, it scrapped plans to build six reactors in Idaho due to rising costs and laid off 40% of its workforce last year. Dilution of shares through secondary offerings and substantial stock-based compensations have also added to investor anxiety.

Over the next few years, analysts project a revenue increase for NuScale, forecasting growth from $23 million in 2023 to $193 million by 2027 as it obtains design approvals, forges new contracts, and expands its operations. Although currently valued at 12 times its predicted 2026 sales, a $500 investment could lead to substantial gains if NuScale maintains its market leadership.

2. Oklo: A Speculative Bet on Microreactors

Oklo represents a more speculative option than NuScale, as it has yet to generate revenue. The company caught attention when Sam Altman, the former CEO of OpenAI, held the CEO position for three years before transitioning leadership to co-founder Jacob DeWitte in 2024. Altman remains involved as the board chairman, adding notable interest to the company.

Oklo designs microreactors, which are smaller still than SMRs. These innovative reactors utilize metallic uranium fuel, known for being denser and more cost-effective to produce than traditional uranium fuel pellets. They also boast minimal carbon emissions in comparison to conventional nuclear reactors, which can emit between 2 to 130 tons of CO2 per gigawatt hour (GWh) generated. Moreover, Oklo is developing a fuel recycling technology that can recover over 90% of the energy from unutilized fuel, potentially slashing fuel costs by up to 80%.

Oklo’s primary microreactor, the Aurora, has a cost of $70 million and generates 15 megawatts of electricity. By comparison, a standard nuclear reactor offering the same output would range between $82.5 million and $121.5 million in construction costs. The Aurora can be scaled to produce 50 megawatts and can operate continuously for more than a decade without refueling. In 2019, it received approval to begin construction of its first reactor in Idaho, working closely with the NRC and DOE.

However, Oklo does not expect to bring its first reactor online until 2027, leaving uncertainty around its current enterprise value of $6.2 billion and whether it is an affordable long-term investment. While investing $5,000 may be too risky for many, a smaller $500 stake might be justifiable for those who believe in its future potential.

Seize Your Opportunity in the Stock Market

Do you often feel you’ve missed out on profitable stock opportunities? Consider this your chance.

Our team of analysts only occasionally provides a “Double Down” stock recommendation for companies that they believe are on the verge of significant growth. If you’re concerned about missing your moment to invest, now may be the ideal time to take action. The numbers are impressive:

- Nvidia: A $1,000 investment in 2009 would now be worth $348,579!

- Apple: Investing $1,000 in 2008 would yield $46,554 today!

- Netflix: A $1,000 investment from 2004 could have grown to $540,990!

We are currently issuing “Double Down” alerts for three promising companies, presenting a rare opportunity for savvy investors.

Learn more »

*Stock Advisor returns as of February 21, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is part of The Motley Fool’s board of directors. Leo Sun holds positions in Amazon. The Motley Fool has interests in and recommends Amazon and NextEra Energy, while also recommending Duke Energy and NuScale Power. For further details, consult The Motley Fool’s disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.