The Future of AI: Major Investments and Promising Stocks to Watch

The excitement around artificial intelligence (AI) continues in the United States, despite the controversies surrounding China’s DeepSeek initiative. Interestingly, the cost-effective DeepSeek ecosystem has contributed to the expansion of the global AI landscape. Excluding DeepSeek, four of the so-called “magnificent 7” stocks are set to pour a staggering $325 billion into AI infrastructure development by 2025. This spending represents an impressive 46% increase in capital expenditures in the AI sector compared to the previous year.

Such significant investments in AI infrastructure are expected to reshape various fields over the next five years, including automation, robotics, self-driving cars, advancements in life sciences, and innovations in energy and materials.

Two Underrated AI Stocks to Consider for Short-Term Gains

Currently, we suggest looking into two lesser-known AI stocks with strong Zacks Ranks that promise solid short-term returns. Both stocks are well-positioned to benefit from long-term global AI spending trends. The selected companies are Five9 Inc. (FIVN) and Astera Labs Inc. (ALAB).

Five9 Inc. (FIVN)

Holding a Zacks Rank #1, Five9 specializes in intelligent cloud software for contact centers across the United States, India, and internationally. The company provides a virtual contact center platform that includes multiple applications for customer service, sales, and marketing.

FIVN’s offerings feature interactive virtual agents, agent assistance tools, workflow automation, and AI-driven insights. This comprehensive platform allows companies to manage customer interactions across various channels, including voice, chat, email, and social media.

For the fourth quarter of 2025, Five9 reported adjusted earnings of $0.78 per share, surpassing the Zacks Consensus Estimate of $0.70 per share. This also reflects growth from the prior year’s earnings of $0.61 per share.

The company achieved quarterly revenues of $278.66 million, exceeding the Zacks Consensus Estimate by 4.18%. This is an increase from last year’s revenues of $239.06 million, with renewable subscription sales rising by 19% year-over-year.

Innovation Through AI at Five9

Five9 is benefitting from the rapid adoption of AI tools within its services, with personalized AI agents driving growth. On February 19, Five9 unveiled its Intelligent CX Platform powered by Five9 Genius AI on the Google Cloud, along with new AI agents tailored for Google Cloud.

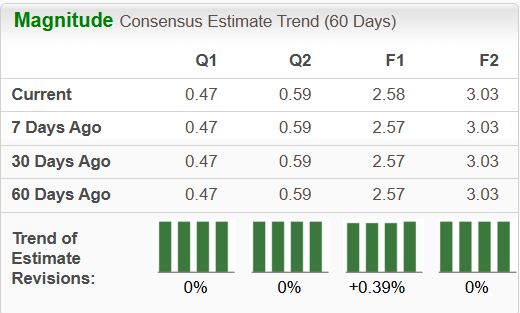

Positive Earnings Estimates for Five9

FIVN anticipates revenue and earnings growth rates of 9.3% and 4.5%, respectively, for the current year. Moreover, the Zacks Consensus Estimate for current-year earnings has improved by 0.4% over the last week.

Looking ahead, analysts forecast revenue and earnings growth rates of 9.8% and 17.5%, respectively, for next year. The Zacks Consensus Estimate for next-year earnings has remained stable over the past two months.

Image Source: Zacks Investment Research

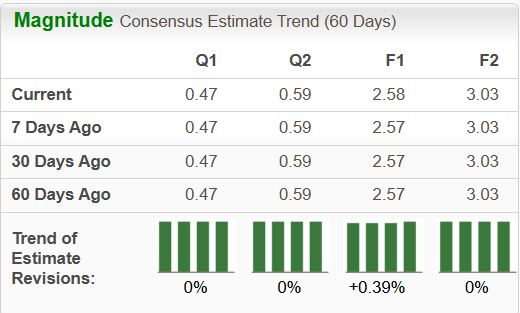

Five9 is currently valued at a forward P/E ratio of 16.33X, compared to the industry average of 28.21X and the S&P 500’s 18.71X. Its forward P/S ratio sits at 3.04X, in contrast to the industry’s 4.46X and the S&P 500’s 3.02X.

The average short-term price target among brokerage firms suggests a potential increase of 23.7% from the last closing price of $42.09. Price targets range between $40 and $67, indicating a possible upside of 59.2% and a maximum downside of 5%.

Image Source: Zacks Investment Research

Astera Labs Inc. (ALAB)

With a Zacks Rank #2, Astera Labs focuses on developing connectivity solutions for cloud computing and AI applications. Its Intelligent Connectivity Platform includes both hardware components, like chips and modules, and software solutions aimed at improving connectivity in AI and cloud environments.

As demand for AI platforms grows, particularly those utilizing high-performance GPUs and AI accelerators, Astera Labs has seen strong sales and design wins for products such as Aries Retimers and Scorpio Fabric Switches.

Astera Labs recently introduced its Scorpio Smart Fabric Switches, specially designed for AI infrastructure at the cloud level. The P-Series provides GPU-to-CPU/NIC/SSD PCIe Gen 6 connectivity, while the X-Series focuses on AI accelerator clustering. These switches are now in pre-production shipment.

Expanding AI Presence and Partnerships

In its fourth quarter of 2024, Astera Labs enhanced its Aries PCIe/CXL Smart DSP Retimer portfolio by launching the Aries 6, which is the lowest power PCIe 6.x/CXL 3.x Retimer solution available, offering improved bandwidth and reach for sophisticated AI applications.

Astera Labs has established partnerships with major chipmakers, including NVIDIA Corp. (NVDA) and Advanced Micro Devices Inc. (AMD). Their products have been integrated into NVIDIA’s GB200 product line, indicating Astera’s essential role in advancing AI technologies.

Similarly, AMD is leveraging Astera Labs solutions to boost the efficiency and scalability of its AI-focused products. These collaborations underlie both companies’ strong positions in the competitive AI market, paving the way for breakthroughs in next-generation technologies.

Astera Labs (ALAB) Sees Positive Growth Ahead: Key Insights

Promising Revenue Growth for ALAB

Astera Labs’ robust demand for AI products and a growing customer base are set to fuel revenue growth. The company anticipates strong performance from its Aries product family across various AI platforms, while also ramping up production of Taurus SCM for 400-gig applications and Scorpio P-Series switches.

For the first quarter of 2025, ALAB forecasts revenues between $151 million and $155 million, with non-GAAP earnings expected to range from $0.28 to $0.29 per share.

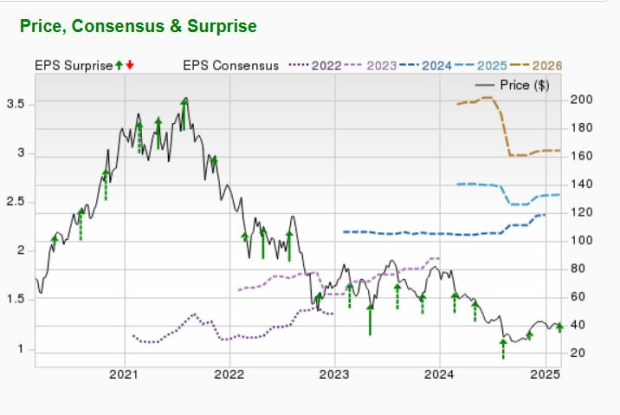

For the current year, Astera Labs projects impressive growth rates with expected revenue growth at 69.1% and earnings growth at 48.8%. The Zacks Consensus Estimate for earnings this year has improved by 10.6% over the last month.

Looking ahead to next year, the company anticipates revenue growth of 32.3% and earnings growth of 36.2%. Notably, the consensus estimate for next year’s earnings has remained stable in the past 30 days.

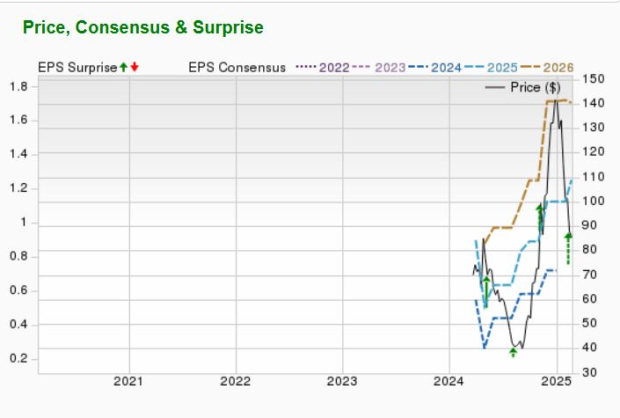

Image Source: Zacks Investment Research

Brokerage firms have set a short-term average price target for ALAB stock that suggests a potential increase of 44.4% from its last closing price of $85.72. Current price targets range from $114 to $150, indicating a possible maximum upside of 75% without any downside risk.

Image Source: Zacks Investment Research

Discover Zacks’ Top Stocks for 2025

Don’t miss the chance to catch our top 10 stock picks for 2025, selected by Zacks Director of Research Sheraz Mian. This curated list has demonstrated remarkable success since its inception in 2012, with a gain of +2,112.6% through November 2024, significantly outperforming the S&P 500’s +475.6%. Sheraz has meticulously reviewed over 4,400 companies to identify the best 10 for investment in 2025. Be among the first to discover these newly released, high-potential stocks.

See New Top 10 Stocks >>

For more insights from Zacks Investment Research, you can download the 7 Best Stocks for the Next 30 Days for free.

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Five9, Inc. (FIVN) : Free Stock Analysis Report

Astera Labs, Inc. (ALAB) : Free Stock Analysis Report

This article was originally published by Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.