Quantum Computing: The Next Frontier for Investors

Following the rapid expansion of the artificial intelligence (AI) sector, quantum computing stands out as a promising next frontier. Quantum technology could revolutionize industries even more profoundly than AI has achieved.

Quantum machines harness subatomic particles to execute calculations at speeds unattainable by today’s computers. This capability may lead to significant advancements across various sectors, including medicine, energy, and manufacturing.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Notable players within this field include specialized quantum companies Rigetti Computing (NASDAQ: RGTI) and IonQ (NYSE: IONQ). Both have potential for substantial growth as the quantum computing market matures.

Keep reading to delve into Rigetti and IonQ, and discover which presents a better investment opportunity in quantum computing.

Examining Rigetti Computing

Rigetti Computing’s stock has seen impressive growth, increasing over 300% in the past 12 months as of February 27. This uptick largely stems from investor enthusiasm surrounding quantum computing’s future prospects.

The company’s technology is built on superconducting qubits, a more established method in quantum computing compared to the trapped ion technology utilized by IonQ. Rigetti also employs solid-state fabrication techniques, which align with existing semiconductor industry standards and may ease customer adoption.

However, challenges persist for Rigetti, mirroring those faced by other firms in the quantum space. Subatomic particles are susceptible to calculation errors, necessitating error correction, which hampers the scalability of quantum devices. While the potential of these machines is vast, they remain unable to replace traditional computers.

Despite the hype, Rigetti’s financial performance has been disappointing. The company reported Q3 revenue of $2.4 million, down 23% from $3.1 million a year earlier, marking the second consecutive quarter of year-over-year revenue declines—an alarming trend.

Additionally, Rigetti’s cost of revenue surged 41% year-on-year to $1.2 million in Q3. This combination of declining sales and rising costs caused the gross profit for Q3 to plummet nearly 50% to $1.2 million from $2.3 million in the same quarter of 2023. Consequently, Rigetti reported a Q3 net loss of $14.8 million.

Understanding IonQ’s Strategy

IonQ focuses on developing networking technology to overcome the hurdle of scaling quantum machines. By connecting multiple quantum computers, IonQ mirrors approaches used in conventional computing related to AI. The company has witnessed a stock surge of over 140% during the past year as of February 27, reflecting strong business growth.

For 2024, IonQ reported revenue of $43.1 million, marking a year-on-year increase of 95%. This growth continues a positive trajectory, as 2023 revenue of $22 million represented a 98% rise from 2022.

IonQ’s revenue is expected to grow further due to advancements in its technology. In February, the company revealed that its ion-based systems can generate vacuums comparable to those found on the moon, enabling their operations at room temperature—the key for wider organizational adoption. In contrast, competitors such as Rigetti often keep their quantum computers in expensive cryogenic chambers.

The efficacy of IonQ’s technology is underscored by its customer base, which includes major firms like AstraZeneca, Airbus, and the U.S. Air Force Research Lab.

Despite impressive revenue growth, IonQ has yet to achieve profitability, exiting 2024 with a net loss of $331.6 million—more than double the $157.8 million loss recorded the previous year.

Rising costs remain a concern for IonQ as well. On February 26, the company announced plans to raise additional capital through an equity offering, leading to a decline in its stock due to potential dilution for existing shareholders.

In response to its financial challenges, IonQ appointed former physicist and board member Niccolo de Masi as the new CEO on February 26. He has extensive experience, having previously served as CEO at the SPAC that took IonQ public.

Investment Considerations: Rigetti vs. IonQ

Analyzing both Rigetti and IonQ, IonQ appears to be the more promising quantum computing investment currently. The stark difference in sales performance, with Rigetti experiencing declines while IonQ’s revenues rise, highlights that IonQ’s ion-based technology is effectively attracting customers.

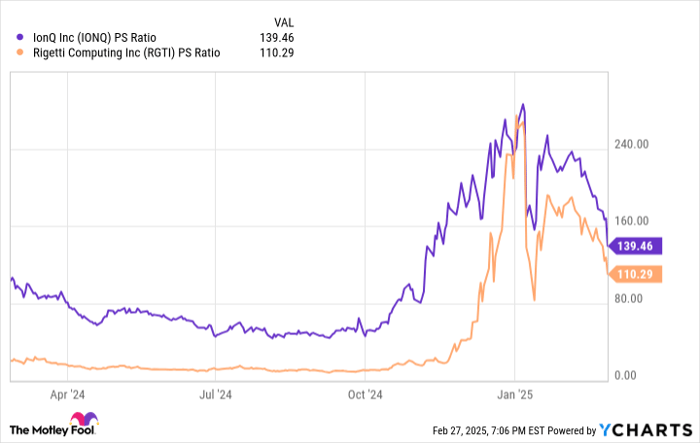

Nevertheless, both stocks carry a hefty price tag. Consider the price-to-sales (P/S) ratio for each, reflecting what investors are willing to pay per dollar of revenue.

Data by YCharts.

The P/S multiples for both companies have risen recently. Although there has been some decline, these metrics remain elevated compared to much of 2024. Investors may want to wait for IonQ’s stocks to dip further before making their purchases.

Investing in either company carries significant risks, given the existing hurdles in quantum technology. Only those with a high tolerance for risk should contemplate buying shares.

Keep an Eye on Emerging Investment Opportunities

If you think you missed out on buying successful stocks, consider this your chance. Rarely, our analysis team identifies a “Double Down” Stock recommendation for companies poised to pop soon. If you feel you’ve missed your opportunity to invest, now is a prime time before the window closes. The statistics underscore our assertions:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $323,920!

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $45,851!

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $528,808!

Right now, we’re offering “Double Down” alerts for three remarkable companies, so don’t miss out.

Continue »

*Stock Advisor returns as of March 3, 2025

Robert Izquierdo has positions in IonQ. The Motley Fool recommends AstraZeneca Plc. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.