Nvidia’s Stock Faces Decline but Bright Future May Loom Ahead

Nvidia (NASDAQ: NVDA) Stock reached a record closing high of nearly $150 in January, but it has recently fallen by 16%. This decline was sparked by reports of a Chinese artificial intelligence (AI) start-up, DeepSeek, which has developed a method to train advanced AI models at a significantly lower cost and with less computing power compared to its American counterparts.

Investors have expressed concerns that DeepSeek’s innovations could diminish the demand for Nvidia’s powerful data center graphics processing units (GPUs). However, CEO Jensen Huang’s recent remarks suggest that the emergence of new AI models may, in fact, increase the demand for these chips.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Here’s what Huang stated, along with predictions that suggest Nvidia’s Stock could rebound this year.

Image source: Nvidia.

Nvidia Achieves Record Financial Results

Before discussing Huang’s insights, it is important to consider Nvidia’s financial performance for fiscal 2025 (ending Jan. 26), released last Wednesday. Investors anticipated robust results as the company began shipping its new Blackwell GB200 GPUs, considered the standard for AI development.

Nvidia reported a staggering $130.5 billion in total revenue for fiscal 2025, representing a 114% increase from the previous year and exceeding management’s projection of $128.6 billion. Notably, the data center segment accounted for $115.1 billion of total revenue, reflecting a remarkable 142% increase year-over-year.

During the fourth quarter of fiscal 2025, Nvidia commenced commercial shipments of its Blackwell GPUs. These chips generated $11 billion in sales, surpassing expectations and marking the fastest product ramp in the company’s history. The Blackwell GB200 GPU is a significant advancement, capable of performing AI inference up to 30 times faster than the previous flagship model, the H100. Inference allows AI models to make predictions and process data, which improves applications like chatbots.

According to Nvidia, ongoing scaling of Blackwell production is essential due to the heightened demand. Some major customers have disclosed their spending plans for AI data centers and chips this year, with figures that are notably high.

While not all of this spending will benefit Nvidia directly, the appetite for computational power remains strong, despite DeepSeek’s recent innovations.

Huang Delivers Optimistic Outlook for Investors

OpenAI has emerged as one of the leading AI start-ups in the U.S. Established in 2015, it has invested over $20 billion to develop data center infrastructure and train its AI models. Thus, when DeepSeek announced it had trained its V3 model, which performs comparably to OpenAI’s GPT-4o, for just $5.6 million, it surprised many in the industry.

This cost does not factor in an estimated $500 million in infrastructure expenses, causing alarm in financial circles. DeepSeek, facing export restrictions on Nvidia’s latest chips, utilized innovative software techniques to work around the lack of computing power. One technique, called distillation, leverages proven models like GPT-4o to accelerate the training of smaller models, significantly reducing required resources.

Though a widespread adoption of distillation might curb demand for training workloads, OpenAI and others have discovered that merely feeding vast amounts of data into their models does not yield the best results. They are now focusing on “reasoning” models that increase computational needs by spending more time refining responses. During a recent investor call, Huang noted that these reasoning models can require up to 100 times more compute power than earlier models, and some future models could need thousands or even millions of times more.

Examples of current reasoning models include DeepSeek R1, xAI’s Grok 3, Anthropic’s Claude 3.7 Sonnet, and OpenAI’s GPT4-o1 to GPT-4o3. The growing trend among developers towards reasoning models suggests that Nvidia may be on the brink of a new demand phase for its chips.

Nvidia’s Stock Might Be Underappreciated

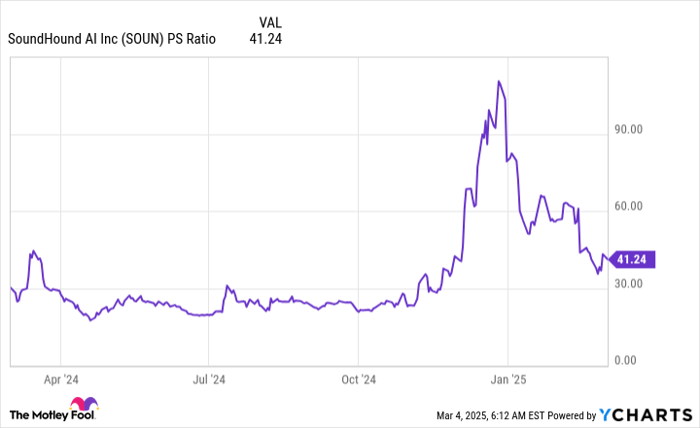

With Nvidia’s earnings per share (EPS) of $2.99 for fiscal 2025, the stock’s price-to-earnings (P/E) ratio currently stands at 42.5. This is a 28% discount from its 10-year average of 59.3. Wall Street’s consensus estimate suggests that Nvidia could achieve an EPS of $4.49 in the current fiscal year 2026, which would place its forward P/E ratio at just 27.7:

NVDA PE Ratio data by YCharts.

In other words, Nvidia’s stock would need to increase by 53% over the next year just to maintain its current P/E ratio, or by 114% to align with its historical average P/E ratio. Considering the recent decline due to the DeepSeek news, Huang’s comments regarding a potential surge in inference workloads may draw investors back, particularly if Nvidia’s financial results validate this perspective.

Consequently, it appears that Nvidia’s stock may experience significant growth within the next year, and possibly beyond.

Seize This Opportunity for Potential Investment Gains

If you’ve ever felt you missed the chance to invest in top-performing stocks, now might be your moment.

Occasionally, our team of analysts issues a “Double Down” Stock recommendation for companies predicted to experience significant growth. If you’re excited about this opportunity, you would need to act fast:

- Nvidia: A $1,000 investment when we doubled down in 2009 would now be worth $295,759!*

- Apple: A $1,000 investment when we doubled down in 2008 would now be worth $45,128!*

- Netflix: A $1,000 investment when we doubled down in 2004 would now be worth $525,108!*

Currently, we are issuing “Double Down” alerts for three promising companies, and this may be one of the last opportunities to invest.

Continue »

*Stock Advisor returns as of March 3, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.