BiomX Inc. Shares Show Signs of Potential Trend Reversal

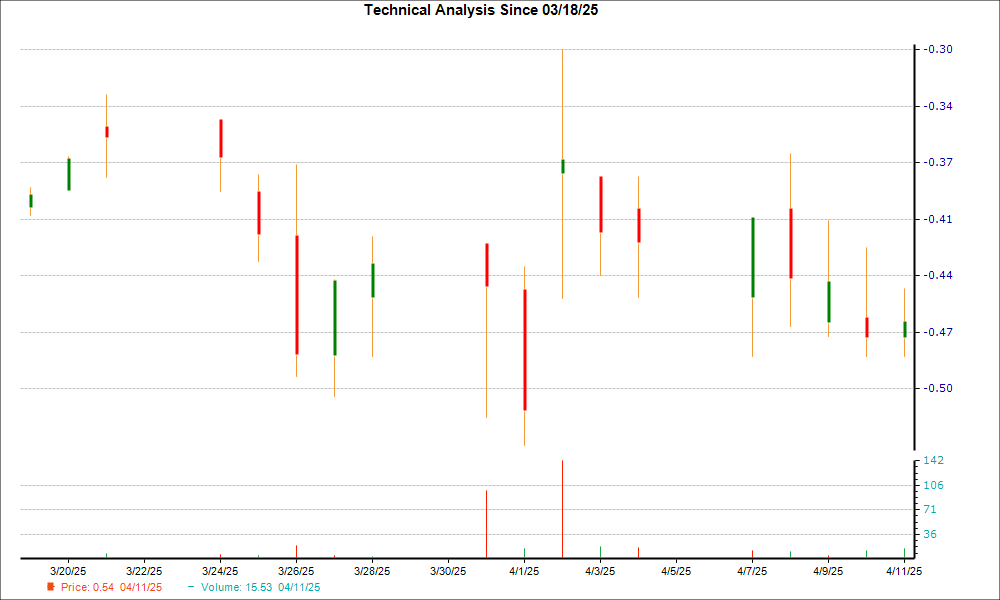

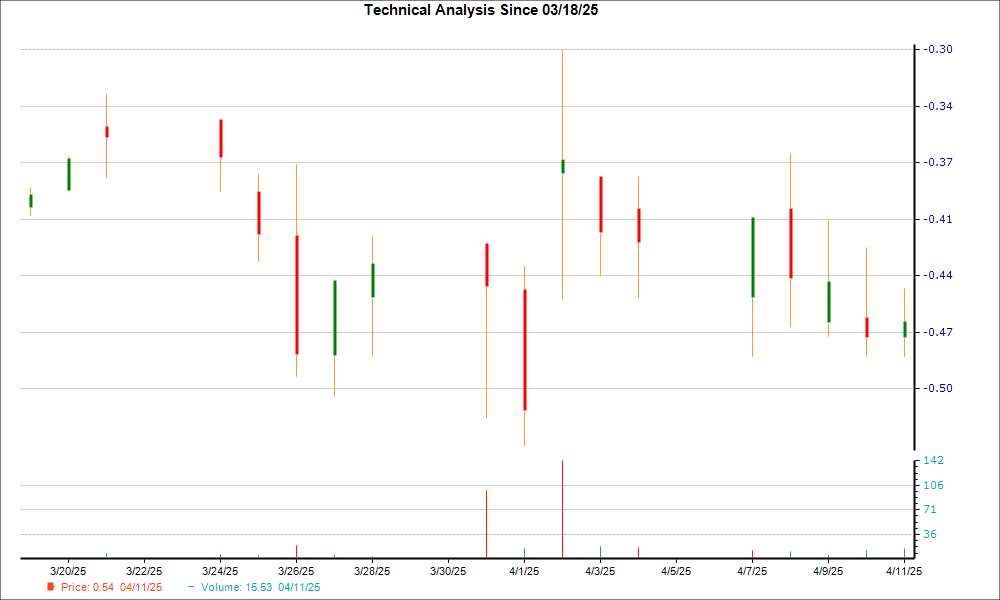

Shares of BiomX Inc. (PHGE) have faced challenges recently, declining by 7.9% over the past two weeks. However, during its last trading session, the stock formed a hammer chart pattern. This development suggests that support may have emerged, allowing bulls to counter the recent bearish momentum, which could signal a potential trend reversal ahead.

The formation of a hammer pattern indicates a possible end to selling pressure and aligns with growing optimism among Wall Street analysts regarding BiomX’s future earnings. This combination of technical and fundamental indicators strengthens the case for a trend reversal in the stock.

What is a Hammer Chart Pattern?

The hammer chart pattern is a well-known formation in candlestick charting that signifies potential price reversal. It consists of a small candle body with a minor difference between the opening and closing prices, paired with a much longer lower wick. For a candle to be identified as a hammer, the lower wick must be at least twice the length of the actual body.

In simpler terms, during a downtrend, the stock typically opens lower than the previous day’s close and continues to fall. On the day a hammer pattern is formed, the stock may reach a new low before attracting buying interest, which can drive the stock price up, closing near or above the opening price. When this occurs at the bottom of a downtrend, it suggests that bearish control is diminishing, signaling a potential reversal.

Hammer candles are versatile and can appear on any timeframe—such as one-minute, daily, or weekly charts—making them valuable for both short-term and long-term investors.

While the hammer pattern offers insights, it has its limitations. The effectiveness of a hammer relies heavily on its context on the chart, and it should be used alongside other bullish indicators to confirm its implications.

Factors Favoring a Turnaround for PHGE

Recently, there has been a positive trend in earnings estimate revisions for PHGE, a strong fundamental indicator pointing towards bullish sentiment. Increased estimates typically correlate with impending price increases.

In the last 30 days, the consensus EPS estimate for the current year has risen by 34.9%. Analysts appear to agree that BiomX is set to report better-than-expected earnings.

Additionally, the stock currently holds a Zacks Rank of #2 (Buy), positioning it within the top 20% of over 4,000 ranked stocks. Stocks with a Zacks Rank of #1 or #2 often outperform the broader market. Investors can see today’s list of Zacks Rank #1 (Strong Buy) stocks here >>>>

Thus, BiomX’s Zacks Rank of #2 further reinforces the potential for a trend reversal, as this ranking has historically proven to be a reliable indicator of improving company prospects.

Zacks Highlights Top Semiconductor Stock

In a different sector, Zacks recently named a leading semiconductor stock—only 1/9,000th the size of NVIDIA—whose value has surged over 800% since it was recommended. Despite NVIDIA’s strong performance, this new stock has significant potential for growth.

With robust earnings growth and a rapidly expanding customer base, the stock is well-positioned to meet the increasing demand for Artificial Intelligence, Machine Learning, and the Internet of Things. The global semiconductor market is forecasted to increase from $452 billion in 2021 to $803 billion by 2028.

Check Out This Stock for Free >>

For those interested in the latest recommendations from Zacks Investment Research, today you can download the report on the 7 Best Stocks for the Next 30 Days. Click to access your free copy.

BiomX Inc. (PHGE): Free Stock Analysis report

This article originally appeared on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.