Berkshire Hathaway’s Strategic Portfolio Moves Spark Investor Interest

Berkshire Hathaway‘s (NYSE: BRK.A) (NYSE: BRK.B) portfolio has experienced notable shifts over the past year, even as billionaire investor and CEO Warren Buffett adopts a seemingly conservative investment approach. This strategy has captured the attention of investors analyzing its implications.

Below are some of the most significant changes in Berkshire’s portfolio this year and what investors may infer from them.

Reduction in Apple Stake

The most significant change Buffett made to Berkshire’s stock portfolio this past year was dramatically reducing its stake in Apple (NASDAQ: AAPL). As of the end of the first quarter of 2024, Berkshire held 789 million shares of the technology giant. By the end of 2024, this position dropped to approximately 300 million shares (as of February 14, 2025). Berkshire has not yet disclosed its 2025 Q1 portfolio specifics, so this number may have further declined.

In 2023, Apple represented about half of Berkshire’s portfolio value. However, by the end of 2024, Apple accounted for just 22% of its total holdings. The other top five stocks, including American Express, Bank of America, Coca-Cola, and Chelsea, remain unchanged, although their relative positions have shifted significantly. American Express, at 14%, has narrowed the gap considerably with Apple.

Berkshire’s Cash Reserves Reach New Heights

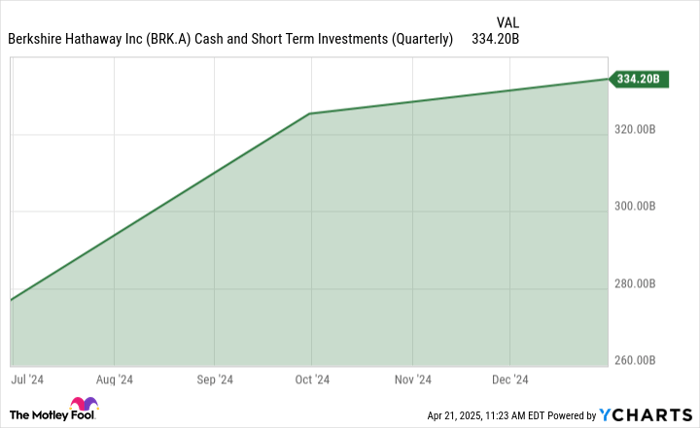

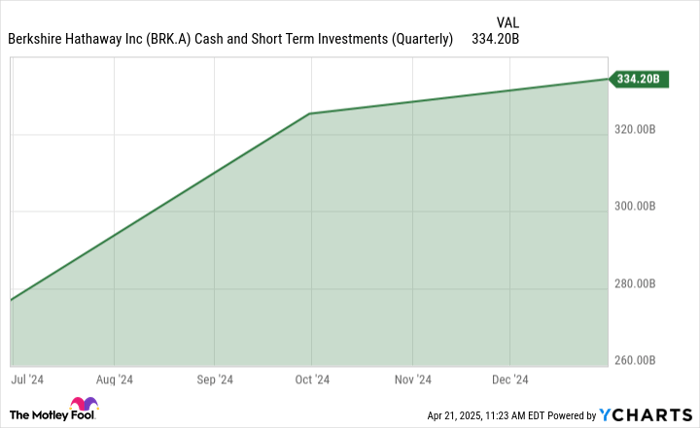

As Berkshire sold Apple shares, its cash position rapidly increased. The company has not reinvested all proceeds from these sales into other stock purchases:

Data by YCharts.

At a record $334 billion, Berkshire’s cash reserves include short-term investments, such as Treasury bills. These highly liquid assets often contribute to the company’s growing cash balance.

Market commentary suggests several reasons for Buffett’s cash-heavy strategy. Some analysts speculate that he may be cautious about economic conditions, preferring to hold safe investments. Others believe he finds current stock valuations too inflated, leaving few attractive deals. Buffett has historically maintained a low profile regarding his rationale, stating previously that “forecasts may tell you a great deal about the forecaster; they tell you nothing about the future.”

Understanding Buffett’s Investment Moves

Buffett’s decision to sell Apple shares and build cash reserves doesn’t necessarily indicate insider knowledge. It’s plausible he might consider repurchasing Apple stock due to its current lower valuation. Regardless of his reasons, these moves should not dictate individual investors’ strategies. Each person’s investment goals differ from Buffett’s.

Buffett often emphasizes that accurately timing the market is a daunting task, even for the savviest investors. The potential for holding more dividend stocks and safer investments amid current market risks is sound. However, exiting the stock market entirely is rarely a wise decision. Investing in an S&P 500 (SNPINDEX: ^GSPC) index fund may be a logical step in light of the index’s recent decline and expected long-term recovery.

Investment Considerations for Berkshire Hathaway

Before making any investment in Berkshire Hathaway, assess the following:

The Motley Fool Stock Advisor has recently highlighted what they believe are the 10 best stocks to buy currently—and Berkshire Hathaway is not one among them. The identified stocks have the potential for substantial returns in the coming years.

For example, when Netflix made the list on December 17, 2004, a $1,000 investment at that time would now be valued at around $561,046!* Similarly, if you invested in Nvidia when recommended on April 15, 2005, that $1,000 would have grown to approximately $606,106!*

Additionally, note that Stock Advisor boasts an average return of 811% compared to the S&P 500’s 153%. To stay updated on the latest top 10 lists, join Stock Advisor.

See the top stocks now »

*Stock Advisor returns as of April 21, 2025

American Express and Bank of America are advertising partners of Motley Fool Money. David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Bank of America, Berkshire Hathaway, Chevron, and Domino’s Pizza. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.