Two Promising Stocks Trading Near 52-Week Lows

A stock trading at a 52-week low indicates that its price has reached its lowest point in the past year. While this may not assure investors of an imminent rebound, exploring a selection of 52-week low stocks can reveal hidden gems. Investors might discover value in high-quality companies that are currently undervalued.

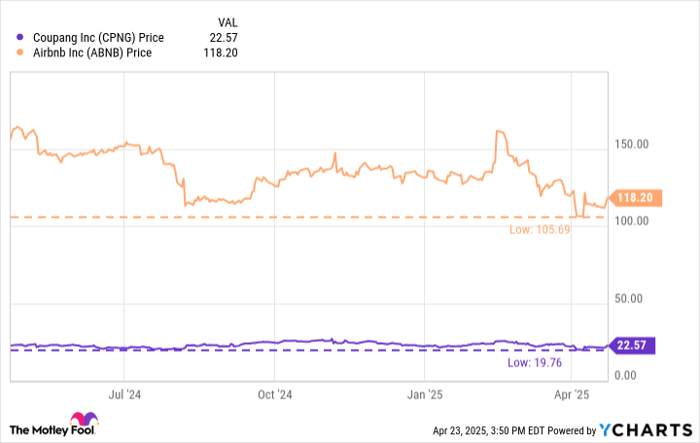

As of April 23, only a few stocks are trading at their 52-week lows, largely due to a significant broad market upward trend over the past two weeks amidst tariff uncertainties. Nevertheless, a couple of strong growth stocks are near these lows, presenting intriguing opportunities for long-term investors. Notably, Coupang (NYSE: CPNG) and Airbnb (NASDAQ: ABNB) stand out as compelling choices.

Coupang’s Growing Market Share

E-commerce continues to experience rapid growth, benefiting innovative companies like Coupang, which is often compared to Amazon for its dominance in South Korea. Many argue that Coupang offers a more compelling value proposition than its American counterpart.

Subscribers to Coupang’s Rocket Wow service gain access to free same-day and next-day delivery for orders placed by midnight, as well as discounts on food delivery. Their service extends to rapid grocery delivery and even includes assistance with household tasks such as tire changes and appliance installation—provided the items are purchased through Coupang’s marketplace.

Currently, Coupang is used by the majority of households in South Korea. The company generates $30 billion in annual revenue alongside $1 billion in free cash flow. This growth comes even as Coupang invests heavily to expand its presence into other markets like Taiwan and enhances its offerings through acquisitions such as luxury marketplace Farfetch.

Last quarter, Coupang achieved a 29% year-over-year increase in gross profit, excluding impacts from foreign currency changes and revenue linked to acquisitions. With e-commerce still a minor segment of overall retail spending in South Korea, Coupang has substantial growth potential, especially with its expansion plans.

At approximately $22.50 per share, Coupang is just above its 52-week low of $19.76 set earlier this year. With a market cap of $41 billion and significant revenue growth prospects, Coupang shares appear to be an attractive investment at current levels.

Airbnb’s Expansion Plans

Airbnb is recognized globally, providing millions with affordable accommodation options. Its home-sharing marketplace has become a crucial part of the international travel sector. In the past year, Airbnb’s marketplace generated $81.8 billion, marking a 12% annual growth.

Even in its more established markets, like North America and Western Europe, Airbnb’s growth trajectory remains strong, as it represents only a small fraction of the overall travel market. To enhance its growth, Airbnb is intentionally expanding geographically and diversifying its product offerings.

Management is customizing its services for specific travel markets, such as Japan and Brazil, leading to accelerated growth in those regions. The company reported over 20% growth in nights and experiences booked in both Latin America and the Asia Pacific during the fourth quarter last year, surpassing overall growth rates. Airbnb is also preparing to introduce new services for its user base, including travel packages and cleaning services, enhancing its marketplace’s value proposition.

At its current price of $118, which is close to its 52-week low of $105.69, Airbnb shows potential for long-term investment, making it an appealing option for investors looking to capitalize on its continued growth.

Should You Invest $1,000 in Airbnb Right Now?

Before investing in Airbnb, consider this: the analyst team at Stock Advisor has identified their top ten stocks to buy, and Airbnb did not make the list. Those featured candidates could deliver strong returns in the forthcoming years.

For context, if you had invested $1,000 in Netflix when it made the list on December 17, 2004, it would be worth approximately $591,533 today. Similarly, an investment in Nvidia, recommended on April 15, 2005, would be worth around $652,319 today.

Additionally, Stock Advisor boasts an impressive average return of 859%, outperforming the S&P 500, which has gained 158% over the same time frame. Investors may want to review the top ten stocks list by joining Stock Advisor.

John Mackey, the former CEO of Whole Foods Market, is a member of The Motley Fool’s board of directors. Brett Schafer holds positions in Amazon and Coupang. The Motley Fool has positions in and recommends Airbnb and Amazon, and it recommends Coupang. For disclosure, see The Motley Fool’s policies.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.