Stock Market Faces Volatility Amid Economic Uncertainty

When viewed through a broader lens, stocks have consistently outperformed other asset classes in terms of returns. However, this doesn’t indicate the stock market is free from challenges. Following a phase of heightened optimism starting in October 2022, Wall Street has recently encountered turbulence over the last two months.

The renowned Dow Jones Industrial Average (DJINDICES: ^DJI), the benchmark S&P 500 (SNPINDEX: ^GSPC), and the growth-sensitive Nasdaq Composite (NASDAQINDEX: ^IXIC) have all decreased by double-digit percentages from their respective record closes. The Dow Jones and S&P 500 are currently in correction territory, while the Nasdaq Composite is experiencing its first bear market since 2022.

Image source: Getty Images.

As volatility rises on Wall Street, investors naturally seek insights into future stock movements. They analyze data points and predictive tools that have previously shown strong correlations with movements in the Dow, S&P 500, and Nasdaq Composite. While no forecasting method can guarantee future outcomes, historical patterns often suggest trends. Recently, on April 22, an unusual yet significant event occurred concerning the growth-oriented Nasdaq-100. If history repeats itself, long-term investors might have reasons for optimism.

Factors Behind Recent Stock Market Volatility

To fully understand the factors contributing to the recent fluctuations in the Dow, S&P 500, Nasdaq Composite, and Nasdaq-100, it’s essential to dissect the five main causes driving investor anxiety.

First, President Donald Trump’s tariff announcements have been a significant trigger for market volatility. The administration imposed a 10% global tariff on imported goods and increased “reciprocal tariffs” on countries with trade deficits with the U.S. Even though these tariffs are paused as of April 9, concerns persist that they could increase domestic inflation and hinder economic growth.

Secondly, the unclear communication from President Trump and his administration further compounds this volatility. The stock market typically favors transparency and consistency. Frequent changes to tariff regulations do not inspire confidence among investors.

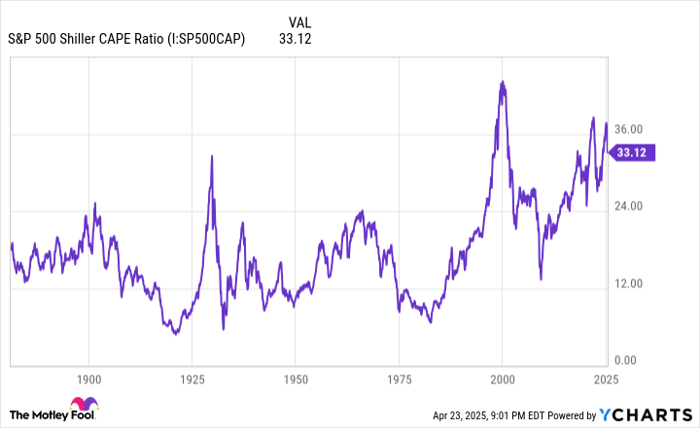

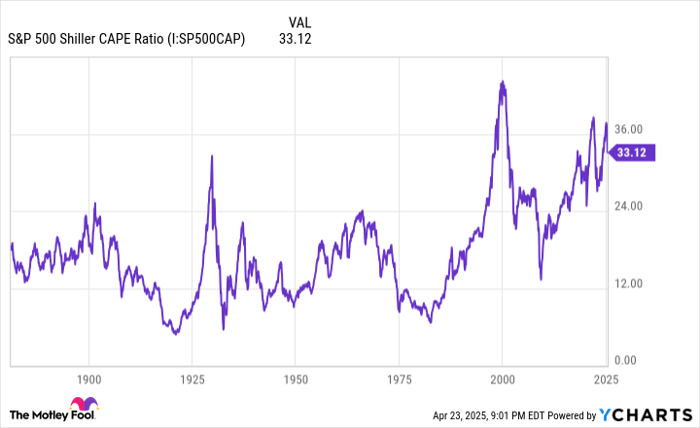

S&P 500 Shiller CAPE Ratio data by YCharts.

Third, the high valuations of stocks entering 2025 also play a role in the market’s volatility. The S&P 500’s Shiller price-to-earnings (P/E) ratio, also known as the cyclically adjusted P/E Ratio or CAPE Ratio, reached a near multiple of 39 in December. This marked its third-highest reading during a bull market since 1871. Previous instances of such elevated valuations have led to market downturns of 20% or more.

The fourth issue is the recent rise in Treasury bond yields. Higher yields can significantly increase borrowing costs for consumers and businesses, negatively impacting U.S. economic growth.

Lastly, the Atlanta Federal Reserve’s GDPNow model has projected a decline in U.S. economic growth for the first quarter of 2025. Initially forecasting nearly 4% growth in late January, the model now anticipates a contraction of 2.2% for the first quarter, raising recession concerns.

Image source: Getty Images.

Positive Sign from the Nasdaq-100

Having explored the dynamics affecting market volatility, let’s focus on the rare feat accomplished by the Nasdaq-100 and its implications for future stock performance.

Despite the Dow, S&P 500, and Nasdaq Composite all achieving their largest single-session point gains in history on April 9, April 22 presented a notable milestone for the Nasdaq-100, which features 100 of the largest non-financial companies on the Nasdaq exchange. Due to some companies having multiple share classes, there are currently more than 100 components in the Nasdaq-100.

On April 22, every component of the Nasdaq-100 closed higher, marking only the 10th time in 23 years that this growth-oriented index saw all its components finish in the green during a single trading session. According to Jonathan Harrier, chief investment officer at CFG Wealth Management Services, this event is significant in the context of market history.

$QQQ $NDX

All 102 securities in the Nasdaq-100 were up today. Only 8 other times in the past 20 years. (June 24th most recently)

# Analyzing Nasdaq-100’s Performance After Significant Upticks

Recent trends have highlighted the Nasdaq-100’s historical performance following notable up days. In a tweet, Jonathan Harrier, CMT, shared metrics on such days since 2022.

Although exceptional market events can be captivating, they do not guarantee future outcomes. However, the Nasdaq-100’s performance post these substantial increases warrants attention. Data from YCharts reveals how the Nasdaq-100 reacted one, three, and five years after notable up days:

- Sept. 18, 2007: one year (-16.6%), three years (-3.9%), five years (+40.4%)

- Oct. 13, 2008: one year (+21%), three years (+62.8%), five years (+126.2%)

- Nov. 24, 2008: one year (+54.7%), three years (+87.7%), five years (+196.4%)

- Sept. 1, 2010: one year (+21.9%), three years (+68.9%), five years (+127.6%)

- Aug. 11, 2011: one year (+25.7%), three years (+80.5%), five years (+121.7%)

- Dec. 20, 2011: one year (+18%), three years (+87.6%), five years (+117.1%)

- Oct. 8, 2014: one year (+7.7%), three years (+50.1%), five years (+88.2%)

- June 24, 2022: one year (+23%)

- Oct. 8, 2022: one year (+35.6%)

- April 22, 2025: To be determined…

Notably, an all-green finish in the Nasdaq-100 yields positive results 89% of the time, averaging a return of 21.2% within one year. For context, since 1985, the Nasdaq-100 has generated an annualized return of approximately 14% (excluding dividends).

^NDX data by YCharts. Nasdaq-100 performance period from Jan. 1, 2002 to April 23, 2025.

When we examine longer-term outcomes, similar trends appear. At the three-year mark, the Nasdaq-100 gained ground 86% of the time, securing an average return of 62%. Impressively, it rose 100% of the time after five years, with an average return of 116.8%.

Overall, in 21 out of 23 cases analyzed, the Nasdaq-100 posted gains. This reflects a 91.3% accuracy rate in predicting future growth for this stock-heavy index.

While predicting when these significant movements will occur remains elusive, heightened market volatility often presents substantial buying opportunities for long-term investors.

Considerations for Investing in the Nasdaq Composite Index

Before investing $1,000 in the Nasdaq Composite Index, it’s important to weigh your options:

The Motley Fool analysts have identified ten high-potential stocks they recommend right now—not including the Nasdaq Composite Index. These selections could lead to impressive returns in the coming years.

For example, if you had invested $1,000 in Netflix when it appeared on the list on December 17, 2004, it would be worth $591,533 today!

Additionally, an investment of $1,000 in Nvidia when it made the list on April 15, 2005, would now be valued at $652,319!

One notable aspect is that Motley Fool’s Stock Advisor has achieved an average return of 859%, significantly outperforming the S&P 500, which stands at 158%.

Review the ten recommended stocks now »

Sean Williams has no position in any of the stocks mentioned. The Motley Fool recommends Nasdaq. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.