Amazon Reports Strong Q1 2025 Earnings Amid Mixed Guidance

Amazon (AMZN) posted solid first-quarter 2025 results, achieving earnings of $1.59 per share. This figure surpassed estimates by 17.78% and marked a 40.7% increase year-over-year. Net sales reached $155.7 billion, reflecting a 9% rise from the previous year and slightly exceeding forecasts. (Read more: Amazon Q1 earnings Beat Estimates, Stock Falls on Mixed Guidance)

However, despite these robust earnings, Amazon’s Stock faced pressure after the earnings announcement due to a cautious second-quarter outlook. For Q2 2025, Amazon forecasts net sales between $159.0 billion and $164.0 billion, indicating a growth of 7-11% compared to Q2 2024. Nonetheless, the expected operating income range of $13.0 billion to $17.5 billion did not meet the market’s $17.7 billion expectation, resulting in a 5% decline in after-hours trading.

The Zacks Consensus Estimate for 2025 net sales stands at $693.74 billion, suggesting an 8.74% increase from the prior-year figure. Furthermore, the Zacks Consensus Estimate for 2025 earnings is projected at $6.3 per share, indicating a 13.92% lift from last year.

Image Source: Zacks Investment Research

Tariff Concerns Impact Retail Expectations

Uncertainties surrounding tariffs are the primary reason for Amazon’s cautious guidance. The retail sector grapples with challenges posed by tariffs on Chinese imports, complicating pricing strategies and potentially affecting consumer demand. During the earnings call, management acknowledged this ambiguity but noted they had not yet seen a drop in demand. In fact, some categories have seen increased buying, possibly signaling consumer stockpiling ahead of tariff changes.

Amazon highlighted its diverse seller base and broad product range as potential buffers against tariff disruptions. The company boasts hundreds of millions of unique SKUs and over two million global sellers, positioning it well to navigate tough market conditions. Notably, sales of everyday essentials grew twice as fast as the overall business in Q1, accounting for one-third of all units sold in the U.S.

AWS and Advertising Show Robust Growth

While retail faces challenges, Amazon Web Services (AWS) remains a strong performer, achieving a 17% year-over-year increase, bringing its annualized revenue to $117 billion. AWS operating income surged 23% to $11.5 billion, showcasing impressive 39.5% operating margins. Management emphasized that more than 85% of global IT spending remains on-premises, indicating ample growth potential ahead.

Advertising services also fared well, growing 19% year-over-year to $13.9 billion. This performance underscores Amazon’s capability to effectively monetize its extensive consumer base through advertising platforms.

AI Investments Amid Increased Competition

Amazon’s focus on artificial intelligence (AI) is rapidly expanding across all business segments. Management disclosed that its AI initiatives now have a “multi-billion dollar annual revenue run rate” with triple-digit growth year-over-year. The company is aggressively investing in AI capabilities, including custom chips like Trainium 2, which reportedly offer 30-40% better performance compared to traditional GPU instances.

Additionally, Amazon has made its Nova foundation models available through nova.amazon.com, an important development in its AI strategy. The introduction of Amazon Nova Act, a new AI model designed for web browser tasks, coupled with the Amazon Nova Act SDK for developers, positions Amazon competitively in the AI landscape.

This advancement puts Amazon alongside competitors such as OpenAI and Anthropic, particularly in agentic AI. Notably, Nova Act has reportedly outperformed competitors in several internal tests.

However, the competitive landscape in agentic AI is intensifying, with advancements from major players like Microsoft (MSFT), Nvidia (NVDA), and Alphabet (GOOGL)-owned Google. Microsoft is integrating advanced AI into its suite, while Google’s collaboration with Nvidia focuses on AI hardware for enhanced reasoning models.

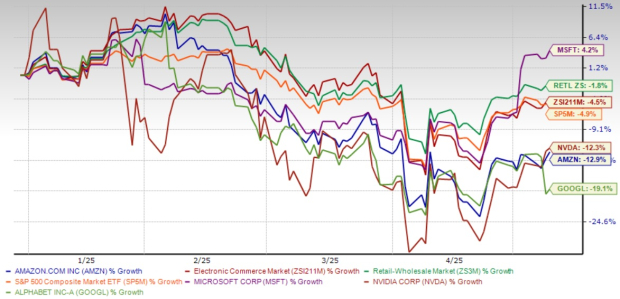

AMZN has seen a 12.9% decline year-to-date, underperforming the broader Zacks Retail-Wholesale sector and the S&P 500, which recorded declines of 1.8% and 4.9%, respectively. In contrast, Microsoft’s stock has gained 4.2%, while Alphabet and Nvidia saw declines of 19.1% and 12.3% respectively during the same period.

AMZN’s Year-to-Date Performance

Image Source: Zacks Investment Research

Concerns About AMZN’s Valuation Persist

Despite its strong performance, Amazon’s valuation metrics raise concerns about potential upside. The forward 12-month Price-to-Sales ratio stands at 2.79X, significantly above the Zacks Internet – Commerce industry average of 1.86X, raising questions about whether the Stock is fully valued at these levels.

The company’s free cash flow decreased sharply to $25.9 billion over the trailing 12 months, down from $50.1 billion a year earlier. This decline highlights Amazon’s aggressive capital investments, amounting to $24.3 billion in Q1, primarily in support of AWS and AI technologies.

AMZN’s P/S F12M Ratio Depicts Premium Valuation

Image Source: Zacks Investment Research

Amazon Investment Outlook: Hold or Wait for Better Entry?

For investors holding shares of Amazon.com, Inc. (AMZN), maintaining current positions seems wise. The company’s long-term growth and its dominance in cloud computing paint a strong picture. However, new investors might find it beneficial to wait for a more favorable market entry, especially if tariff issues lead to increased volatility in the near future.

Despite potential short-term pressures stemming from cautious guidance for the second quarter and elevated valuation multiples, Amazon’s diversified business model continues to provide resilience. The company’s expanding high-margin revenue sources and strategic investments into emerging technologies indicate that it remains well-situated for sustained growth. This is notable, particularly amid intensified competition in the artificial intelligence sphere. Currently, AMZN holds a Zacks Rank of #3 (Hold).

Investment Opportunities: 7 Stocks to Watch

Recently, experts have identified seven elite stocks from a pool of 220 Zacks Rank #1 Strong Buys. These stocks are seen as the “Most Likely for Early Price Pops.”

Historically, since 1988, this comprehensive list has outperformed the market more than twice over, boasting an average annual gain of +23.9%. Investors may find immediate attention warranted for these selected stocks.

For further insights, you can explore the complete list of stocks at Zacks Investment Research.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.