JMP Securities Downgrades Iovance Biotherapeutics Amid Price Target Increases

According to recent reports from Fintel, JMP Securities downgraded its outlook for Iovance Biotherapeutics (LSE:0JDK) on May 9, 2025. The new rating is Market Perform, a change from their previous Market Outperform designation.

Analyst Price Forecast Indicates Significant Upside Potential

As of May 7, 2025, analysts forecast a one-year price target for Iovance Biotherapeutics at 20.74 GBX/share. This forecast presents a wide range, with estimates varying from a low of 5.35 GBX to a high of 35.62 GBX. The average price target suggests an impressive potential increase of 540.10% from the most recent closing price of 3.24 GBX/share.

Projected Revenue and Earnings

The annual revenue projection for Iovance Biotherapeutics stands at 454 million, reflecting a significant increase of 113.41%. The estimated annual non-GAAP earnings per share (EPS) is forecast at -0.82.

Fund Sentiment Analysis

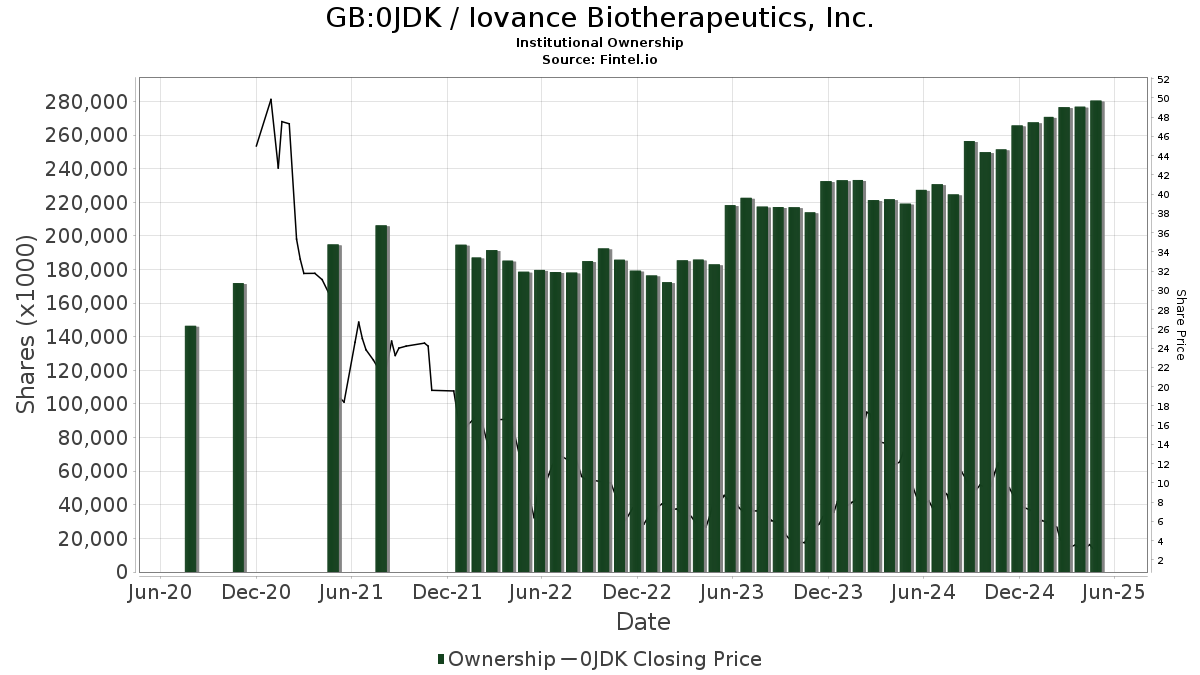

Currently, there are 523 funds and institutions reporting positions in Iovance Biotherapeutics. This indicates an increase of 10 owners, or 1.95%, over the last quarter. The average portfolio weight dedicated to 0JDK among these funds is 0.16%, which marks a rise of 15.99%. Institutional ownership has also seen a 2.93% increase, bringing the total shares held to 280,557K.

Shareholder Movements

Among significant shareholders, Mhr Fund Management holds 24,417K shares, giving it a 7.45% stake in the company. This represents a slight increase from 23,997K shares previously reported, although it has reduced its overall portfolio allocation in 0JDK by 18.70% in the past quarter.

Perceptive Advisors owns 22,112K shares, accounting for 6.74% of Iovance Biotherapeutics. This reflects a decrease from the 26,618K shares held earlier, resulting in a portfolio reduction of 14.72% over the last quarter.

Hood River Capital Management increased its holdings to 8,992K shares, representing a 2.74% ownership. Previously, it held 8,145K shares, indicating a 9.42% rise, although they also decreased their equity allocation in 0JDK by 20.44% over the past quarter.

Additionally, the VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 8,609K shares (2.63% ownership), down slightly from 8,718K shares, a decrease of 1.27% in portfolio allocation of 23.31%. iShares Russell 2000 ETF’s stake of 7,382K shares represents a 2.25% ownership, increasing from 6,599K, yet they, too, decreased their investment proportion in 0JDK by 15.05% over the last quarter.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.