# Major Trade Deal Sparks Stock Market Optimism and Potential Boom

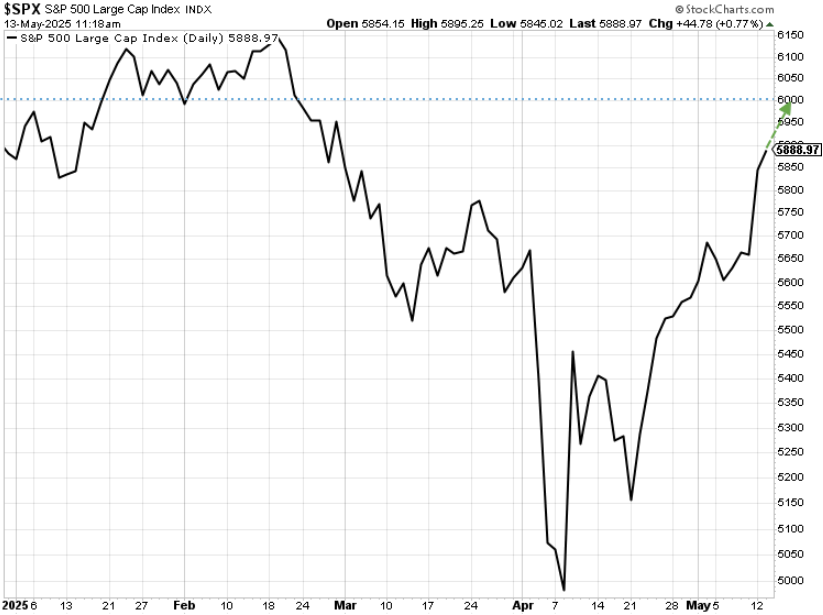

Yesterday marked a significant day for the Stock market, signaling a pivotal shift that may indicate the end of the intense trade war between the United States and China. Following weeks of increasing tariffs and market instability, the two nations reached a substantial trade agreement, prompting the Stock market to react positively.

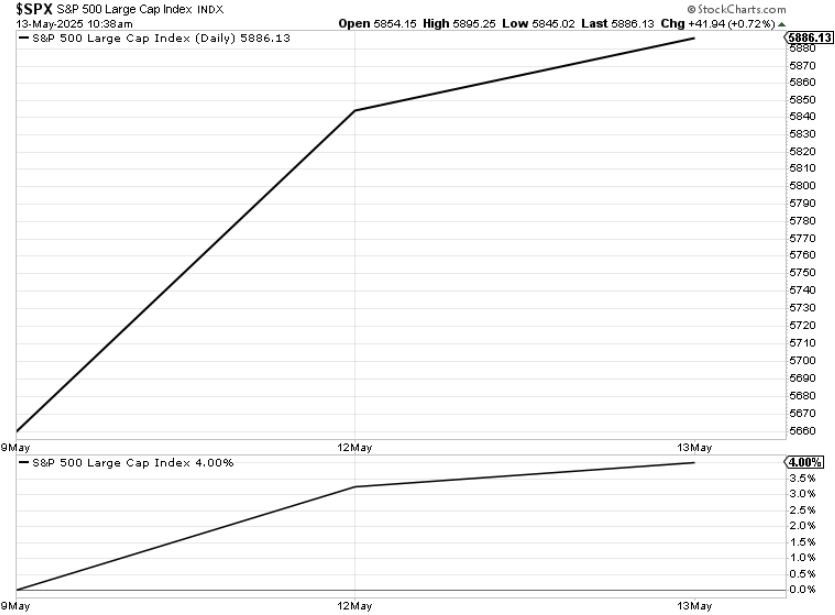

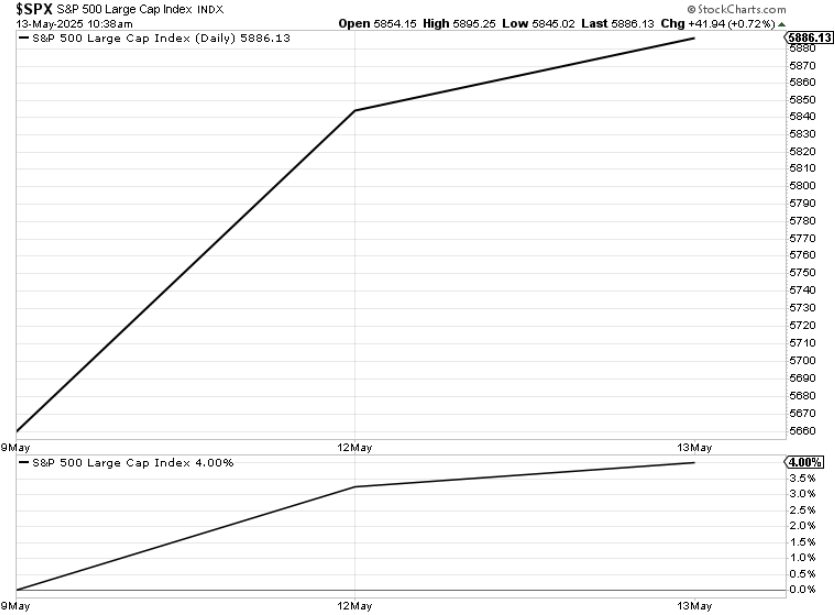

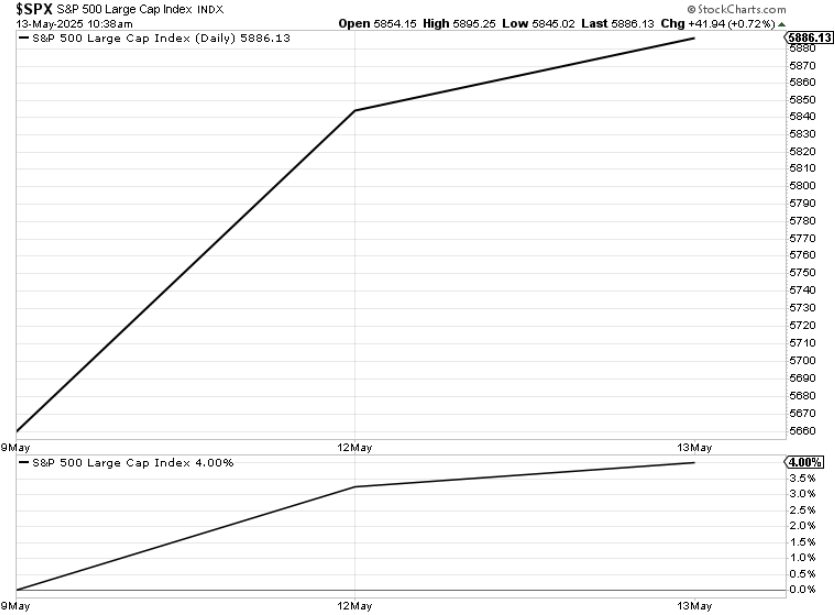

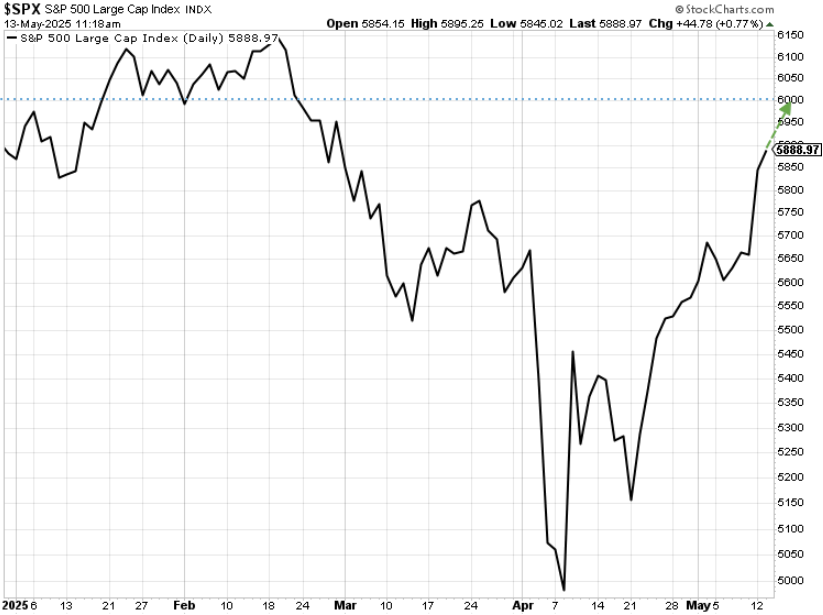

The S&P 500 surged to recover all its losses since Liberation Day, increasing approximately 4% between Friday, May 9, and this morning’s open.

This rebound signals more than just a recovery.

We view this truce as a significant ceasefire, paving the way for a potential summer rally focused on a promising sector: high-quality AI infrastructure stocks.

Impact of the U.S.-China Trade Deal on Markets

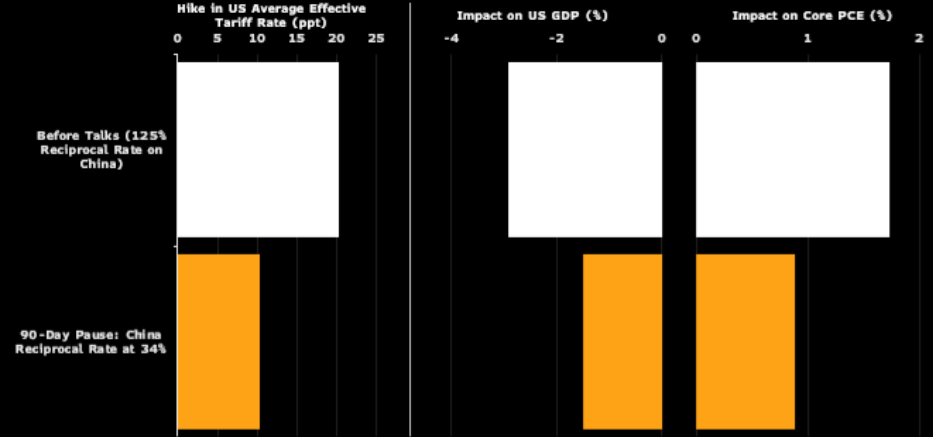

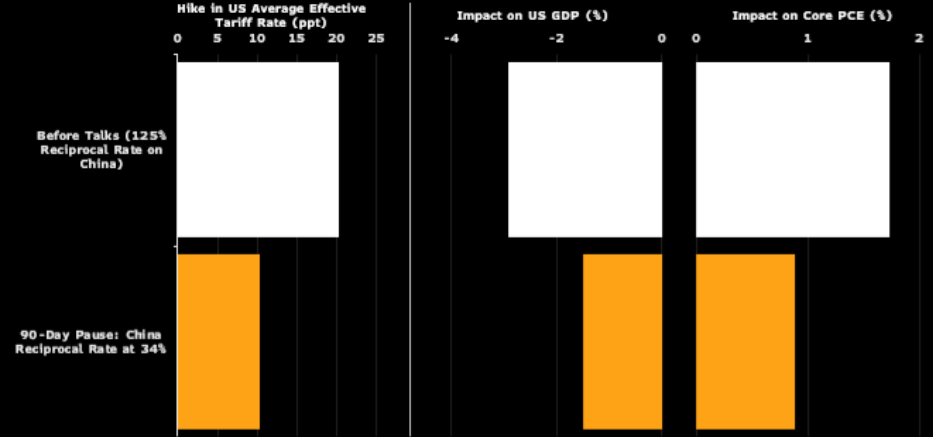

In recent weeks, investors feared a complete economic decoupling between the world’s two largest economies. Escalating tariff rates forced U.S. companies to adjust their supply chains, while Wall Street braced for a staggering 125% reciprocal tariff on Chinese imports—a measure that could have critically hampered trade relations.

Then the news broke.

As reported by CNN, both countries agreed to lower their reciprocal tariffs by a remarkable 115 percentage points for 90 days. Specifically, the U.S. tariff on Chinese imports will drop from 125% to 10%.

This notable reduction marks a transition from a looming trade disaster to a more balanced trade environment.

Moreover, considering China’s significant trade relationship with the United States, this tariff reduction alone has caused the average effective U.S. tariff on all imports to fall from 23% to just 13%.

While still higher than the 3% pre-trade-war baseline from 2024, this rate is significantly improved from the crisis-level 30% seen just weeks prior. Furthermore, it closely aligns with the White House’s new 10% “global minimum” tariff, seemingly establishing a long-term framework.

This development leads us to believe that the negative impacts of the trade war are not just behind us—they’re effectively erased, allowing markets to resume their focus on future opportunities.

Potential Economic Growth from Lower Tariffs

Tariffs function as a tax, and like any tax, they tend to slow economic growth.

The Federal Reserve estimates that each one-point increase in the average U.S. tariff rate decreases GDP by approximately 0.14%.

At a 30% tariff rate, the implied GDP drag was around 3.8%—enough to counteract any gains from tax cuts, deregulation, or rate adjustments. The economic landscape resembled an uphill sprint with obstacles.

Now, with tariffs lowered to 13%, the impact is reduced to a manageable 1.4% drag. Coupled with ongoing tax cuts, deregulation efforts, and anticipated rate cuts, the economy appears poised for substantial growth to offset this drag.

Investors can now shift their focus from recession fears to key market drivers: earnings, innovation, and growth.

Revival of AI Infrastructure Stocks

As macroeconomic challenges ease, the Stock market is likely to normalize, suggesting a potential 5% upside for the S&P by mid-summer.

However, the upward trajectory for AI infrastructure stocks could be even more significant, potentially reaching gains of 50% to 100%.

These companies, which include chipmakers and data center builders, are integral to the foundation of artificial intelligence technology, supplying the necessary hardware and infrastructure.

Yet, they have been vulnerable to trade tensions.

Global supply chains and customer bases mean these stocks faced significant risks during the trade conflict.

As trade tensions dissipate, these stocks are now positioned for growth.

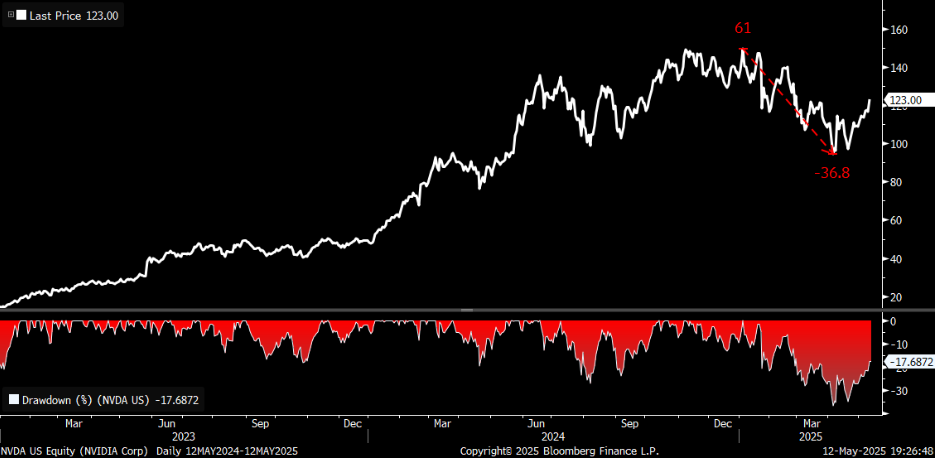

Take Nvidia (Stock-ticker”>NVDA), a leader in AI chips. Despite peaking at $150 prior to Liberation Day, tariffs triggered a decline, leaving its shares almost 25% below that peak even after yesterday’s rally.

This presents a buying opportunity.

If economic normalization is indeed underway, stocks like Nvidia may not just recover but also surpass their previous highs.

Similar favorable conditions are present for other companies, including Broadcom (Stock-ticker”>AVGO), Marvell (Stock-ticker”>MRVL), and Super Micro (Stock-ticker”>SMCI, along with Arista Networks.

Market Rally Expected as Trade Tensions Ease and AI Investments Surge

Several key stocks, including Arista Networks (ANET), Micron (MU), and Applied Materials (AMAT), are currently trading between 30% to 50% below their peaks from earlier this spring.

This significant gap presents an opportunity that could be bridged by a few weeks of positive market sentiment.

Strong Stocks Ready for Growth as Trade Conditions Improve

It’s important to clarify that the focus here isn’t on blindly purchasing every AI stock with hopes of high returns.

This analysis emphasizes the importance of timing and positioning.

Over the past two months, leading AI infrastructure stocks faced declines not due to weakening business fundamentals, but rather because of macroeconomic challenges. Fortunately, these issues are now dissipating.

The AI sector remains robust. Spending continues to rise, data centers are under construction, and the demand for chips is high. Major companies like Microsoft (MSFT), Meta (META), and Amazon (AMZN) are investing billions into advanced infrastructure.

With reduced tariffs and restored trade flows, these companies—and their stock prices—are positioned to gain momentum.

This leads us to believe that a significant market rally is on the horizon.

The initial wave included the market rebounding after experiencing losses earlier this year. The expectation is that the second wave will witness a sharp rotation into trade-sensitive sectors with growth potential.

The final wave could result in a surge of investment in AI infrastructure stocks as investors anticipate the next phase of the AI super-cycle, liberated from the burden of previous trade tensions.

Conclusion: The Trade Agreement That Could Ignite a New AI Supercycle

If this situation seems reminiscent, it may be because history has a pattern.

In 1998, during the Dot Com Boom, fears of global financial instability, spurred by events like the Asian financial crisis, caused market hesitance. The Nasdaq index experienced a decline before recovering due to rate cuts and a stabilization in the economy.

What followed was not only a recovery but an explosive growth trajectory, with the Nasdaq more than doubling in 1999—the best year recorded.

Today, we believe we are at a similar turning point.

The AI boom is not finished; it’s merely consolidating, setting the stage for future growth.

As macroeconomic pressures lessen and trade disputes diminish, the potential for a renewed surge in the AI sector is strong.

The recent U.S.-China agreement marks the beginning of a new chapter in this narrative.

We anticipate the emergence of a new form of AI—referred to as AI 2.0—which is expected to command attention on Wall Street.

This next phase encompasses intelligent systems capable of real-world navigation: machines that can see, hear, move, adapt, and even solve problems autonomously.

It’s noteworthy that leading technology companies are vying to develop these advancements in humanoid robotics.

We are observing significant opportunities arising in this evolving landscape, and we have pinpointed strategic avenues to capitalize on this new phase of the AI revolution.

For inquiries or feedback regarding this discussion, contact us at [email protected].