Key Insights on Q1 Earnings as Q2 Estimates Decline

Note: The following is an excerpt from this week’s earnings Trends report. Access the complete report for detailed historical actuals and estimates for current and future periods.

Here are the key points:

- Total Q1 earnings for 456 S&P 500 members that have reported results rose by +12.1% compared to last year, with revenues increasing by +4.5%. Notably, 73.9% surpassed EPS estimates and 62.1% exceeded revenue expectations.

Reflecting on the current earnings season, it appears less focused on the actual earnings of Q1 2025 and more on the potential impact of changing macroeconomic conditions and public policies. Despite prevailing uncertainty, management commentary has remained largely reassuring.

- Estimates for the current period (Q2 2025) have faced downward pressure, showing more significant declines compared to prior post-COVID periods. However, the Tech sector’s estimates have recently stabilized.

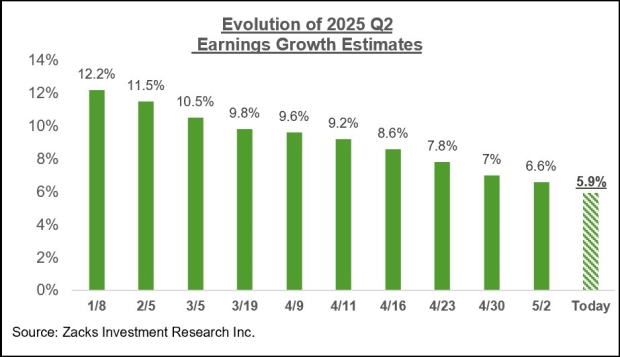

For 2025 Q2, total S&P 500 earnings are projected to grow by +5.9% from the same quarter last year, alongside +3.8% greater revenues. These Q2 estimates have consistently declined, with the extent and range of negative revisions exceeding those seen in previous quarters.

Current Trends in Q2 Earnings Estimates

The onset of Q2 has coincided with increased tariff uncertainties following the punitive April 2nd announcements. Although the imposition of these tariffs was postponed by three months, this issue has significantly impacted estimates for the present and upcoming quarters.

The current expectation is for Q2 earnings for the S&P 500 index to rise by +5.9% compared to the previous year, bolstered by +3.8% higher revenues. The evolution of Q2 earnings growth expectations since the beginning of the year is depicted in the chart below.

Image Source: Zacks Investment Research

While it is common for estimates to be revised lower, the scale and scope of the Q2 cuts are unprecedented compared to recent similar periods. Estimates have dropped for 13 of the 16 Zacks sectors, with the Transportation, Autos, Energy, Construction, and Basic Materials sectors experiencing the largest declines.

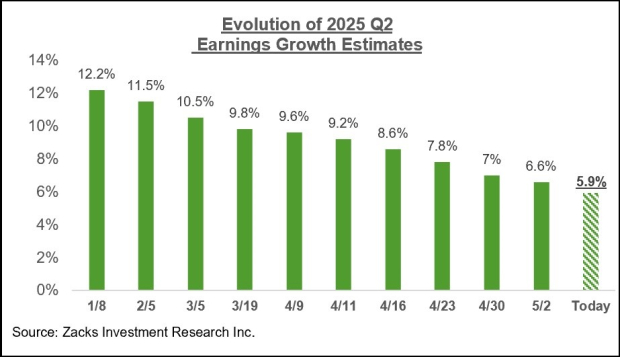

Estimates for the key earnings contributors—Tech and Finance—have decreased since the quarter’s commencement. The Tech sector’s earnings are anticipated to grow by +12.4% in Q2 with +9.8% higher revenues. Despite substantial revisions since early April, the trend appears to be reversing, indicating greater stability, as illustrated below.

Image Source: Zacks Investment Research

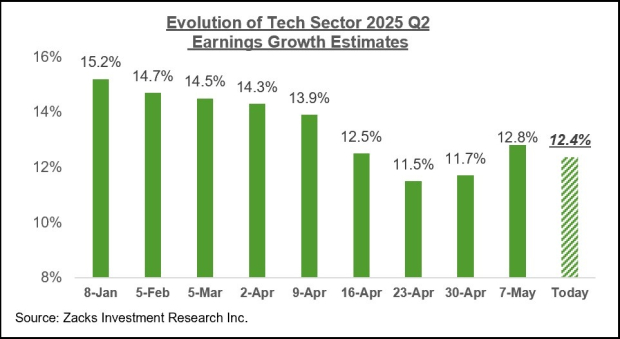

This shift in the Tech sector’s revisions reflects positively on the full-year 2025 projections as well. The following chart illustrates this trend:

Image Source: Zacks Investment Research

It remains uncertain how sustainable this favorable trend in Tech estimates will be. However, the positive shift in Q2 estimates indicates that the growth pace isn’t solely driven by strong Q1 earnings from major players. This can be seen in the revisions for companies like Microsoft MSFT, Alphabet GOOGL, and Meta META.

Currently, the Q2 Zacks Consensus EPS estimate for Alphabet stands at $2.12, slightly down from $2.15 on April 4th, yet up from $2.08 on April 25th and $2.07 a week prior. For Meta, the Q2 EPS estimate is $5.84, down from $5.94 on April 4th, but higher than $5.70 on May 2nd and $5.51 on April 25th. Microsoft shows a similar trend with its current estimate slightly higher than at the start of April.

The Tech sector’s revisions will be closely monitored in the following weeks.

The Overall Earnings Landscape

The chart below displays expectations for 2025 Q1 alongside achievements from previous periods and current forecasts for the next three quarters.

Image Source: Zacks Investment Research

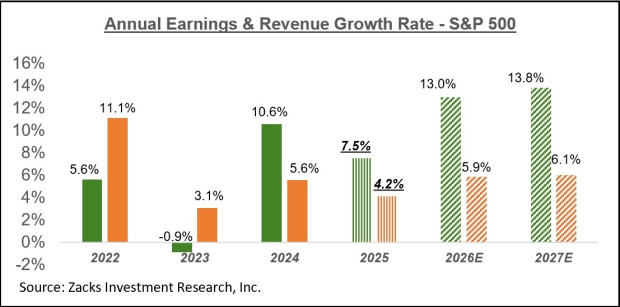

Another chart outlines the annual earnings outlook for the S&P 500 index.

Image Source: Zacks Investment Research

Although 2025 estimates have started to decline recently, projections for the subsequent two years remain relatively steady. As concerns mount regarding the growth potential of the economy, further reductions in these estimates can be anticipated as the impact of tariffs starts to materialize in economic data.

The first quarter’s modest GDP reading primarily reflected anticipatory effects of the trade regime, as importers stocked up on supplies ahead of impending tariffs.

The views and opinions expressed herein are those of the author and do not necessarily reflect Nasdaq, Inc.’s views.