Monarch Cement Earnings Decline Amid Weather and Investment Challenges

Shares of The Monarch Cement Company (MCEM) increased by 2.8% since its first-quarter 2025 earnings report, compared to a 4.3% rise in the S&P 500 index during the same period. Over the past month, the stock rose by 8%, while the S&P 500 rallied by 11.4%.

Revenue & Earnings Decline Due to Adverse Weather

In Q1 2025, Monarch Cement’s net sales fell to $38.7 million, down 22.7% from $50.1 million a year ago. This decline was significant in both the Cement Business, which saw a revenue drop of $2.3 million, and the Ready-Mixed Concrete Business, which decreased by $9.1 million.

Adverse winter weather and rainfall led to reduced volumes in both sectors. Basic earnings per share plummeted to 72 cents, down from $4.53 in the same quarter last year. Net income decreased 84.1%, falling to $2.7 million from $16.6 million in Q1 2024.

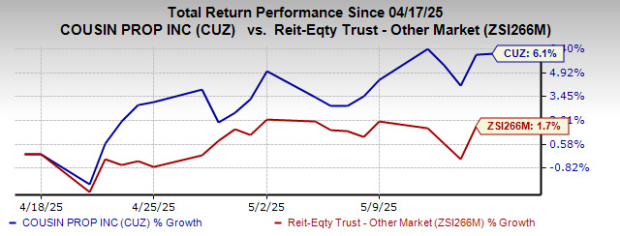

Price-Earnings Trends for Monarch Cement

Sales Weakness Yet Margins Show Resilience

While sales volumes decreased, Monarch Cement’s gross profit margins remained relatively stable. The overall gross margin increased to 30.2% from 28.8% a year earlier. The Cement Business reported a gross margin of 44.3%, down slightly from 44.9%. The Ready-Mixed Concrete Business saw a significant margin reduction to 5.8% from 10.3%, reflecting a 46.6% drop in sales volume, though pricing increases and lower material costs provided some relief.

Selling, general, and administrative expenses remained stable at $6.6 million, consistent with the company’s fixed-cost perspective. Total operating income decreased to $5.1 million from $7.4 million in the previous year.

Investment Losses Lead to Net Income Volatility

The most considerable impact on net income stemmed from fluctuations in investment performance. Monarch Cement recorded a $12.3 million unrealized loss on equity investments in Q1 2025, compared to a $10.9 million gain in the prior year. Despite realizing $9.5 million from equity sales—up from $0.6 million last year—the volatility in equity valuations compressed reported earnings significantly. Dividend income from investments also declined to $0.1 million from $1.1 million year-on-year.

These investment income fluctuations sharply reduced pre-tax earnings to $2.8 million from $20.6 million a year earlier. Additionally, the effective tax rate rose to 26% from 21%, further contributing to the decline in net income.

Management Outlook: Seasonal Trends & Capital Expenditures

Management acknowledged the seasonal constraints affecting operations during Q1, typically due to weather. They anticipate that the business will peak in the second and third quarters as construction activity increases. However, high rainfall could also disrupt operations during these periods.

On the capital investment front, Monarch Cement allocated $10.1 million in Q1 2025—$7.1 million for cement production facilities and $2.9 million for equipment in its Ready-Mixed Concrete Business. The total planned capital investment for the year stands at $40.1 million, underscoring a commitment to operational upgrades and long-term efficiency.

Strong Liquidity Despite Declining Earnings

Despite reduced earnings, Monarch Cement reported a strong balance sheet. Working capital increased to $148 million at the end of March 2025, up from $141.2 million at the end of 2024. Cash and equivalents rose to $50.7 million from $45.8 million a year earlier.

Inventories increased by $6.3 million, while receivables grew by $4 million, consistent with seasonal trends. Current liabilities rose by $4.5 million, primarily due to higher accounts payable and accrued expenses.

The company has no off-balance sheet arrangements and faces no significant debt constraints. The dividend policy remains unchanged, with distributions typically occurring in March, June, September, and December.

Strategic Joint Venture Development

In late 2024, Monarch Cement formed RMCMO Holdings, LLC, a joint venture with AYG, Inc., contributing full ownership of three subsidiaries—Springfield Ready Mix, LLC; City Wide Construction Products, LLC; and Kay Concrete Materials, LLC—along with 114,618 shares of capital stock, valued at $217.49 per share, in exchange for a 49% stake in the new venture. In Q1 2025, Monarch Cement recognized $154,342 in equity income from this joint venture, with no other acquisitions or divestitures reported for the period.

In conclusion, Monarch Cement faced operational challenges due to weather conditions and investment losses that negatively impacted quarterly results. Nevertheless, the company maintains a solid liquidity position and is investing strategically for future operational resilience.