JP Morgan Upgrades Pentair’s Outlook Amid Shifting Fund Positions

Fintel reports that on May 16, 2025, JP Morgan upgraded its outlook for Pentair (BIT:1PNR) from Neutral to Overweight.

Fund Sentiment Overview

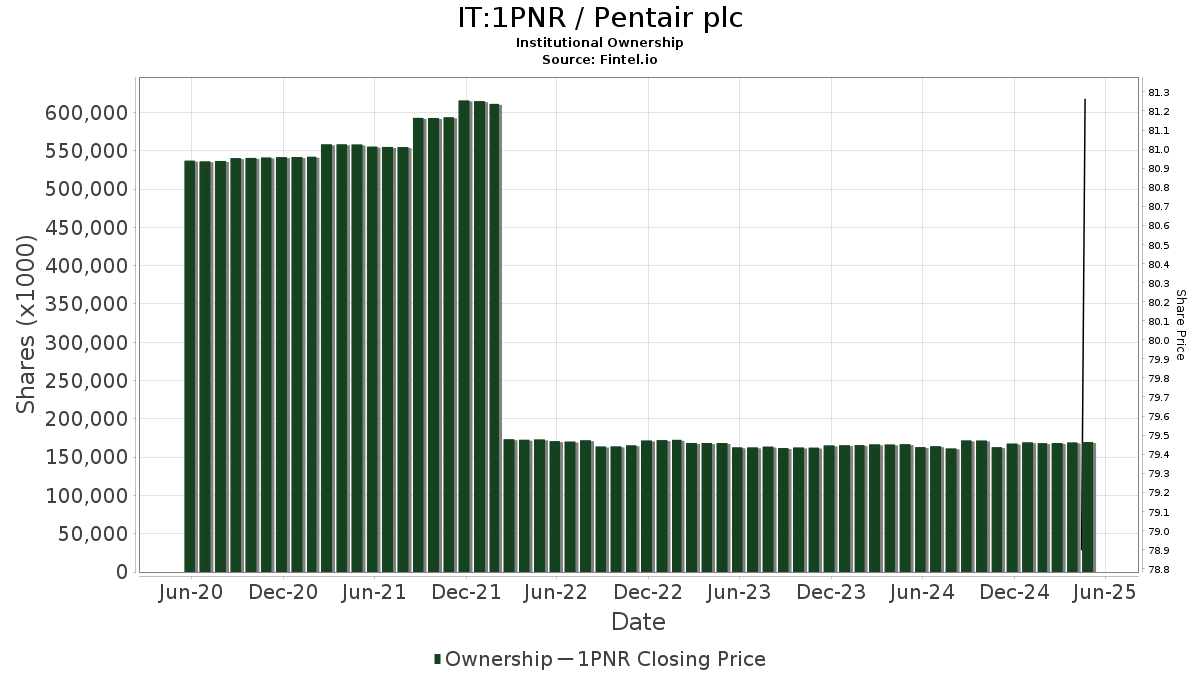

Currently, 1,373 funds or institutions hold positions in Pentair. This marks an increase of 42 owners, or 3.16%, over the last quarter. The average portfolio weight dedicated to 1PNR is 0.19%, reflecting an increase of 8.61%. In the past three months, total institutional shares owned rose by 0.15% to reach 169,018K shares.

Activities of Other Shareholders

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 5,166K shares, equating to 3.14% ownership. Previously, the firm reported owning 5,245K shares, indicating a decrease of 1.53%. Additionally, the portfolio allocation to 1PNR was reduced by 0.11% in the last quarter.

Amundi, on the other hand, holds 4,975K shares, representing 3.02% ownership. Its prior report indicated ownership of 4,380K shares, marking an increase of 11.96%. However, Amundi decreased its portfolio allocation to 1PNR by 95.24% over the last quarter.

Impax Asset Management Group owns 4,969K shares, equal to 3.02% ownership. Previously, the firm held 5,062K shares, showing a decrease of 1.87%. Yet, it increased its portfolio allocation in 1PNR by 13.46% over the last quarter.

Pictet Asset Management Holding holds 4,610K shares, or 2.80% ownership. In its last filing, it reported owning 4,691K shares, a decrease of 1.77%. The firm’s portfolio allocation in 1PNR dropped by 12.09% during the last quarter.

Lastly, VFINX – Vanguard 500 Index Fund Investor Shares currently holds 4,473K shares, representing 2.72% ownership. The prior report showed ownership of 4,334K shares, reflecting an increase of 3.10%. The allocation to 1PNR increased by 0.48% in the last quarter.

The views and opinions expressed herein are those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.