David Tepper’s Investment Moves: Nvidia Sold, Broadcom Acquired

Recent weeks have seen a barrage of data releases and economic announcements, making it easy for critical information to go unnoticed. Notably, on May 15, a key event occurred that investors should be aware of.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

May 15 marked the deadline for institutional investors managing at least $100 million in assets to file Form 13F with the Securities and Exchange Commission. This form allows everyday investors to see which stocks top Wall Street managers have bought and sold in the previous quarter, in this case, the first quarter of 2025.

Though 13Fs have limitations, being up to 45 days outdated, they offer crucial insights into the stocks, sectors, and trends capturing the attention of successful asset managers.

Image source: Getty Images.

Warren Buffett often comes to mind when considering elite investors, but he’s not the only notable name. David Tepper, from Appaloosa Management, oversees over $8.3 billion in assets and showcases his own investment acumen.

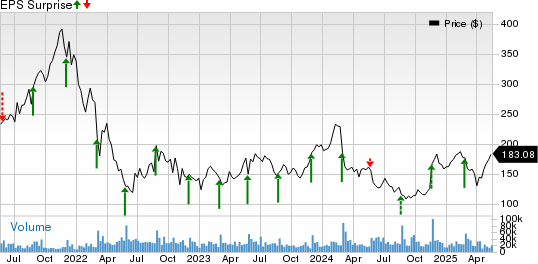

Known for being active, Tepper’s top-20 holdings are typically held for just over two years. Recently, he’s been particularly focused on the tech sector. In the first quarter, Tepper significantly reduced his fund’s stake in leading AI company Nvidia (NASDAQ: NVDA) while investing in another AI stock.

Appaloosa Cuts Nvidia Stake in Q1

Tepper’s decision to sell Nvidia shares isn’t new. After accounting for Nvidia’s historic 10-for-1 stock split in June 2024, his fund held 4.42 million shares as of March 31, 2024. However, this figure has now dropped to 300,000 shares, with the most recent filing showing a sale of 380,001 shares, marking a 56% reduction.

The critical question arises: Why is Tepper divesting from Nvidia, a leader in AI graphics processing units (GPUs)?

This ongoing selling could simply represent profit-taking on a stock that has performed remarkably since its acquisition in early 2023. Alternatively, there might be more complex factors at play.

One significant concern is the rising competition that Nvidia faces. Competitors like Advanced Micro Devices (NASDAQ: AMD) and Chinese firm Huawei are developing their own next-generation AI GPUs for data center sales.

A potentially more pressing challenge comes from within: Nvidia’s top customers are increasingly developing their own AI chips. While these chips are usually complementary to Nvidia’s technology, they are often cheaper and more readily available, which could inhibit Nvidia’s market share.

As competition grows, Nvidia’s pricing power—its most significant advantage—has begun to erode. Early in 2024, Nvidia’s Hopper (H100) chip sold for over $40,000, in stark contrast to AMD’s chips priced at $10,000 to $15,000. Concurrently, Nvidia’s gross margin has declined each quarter since reaching its peak a year ago.

Moreover, Tepper’s ongoing sales could be influenced by historical trends in technology investments. Since the rise of the internet in the mid-1990s, every transformative technological wave has been followed by a bubble-bursting event. Investors often overestimate the pace of adoption and utility of groundbreaking innovations.

Currently, many companies lack a clear strategy for harnessing AI, heightening the risk of a potential AI bubble. If this bubble were to burst, Nvidia would likely be significantly impacted.

Image source: Getty Images.

Tepper Shifts Focus to Broadcom as a New AI Investment

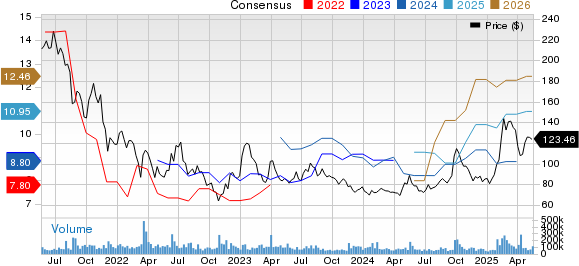

Although Tepper’s 13F reflects more selling than buying activity for the quarter ending in March, he did acquire over 130,000 shares of AI-networking firm Broadcom (NASDAQ: AVGO).

Broadcom’s stock began to gain traction two years ago, driven by the launch of its Jericho3-AI fabric, which can connect up to 32,000 GPUs simultaneously. The company’s solutions are designed to optimize hardware performance in AI data centers while minimizing delays, crucial for AI systems.

While Broadcom isn’t insulated from an AI bubble, its business model is more diversified compared to Nvidia’s. This diversification positions Broadcom to better weather adverse market conditions that may affect the AI sector.

For instance, Broadcom is a leading supplier of wireless chips and accessories important for smartphones.

Broadcom’s Resilient Demand and Growing Margins Strengthen Appeal

While smartphones may no longer be the primary growth sector they once were, the rollout of 5G wireless networks is contributing to steady demand for Broadcom’s chips. This consistency provides a level of stability in the company’s financial performance.

Diverse Industry Presence Benefits Broadcom

Broadcom operates in several crucial sectors that serve to insulate the company against potential market fluctuations, such as an AI bubble. Its product offerings encompass a variety of networking and optical solutions for next-generation vehicles, enhancements for industrial automation, cybersecurity solutions, and medical systems equipment.

Margin Performance Distinguishes Broadcom

Another factor that may attract investor David Tepper to Broadcom is its gross margin performance. Unlike Nvidia, which has seen its gross margin decline over the past year, Broadcom’s margins have shown a consistent upward trajectory over the trailing twelve months. Typically, higher margins enable earnings to grow faster than sales.

Strategic Timing for Investment Opportunities

Recent weakness in Broadcom’s stock in the first quarter has allowed Tepper to potentially acquire shares at a forward-year earnings multiple of approximately 23, close to a two-year low. This may present a strategic buying opportunity for investors looking to enter the stock at a favorable price.

As the tech landscape evolves, Broadcom’s diversified portfolio and improving financial metrics make it an intriguing consideration for investors aiming for sustained growth. The company’s solid grounding in essential industries positions it well for future performance.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.