Is It Time to Invest in Housing Market Stocks This Summer?

As summer is the peak season for construction, investors are considering whether to buy stocks linked to the housing market.

Homebuilder stocks and home improvement retailers, such as Home Depot HD, often attract attention. Home Depot recently reported mixed Q1 results.

Spring Buying Season Insights

Typically, spring and early summer mark peak homebuying periods, as more homes enter the market, expanding buyer options. Zillow Z notes that prices may decrease in late summer as sellers adjust before fall.

However, increased demand during summer often drives up material costs, which can be exacerbated by high tariffs.

Consequently, housing and construction stocks warrant investor attention as summer unfolds.

Home Depot’s Q1 Performance

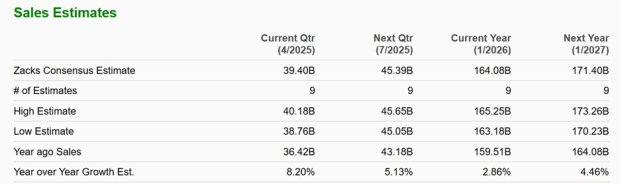

Home Depot’s Q1 report reveals potential resilience against tariffs, with over 50% of its materials sourced domestically. The company reported a 9% year-over-year sales increase, reaching $39.85 billion, exceeding expectations of $39.4 billion.

However, earnings per share (EPS) at $3.56 slipped slightly from $3.63 from the prior period, missing forecasts of $3.59. Despite this, Home Depot maintains its fiscal 2025 guidance, anticipating sales growth of about 2.8%, aligning with Zacks’ estimates. Projections suggest this growth might rise another 4% in FY26 to $171.4 billion.

Currently, Home Depot holds a Zacks Rank #3 (Hold) and may provide a good long-term investment opportunity as the home improvement season approaches.

Image Source: Zacks Investment Research

Zillow’s Market Forecast

Zillow’s recent report indicates mixed trends in the housing market. The forecast shows home values expected to decrease by 1.9% this year, a revision from earlier estimates of a 0.6% decline. In contrast, existing home sales are projected to grow by 3.3%, reaching 4.2 million in 2025.

April saw newly pending listings drop by 2.5% year-over-year, even with lower average mortgage rates. However, overall new home listings increased by 7.6%, suggesting increased seller enthusiasm. Unfortunately, Zillow’s stock currently holds a Zacks Rank #4 (Sell), reflecting recent declines in earnings estimates.

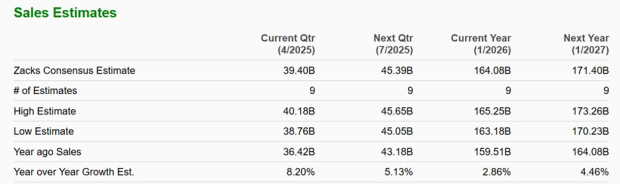

The volatility in mortgage rates is also a concern, with expectations that the average fixed 30-year rate could settle near 6.5% by the end of the year.

Image Source: Federal Reserve Economic Data

Promising Investment Opportunities

Within the homebuilding sector, Dream Finders Homes DFH stands out with a Zacks Rank #2 (Buy). Despite facing pressures like other builders, DFH stock trades at $22 and offers a favorable risk-to-reward ratio at just 7X forward earnings. Although earnings are expected to dip 3% this year, they are anticipated to bounce back by an 8% increase in FY26 to $3.49 per share.

Image Source: Zacks Investment Research

Comfort Systems USA FIX and AAON Inc. AAON are also attractive as they provide comprehensive heating and air conditioning systems. Both companies carry a Zacks Rank #2 (Buy) and are expected to see significant growth in revenues and profits in FY25 and FY26.

Limbach LMB is another strong candidate, currently rated Zacks Rank #1 (Strong Buy). This company has seen its earnings estimates surge recently, focusing on various building systems. Limbach’s stock has risen over 2000% in the past three years, while Comfort Systems and AAON have appreciated more than 400% and 200%, respectively.

Image Source: Zacks Investment Research

Homebuilder Stocks Lack Appeal Despite Peak Season’s Arrival

Bottom Line: Currently, many well-known homebuilder stocks are less attractive, even as peak construction season is on the horizon. In contrast, opportunities abound in the broader housing market, particularly among air conditioning and building systems providers.

5 Stocks with Potential for Significant Gains

A Zacks expert has identified five stocks expected to gain 100% or more in 2024. Although not all selections will perform well, past recommendations have seen impressive returns of 143.0%, 175.9%, 498.3%, and 673.0%.

Interestingly, many of these stocks remain under the radar of Wall Street, presenting a prime opportunity to invest early.

Discover These 5 Potential Home Runs >>

Below are links to detailed stock analyses:

- The Home Depot, Inc. (HD): Free Stock Analysis Report

- Zillow Group, Inc. (Z): Free Stock Analysis Report

- AAON, Inc. (AAON): Free Stock Analysis Report

- Comfort Systems USA, Inc. (FIX): Free Stock Analysis Report

- Limbach Holdings, Inc. (LMB): Free Stock Analysis Report

- Dream Finders Homes, Inc. (DFH): Free Stock Analysis Report

This article was originally published by Zacks Investment Research.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.