The S&P 500 reached a new all-time high of over 6,180 on Friday, having rebounded more than 10% from a decline in March when it hit a low of 6,144. This significant rebound is notable given that just three months prior, the index was in correction territory.

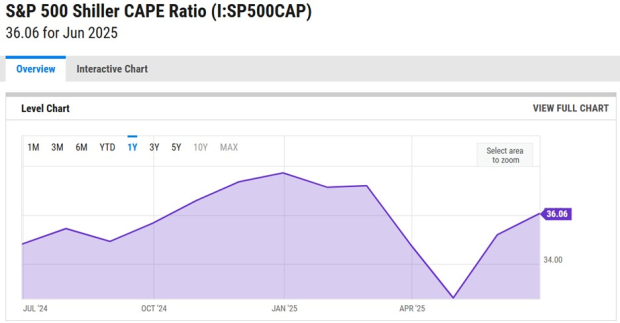

Currently, the Cape ratio for the S&P 500 stands at 36X, significantly above its historical average of 16-17X. Analysts, including Jeffrey Gundlach, had previously warned of potential market corrections, attributing concerns to the Cape ratio’s elevated readings.

Despite concerns of overvaluation indicated by the Cape ratio, recent economic developments such as a trade agreement with China and stable job growth have fostered positive market sentiment. S&P 500 earnings for Q2 are expected to rise by 4.9% year-over-year, reflecting a broader trend of increasing corporate profitability.