“`html

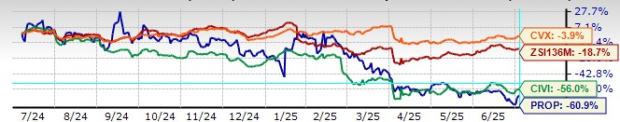

Prairie Operating Co. (PROP) has seen a dramatic decline, hitting a 52-week low of $2.74 on July 1, representing a 61% drop over the past year. This performance starkly contrasts with the Zacks Oil & Gas US Exploration & Production industry, which experienced a 19% decline. The downward trajectory raises concerns about PROP’s investment viability, especially compared to established competitors like Chevron (CVX) and Civitas Resources (CIVI).

The company’s aggressive consolidation in the Denver-Julesburg Basin comes with significant risks, including a near doubling of its share count and substantial equity dilution as it attempts to lower debt. PROP aims to massively ramp up production from approximately 7,000 barrels of oil equivalent per day (BOE/d) to over 30,000 BOE/d within a year, posing execution challenges amid negative cash flow and a bearish 32% drop in 2025 earnings-per-share estimates over the past month.

Adding to the issues, PROP has missed earnings expectations by an average of 228% over the last four quarters, with current estimates suggesting that the stock’s valuation, at 0.33 times forward sales, reflects significant market apprehensions about its financial stability and operational risks. The ongoing regulatory environment and projected declines in Brent crude prices could further strain the company’s financial outlook.

“`