“`html

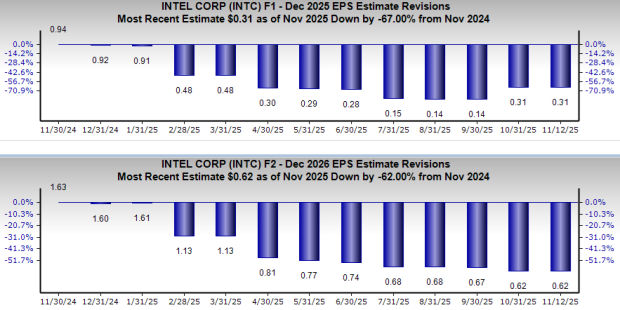

Intel Corporation (INTC) faces declining earnings estimates, with projections for 2025 dropping 67% to 31 cents and for 2026 down 62% to 62 cents. This bearish sentiment is attributed to the company’s slow adaptation to market demands, particularly in AI chips, where it lags behind NVIDIA Corporation (NVDA). Factors impacting margins include rising production costs, competition, and a shift towards over-the-top service providers.

China represented over 29% of Intel’s revenue in 2024, but increased domestic competition and U.S. export restrictions may threaten these earnings. Despite these challenges, Intel secured a $5 billion investment from NVIDIA for joint AI developments and received $7.86 billion from the U.S. Department of Commerce to boost semiconductor manufacturing. The company aims to ship over 100 million AI PCs by the end of 2025 to revitalize growth.

Over the past year, Intel’s stock has increased by 52.1%, outperforming the industry’s growth of 29.9%, but still trails behind competitors like Advanced Micro Devices, Inc. (AMD), which rose 85.8%. In response to market pressures, Intel continues to review its operations while pursuing strategies to enhance its production capabilities.

“`