“`html

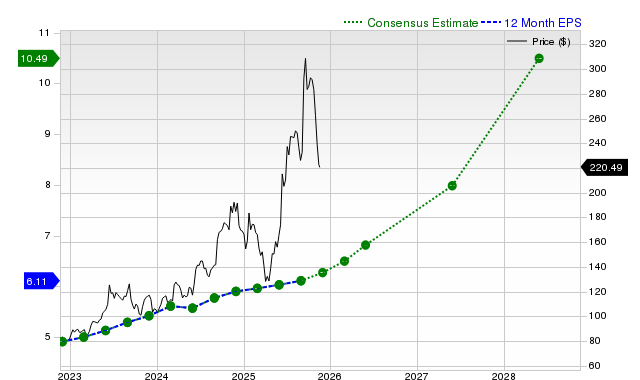

Oracle Corporation (ORCL) is currently highlighted for its stock performance, having returned +1.8% over the past month compared to the Zacks S&P 500 composite’s +3.4% and the Zacks Computer – Software industry’s +0.5%. As of the latest estimates, Oracle is projected to post earnings of $1.64 per share for the current quarter, a year-over-year change of -1.8%. The consensus estimate for the current fiscal year is $5.58, indicating an anticipated growth of +9%.

For revenue, Oracle’s expectations for the current quarter are at $14.56 billion, reflecting a year-over-year increase of +5.2%. The consensus for the current and next fiscal years stands at $53.22 billion and $57.5 billion, suggesting revenue growth rates of +6.5% and +8%, respectively. The company reported sales of $13.28 billion last quarter, surpassing the Zacks Consensus Estimate by +0.04%.

Oracle holds a Zacks Rank #3 (Hold), indicating it may perform in line with the broader market. However, the stock’s valuation suggests it is trading at a premium to its peers, receiving a Zacks Value Style Score of D.

“`