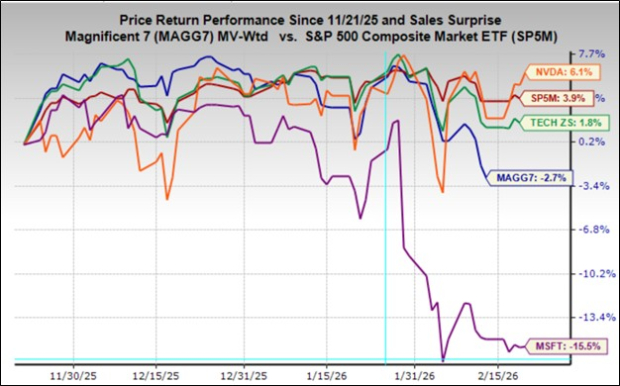

Recent sentiment regarding the Magnificent 7 tech stocks, including Amazon, Alphabet, and Microsoft, has been overwhelmingly negative. These stocks are experiencing significant underperformance, with Microsoft down 15.5% over the past three months, compared to the broader Magnificent 7’s decline of 2.7%. The underlying issue stems from concerns over rising capital expenditures related to their AI investments, exemplified by Amazon’s projected capex hike to $200 billion in 2026 from $132 billion in 2025, which is expected to exceed its operating cash flows.

Nvidia, a leading chipmaker in the AI space, is set to report its Q4 results on February 25th, expecting earnings of $1.52 per share on revenues of $65.56 billion, marking year-over-year growth of 70.8% in EPS and 66.7% in revenues. Nvidia’s impressive growth trajectory is underscored by its revenue forecast of $312 billion for the fiscal year ending January 2027, nearly four times its revenue in 2021. The Magnificent 7 group is poised to capture 25.5% of S&P 500 earnings in 2025, an increase from 23.2% in 2024, while maintaining a market cap share of 32.7% within the index.

As of February 20th, 427 S&P 500 companies, representing 85.4% of the index, have reported earnings, showing a 12.8% increase in overall earnings year-over-year and 8.8% revenue growth. Upcoming results this week include major tech players like Nvidia and others, amid expectations of continued earnings growth in the coming quarters.