Electric vehicle companies are wrapping up their 2023 production and delivery totals, and the results are in. While many in the sector have performed as expected, Fisker (NYSE:FSR) has fallen dramatically short of its production and delivery goals for the year, raising concerns about the company’s future prospects.

A Disappointing Performance

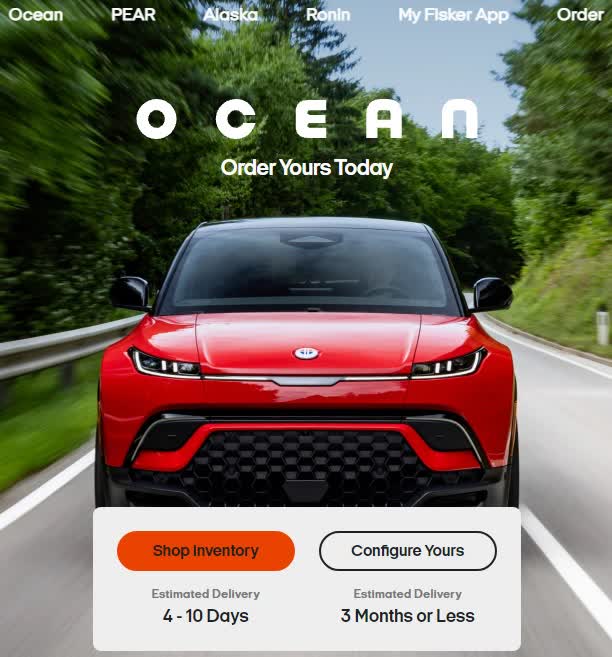

Fisker only managed to produce 10,142 units of its Ocean SUV in 2023, considerably less than the anticipated 42,400 vehicles. This shortfall has had a significant impact on the company’s revenue, which is now estimated to be around $376 million, a far cry from the initial projection of almost $2 billion.

Demand Questions

The company’s ability to fulfill the demand for its vehicles is also in question. Despite having approximately 65,000 reservations for the Ocean in early 2023, Fisker has only managed to produce less than one-sixth of that number by the end of the year. This has raised doubts about the actual demand for Fisker’s vehicles, particularly considering the current estimated waiting time for a custom-built vehicle is only three months.

Financial Concerns

Fisker finished Q3 with a little over half a billion in cash but also had nearly $1.2 billion in principal debt on the balance sheet. With a cash burn of over $330 million in Q3 and plans to launch multiple new vehicles in the coming years, the company may need to raise more capital to sustain its operations.

Analyst Outlook

Despite these challenges, street analysts remain optimistic about Fisker’s prospects, with an average price target representing more than 150% upside from current levels. However, with only a handful of analysts covering the company, the stock’s valuation continues to face headwinds, especially when compared to its competitors in the electric vehicle space.

Rating Downgrade

In light of these concerns, I am downgrading Fisker’s stock to a sell. The company’s significant production and delivery shortfalls, coupled with ongoing cash burn and uncertain demand, paint a troubling picture for the future. While the current valuation may appear tempting, the risk of further disappointment and potential capital raises could weigh heavily on the stock’s performance moving forward.