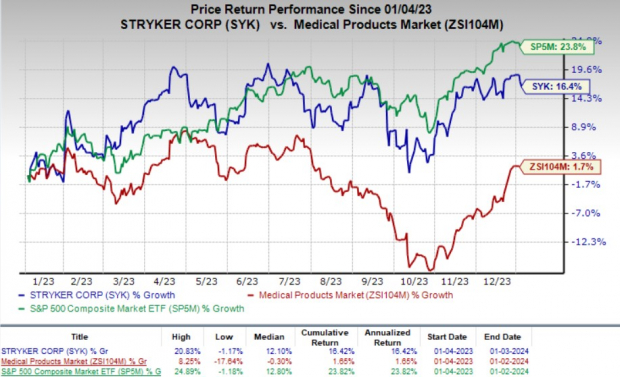

Stryker Corporation SYK is set for a solid growth trajectory backed by a formidable robotic arm-assisted surgery platform, Mako, and a diverse product portfolio. The company has seen a 16.4% stock increase in the past year, far surpassing the industry’s 1.7% rise, and demonstrating a substantial leap compared to S&P 500 Index’s 23.8% upturn.

With a market cap of $112.54 billion, Stryker is a leading player in the orthopedic market and projects a 10.1% growth in earnings over the next five years. SYK’s 3.9% earnings yield fares significantly better than the industry average of 0.8%.

Image Source: Zacks Investment Research

Factors Propelling Stryker’s Growth

Stryker continues to witness vigorous performance in the United States as well as strong international sales. These positive trends are expected to persist due to ongoing procedural recovery, a robust order book for capital equipment, and improved pricing. The company is optimistic that this momentum will carry through to 2024.

Stryker is dedicated to expanding Mako with launches in new markets and is confident about substantial growth in Mako revenues in 2024. The company anticipates this growth to be driven by continued adoption, new launches, and software upgrades.

Moreover, Stryker’s diversified product portfolio insulates it from significant sales declines during economic uncertainty. Its extensive product range includes Mako as well as products for hip and knee surgeries.

Stryker’s steadfast commitment to innovation and customer support is poised to fuel growth post-pandemic. The company allocated 6.6% of net sales to adjusted research and development expenses in the first nine months of 2023, underscoring its dedicated innovation efforts. Management believes this focus will drive new product launches.

In 2022, Stryker introduced a game-changing Spine Guidance Software — Q Guidance System — for spine applications. The system demonstrated promising uptake in the first half of 2023. Additionally, the company launched the Q Guidance system with Cranial Guidance software in the United States. Stryker also rolled out a fully autonomous guidance system, Ortho Q Guidance, tailored for orthopedic customers. These innovations are expected to continue driving revenues in 2024.

In September, Stryker unveiled the next generation of minimally-invasive surgical cameras, the 1788 platform. The enhanced camera is poised to elevate surgical outcomes across various specialties. Moreover, the FDA’s 510k clearance of its Pangea systems for Femur, Fibula, Tibia, Humerus, and Utility indicates potential revenue growth.

Stryker is implementing cost-cutting measures, including restructuring initiatives, which bode well for 2024. Strong customer demand for existing products and new launches further enhance the company’s prospects in the coming year. The adjusted selling, general, and administrative expenses during the first nine months of 2023 were 34.4% of net sales, expanding approximately 90 basis points year over year.

Challenges Facing the Stock

Stryker faces potential headwinds from unfavorable currency rate fluctuations impacting its core businesses. Additionally, inflationary pressure is squeezing margins, posing further challenges.

Estimate Trend

The Zacks Consensus Estimate for 2024 earnings per share stands at $11.53, indicating a 10.8% year-over-year growth. Over the past 60 days, the bottom-line estimate for 2024 has improved by 0.3%. The consensus mark for revenues is placed at $21.81 billion, signaling a 7.5% increase from the previous year.

Stryker Corporation Price

Stryker Corporation price | Stryker Corporation Quote

Top Medical Stocks to Consider

Other promising stocks in the medical space include DaVita Inc. DVA, Biodesix BDSX, and Integer Holdings Corporation ITGR.

DaVita boasts a Zacks Rank #1 (Strong Buy) and projects an estimated long-term growth rate of 17.3%. With earnings surpassing estimates and a substantial stock growth, it’s carving a strong path in the healthcare domain.

On the other hand, Biodesix, with a Zacks Rank #2 (Buy), holds an estimated growth rate of 32.3% for 2024, positioning itself as a robust contender in the medical services industry.

Integer Holdings, with an estimated long-term growth rate of 15.8% and a Zacks Rank of 2, holding a remarkable track record of earnings surprises, remains a stock worth considering.