Seeking to unearth stocks that boast not only an affordable price tag but also fundamental value, investors are perpetually scouting for “cheap” stocks with the potential for substantial upside.

Three companies currently piquing interest due to their promising risk-to-reward ratio are Direct Digital, Vaalco Energy, and Grifols.

The Beacon of Bright Prospects: Direct Digital

Direct Digital, an advertising and marketing technology company in the consumer discretionary sector, is creating a stir with its Zacks Rank #1 (Strong Buy). Priced around $13 a share, the company is on the cusp of a substantial expansion, with a high double-digit percentage growth forecasted for both its top and bottom lines in fiscal 2024.

Despite trading at a 17.5X forward earning multiple, Direct Digital’s market share-expanding trajectory does not demand an exorbitant premium. Additionally, the skyrocketing earnings estimate revisions for FY23 and FY24 reinforce the potential for advertising-related businesses to thrive as inflation eases.

A Diamond in the Rough: Vaalco Energy

Vaalco Energy, an independent energy company involved in crude oil and natural gas acquisition, is an intriguing pick within the energy sector. Despite its stock trading just under $5, Vaalco’s Zacks Rank #1 (Strong Buy) adds to its allure, with a projected FY24 EPS of $1.49 per share, signifying a robust rebound from the estimated $0.35 a share for FY23.

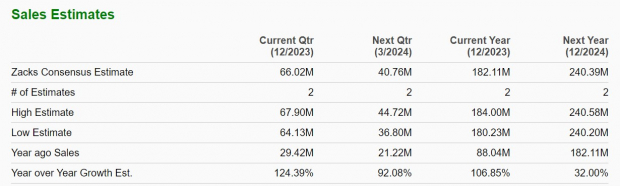

At a mere 3.1X forward earnings multiple based on FY24 EPS projections, Vaalco Energy appears considerably undervalued. Moreover, with total sales forecasted to surge in both FY23 and FY24, the company’s 1.2X price-to-sales valuation adds to its attractiveness.

A Jewel in the Medical Sector: Grifols

Grifols, a Spain-based healthcare company, rounds out the trio with its Zacks Rank #2 (Buy) and stock trading around $11. The company’s steadfast top-line growth and heightened profitability make it a compelling investment prospect. With expected significant increases in total sales and EPS for both FY23 and FY24, Grifols stock trades attractively at 9.7X forward earnings.

In summary, these stocks are primed to deliver substantial value, bolstering their allure as financially sound investments at the outset of the year. It would not be surprising if Direct Digital, Vaalco Energy, and Grifols’ stock vaulted significantly higher in 2024 from their current levels.