After revealing strong fiscal second-quarter results on Thursday, investors might be contemplating whether it’s the opportune moment to grab a slice of Lamb Weston’s stock. The company, in recent years, has garnered considerable attention on Wall Street, analogous to the recognition earned by other leading consumer food companies such as General Mills and Hormel Foods.

The reigning monarch of frozen potato products in North America, Lamb Weston retains a formidable global footprint. Let’s evaluate whether the time is ripe for investors to consider acquisition of its stock following an exceptional performance in Q2.

Quarterly Performance & Notable Developments

Lamb Weston CEO Tom Werner hailed the company’s robust financial performance, underscored by efficient operations across customer channels in North America and major international markets. This success was attributed to strategic pricing initiatives driven by inflation, enhancements in customer and product mix, and cost-saving measures in the supply chain.

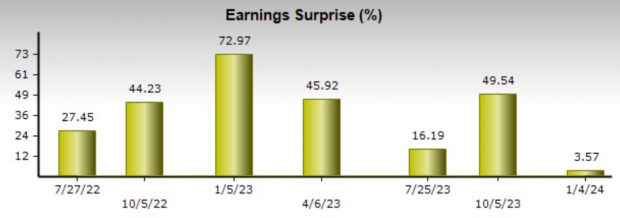

The company’s net sales surged by 36% year-over-year to $1.73 billion, surpassing the Zacks consensus by 2%. Furthermore, adjusted net income soared by 17% year-over-year to $212 million, with earnings per share witnessing a 13% uptick to $1.45, surpassing expectations by 3%. The quarter also saw Lamb Weston repurchasing $50 million of its common stock and boosting its quarterly dividend by 29% to $0.36 per share.

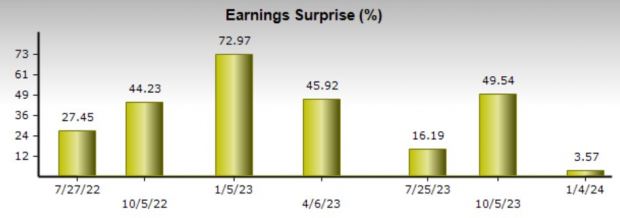

Looking ahead to fiscal 2024, Lamb Weston has upgraded its adjusted net income projection from $805-$875 million to $830-$900 million, translating to $5.50-$5.95 a share to $5.70-$6.15 per share. The company maintained its net sales goal of $6.8-$7 billion and adjusted EBITDA target of $1.54-$1.62 billion.

Image Source: Zacks Investment Research

Growth Trajectory & Future Expectations

Based on Zacks estimates, Lamb Weston’s annual earnings are projected to surge by 25% in fiscal 2024 to $5.84 per share from $4.68 a share in 2023. Moreover, total sales are anticipated to climb by 28% this year to $6.85 billion compared to $5.35 billion in the prior year. In fiscal 2025, sales are predicted to edge up by 5% to over $7.1 billion.

Image Source: Zacks Investment Research

Market Performance

While several consumer food stocks have suffered setbacks over the past year, Lamb Weston’s stock has flourished, surging by a commendable +10% to outstrip the Zacks Food-Miscellaneous Markets’ -6%, and significantly surpassing the -22% and -30% plunges of General Mills and Hormel Foods, respectively. Over the last three years, Lamb Weston’s stock has soared by +40%, outshining the S&P 500’s +26%, and eclipsing its Zacks Subindustry’s -2%, General Mills’ +12%, and Hormel Foods’ -29%.

Image Source: Zacks Investment Research

Final Thoughts

Lamb Weston’s stock currently holds a Zacks Rank #3 (Hold). Despite this, the company’s enhanced EPS guidance could potentially trigger a surge in annual earnings estimates in the upcoming weeks, possibly paving the way for a buy rating as Lamb Weston’s prospects appear even more promising following its Q2 report.

Just Released: Zacks Top 10 Stocks for 2024

Hurry – you can still get in early on our 10 top tickers for 2024. Hand-picked by Zacks Director of Research, Sheraz Mian, this portfolio has been stunningly and consistently successful. From inception in 2012 through November, 2023, the Zacks Top 10 Stocks gained +974.1%, nearly TRIPLING the S&P 500’s +340.1%. Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2024. You can still be among the first to see these just-released stocks with enormous potential.

Lamb Weston (LW): Free Stock Analysis Report

General Mills, Inc. (GIS): Free Stock Analysis Report

Hormel Foods Corporation (HRL): Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.