Strong Momentum Despite Cost Pressures

Monster Beverage Corporation MNST has been on a winning streak, driven by its robust performance in the energy drinks category. The company’s strategic pricing initiatives, coupled with lower freight-in costs and reduced aluminum can expenses, have significantly bolstered its profit margins. This sustained momentum in market performance underscores a resounding victory for the beverage titan.

Notably, Monster Beverage has also found considerable success in its innovative product launches, further solidifying its position in the industry. The company’s foresight and calculated risk-taking have proven to be critical factors propelling its upward trajectory.

Year over year in the third quarter of 2023, Monster Beverage’s sales saw an impressive uptick of 14.3%, painting a picture of solid financial health. As the company’s earnings soared by 36.7%, it became abundantly clear that their strategic maneuvers were bearing fruit.

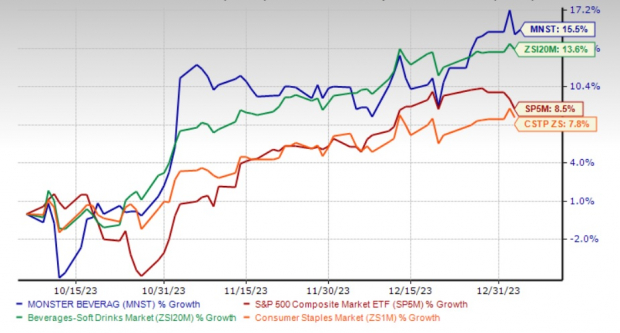

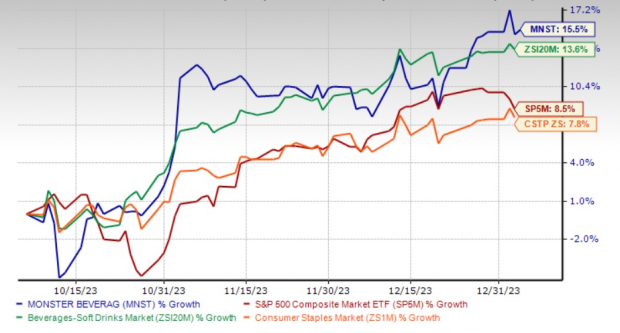

With a market capitalization of $59.8 billion and a Zacks Rank of #3 (Hold), MNST has managed to outperform its peers, securing a 15.5% increase in share value over the past year. This stands in stark contrast to the industry’s growth of 13.6%, indicating that Monster Beverage has left a trailblazing impression in the market.

The Zacks Consensus Estimate augurs positively for MNST’s sales and earnings, forecasting growth rates of 13.3% and 39.3%, respectively, compared to the previous year’s figures.

Image Source: Zacks Investment Research

Favorable Trends Fuelling Growth

The remarkable expansion of the global energy drink market has undeniably played a pivotal role in delivering favorable tailwinds for Monster Beverage. With an ever-increasing demand for energy drinks, the company has been able to flex its muscles and expand its market share significantly.

Amidst these upbeat market trends, the energy drinks segment continues to be the lynchpin of Monster Beverage’s revenue stream. The company’s diversified portfolio of energy drink brands has steered a commendable 13.7% surge in net sales for the Monster Energy Drinks segment in the third quarter of 2023.

Moreover, Monster Beverage’s astute pricing strategies, deftly calibrated to counter inflationary headwinds, have proven to be game-changers. These initiatives have led to a commendable 170 basis points gross margin expansion to 53% in the third quarter, along with a staggering 22% year-over-year surge in operating income.

Product innovation boasts a longstanding tradition of serving as the driving force behind MNST’s accomplishments. Notably, the company saw triumph in the third quarter with the successful launch of The Beast Unleashed—a flavored-malt-beverage alcohol product— in the United States. The product was met with resounding acclaim and is set to achieve nationwide distribution, closely followed by the upcoming launch of Nasty Beast Hardcore Tea, aimed at achieving nationwide distribution in the first half of 2024.

Challenges on the Horizon

While Monster Beverage is undoubtedly riding on a wave of success, it is not immune to mounting cost pressures. The changing dynamics of consumer preferences are directly impacting the sales volumes of soda beverages and energy drinks, exerting a discernible strain on the company’s profits and margins.

Identifying Lucrative Opportunities

Despite the challenges, there exist compelling investment prospects in the broader Consumer Staples sector. Stocks such as Dutch Bros BROS, Fomento Economico Mexicano FMX, and Molson Coors TAP present investors with promising potential for substantial returns.

Dutch Bros, currently holding a Zacks Rank #1 (Strong Buy), has consistently delivered impressive earnings surprises, boasting a trailing four-quarter average of 57.1%. Similarly, Fomento Economico Mexicano, or FEMSA, with a Zacks Rank #1, has managed a striking 23.2% trailing four-quarter average earnings surprise. Meanwhile, Molson Coors, with a Zacks Rank #2 (Buy), secured a 41.3% trailing four-quarter average earnings surprise.

The Zacks Consensus Estimates forecast robust growth for all three companies, indicating a rise in sales and earnings from the prior year levels.

Opportunities such as these present investors with the chance to explore a diverse array of investment avenues, with the potential to secure substantial gains.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.