Westlake Corporation (WLK) sees its shares scaling new heights, despite a dismal earnings outlook. Additionally, WLK’s position in the Chemical – Plastic segment currently ranks in the lowest 18% among 250 Zacks industries.

The WLK Basics

Westlake Corporation is a crucial manufacturer and supplier of essential materials and products. Its diverse offerings encompass ethylene, polyethylene, styrene, vinyl intermediates, PVC, fence, decking components, and more.

The company harnesses internally-produced basic chemicals to produce higher value-added chemicals and building products. Its two primary segments are Performance and Essential Materials, as well as Housing and Infrastructure Products.

However, Westlake faces headwinds in the form of a slowing housing market and a decline in industrial and construction activities. Its growth prospects are further hampered by a challenging stretch of growth. Zacks estimates project a 20% drop in revenue for fiscal 2023, followed by another 2% downturn next year.

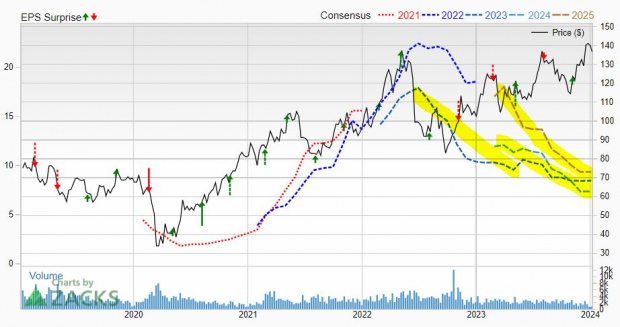

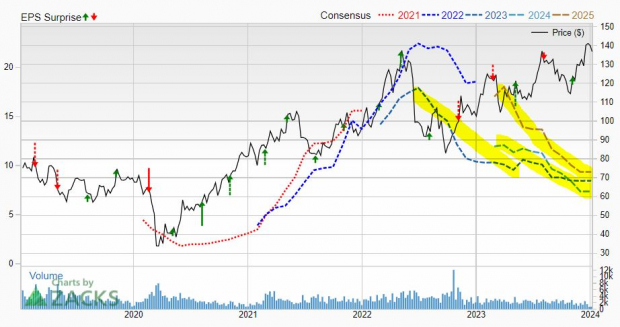

On the earnings front, Westlake’s adjusted earnings are anticipated to plummet by 51% in FY23, with a further 13% decline expected the following year. The company’s EPS outlook has deteriorated steadily since mid-2022, with no signs of recuperation.

Image Source: Zacks Investment Research

The consensus estimate for WLK’s Q4 earnings has plunged 35% over the last two months, with the most recent estimate trailing the already pessimistic consensus. In prepared Q3 remarks, CEO Albert Chao attributed the challenging conditions to weak macroeconomic factors such as elevated inflation and high interest rates, which have dampened demand for all products and led to low sales prices in the PEM segment.

Despite the downward earnings spiral and bleak near-term expectations, WLK shares have surged over 30% in the past year, outpacing the Zacks Basic Materials sector’s 7% climb. Moreover, the stock has soared by approximately 100% in the last five years, surpassing the S&P 500 and hitting new highs after Christmas.

Currently, Westlake stock is trading well above its 50-day and 50-week moving averages, indicating a potential impending pullback.

The Bottom Line

Westlake’s downward earnings revisions have resulted in a Zacks Rank #5 (Strong Sell). Consequently, investors may be well-advised to steer clear of the stock for now. However, some may consider keeping WLK on their long-term watchlists.

Just Released: Zacks Top 10 Stocks for 2024

Harness the opportunity to be among the first to explore these recently unveiled stocks with immense potential.

Interested in Zacks’ latest recommendations?

Westlake Corp. (WLK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.