Brokers are a stock investor’s North Star. But, can the views of these Wall Street pros actually guide your investment moves? Before we delve into the reliability of broker recommendations and how to exploit them favorably, let’s peek into the sentiments echoing on the Street regarding Dave & Buster’s (PLAY).

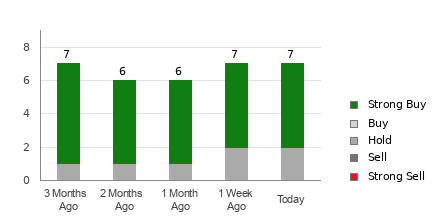

It comes as no surprise that Dave & Buster’s currently basks in the glow of an Average Brokerage Recommendation (ABR) of 1.38, a figure derived from the assessments of eight brokerage firms. On the brokerage scale of 1 to 5, which spans from Strong Buy to Strong Sell, this implies a standing leaning closer to Strong Buy.

In the breakdown, six of the eight recommendations counsel a Strong Buy, while one suggests a Buy. This reflects an overwhelming 75% being in favor of Strong Buy and a further 12.5% backing Buy.

The Perils of Blindly Trusting Brokerage Recommendations

Inching closer and fixating on a decision singularly based on this statistic, however, could be a frought move. Numerous studies have put brokerage recommendations under the microscope, and the findings aren’t flattering. The haunting truth is that these notions hardly furnish a reliable roadmap for cherry-picking profitable stocks. Why the skepticism, you wonder? Well, let’s take a peek behind the curtain.

A latent partiality often distorts the views of these sell-side analysts, courtesy of their vested interest in the stocks they cover. This predisposes them to a marked proclivity for doling out buoyant ratings. To cite a telling statistic, these analysts dole out five “Strong Buy” recommendations for every “Strong Sell” tip. This lopsidedness mars their outlook, rendering it far removed from an investor’s reality. So, pinning your hopes solely on their suggestions might lead you down the garden path.

Validate Adherence to the Zacks Rank

Instead, paving your investment path through the uncharted wilds of financial markets requires a guiding light like the Zacks Rank — a trusted symposia of stock ratings put through stringent external audits. This nifty tool segregates stocks into five clusters ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell) and is a reliable fortune-teller of a stock’s immediate price movements. Aligning this with the ABR could be your winning ticket.

But, before we take another stride, remember, don’t confuse apples with oranges. In terms of measurements, ABR is crafted exclusively from broker endorsements, typically reflected in decimals (e.g., 1.28). On the flip side, the Zacks Rank is a bird of a different feather, leaning on a quantitative model designed to capture the power of earnings estimate revisions, unfurled in whole numbers from 1 to 5.

The Zacks Rank vs. ABR

Where do the paths diverge? The Zacks Rank hinges on the bedrock of earnings estimate revisions while its counterpart relies on the opinions of brokerage analysts. And this is where the scales tilt radically. Data incontrovertibly underscores a compelling correlation between trends in earnings estimate revisions and the immediate price trajectory of a stock. With suitable words of caution, the latter hardly proves to be on par.

Casting a deeper look, the diverse Zacks Rank grades are consistently applied across the entire gamut of stocks subject to current-year earnings estimates touched upon by brokerage analysts. This impartiality bedecks it with an unassailable balance.

The Verdict on PLAY

Folding back on Dave & Buster’s, the Zacks Consensus Estimate for the current year remains steadfast at $3.19 over the past month. This tenacity underpinning analysts’ projections casts a credible glow over the stock’s near-term performance, landing it a Zacks Rank #3 (Hold). Yet, it’s worth approaching the Buy-equivalent ABR with a modicum of caution.

Preferring a well-calculated stride over irrational bulls, making friends with the Zacks Rank might just hold the key to unlocking sparkling investment vistas. In an arena littered with confounding picks, letting the data do the talking could be your ace in the hole.