Today marked a momentous occasion for Bitcoin enthusiasts as the Securities and Exchange Commission (SEC) officially approved the creation of spot Bitcoin exchange-traded funds (ETFs). The culmination of years of anticipation, this watershed ruling opens the floodgates for a transformed landscape in cryptocurrency investment.

The approval grants Grayscale Investments, among others such as BlackRock and Ark Invest, the green light to convert their closed-end Bitcoin funds into ETFs, effectively democratizing access to Bitcoin for millions of U.S. investors. The public’s fervor for this development was evidenced by the Bitcoin ETF being the top trending topic on Twitter for several consecutive days.

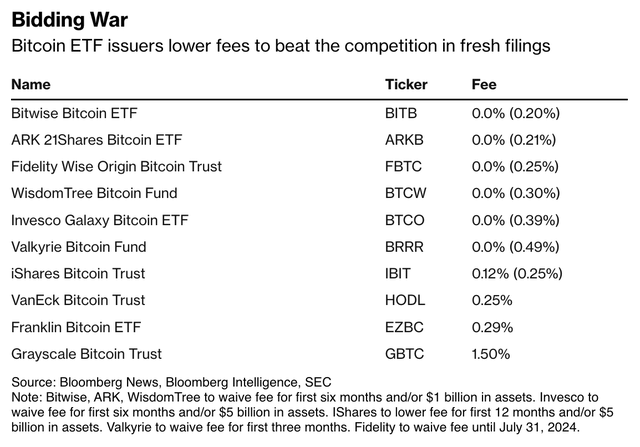

The conversion process for the ETFs is set to commence in the morning, ushering in a new era for crypto. As Grayscale’s Bitcoin Trust redeems shares until it trades at net asset value, the billions of dollars previously trapped inside the fund now have the opportunity to flow freely. Notably, the approval introduces healthy competition to the fund space, with new funds boasting significantly lower fees, opening up new avenues for investors to maximize their gains.

Fee Structures of Approved Bitcoin ETFs

The SEC’s blanket approval of the ETF applications is expected to ignite a pricing war among ETF issuers, prompting a reduction in fees to attract assets. This competitive dynamic has led to the introduction of new fee schedules with significantly lower costs for investors.

Impact of Spot Bitcoin ETFs on the Market

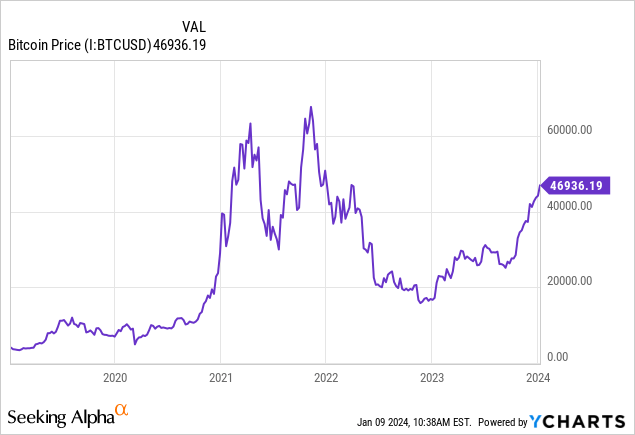

Unquestionably, the advent of spot Bitcoin ETFs catapults demand for Bitcoin, finally providing a seamless avenue for investors to gain exposure to the cryptocurrency. Previously, the absence of a spot ETF acted as a damper on investor demand, resulting in subdued Bitcoin purchases.

Investors historically faced limited options, such as platforms like Coinbase with exorbitant transaction fees, or platforms like BlockFi and Celsius that proved to be unreliable. The Bitcoin Futures ETF, BITO, also failed to live up to expectations, trailing behind Bitcoin’s performance by approximately 3.5% annually since its inception. Indeed, the approval underscores a pivotal milestone, making Bitcoin accessible through viable investment vehicles.

The influx of speculative capital into Bitcoin ahead of the ETF approval eventuates in an inevitable market correction, as profit-taking ensues. However, the intrinsic scarcity of Bitcoin implies that even minor alterations in demand can trigger substantial price movements. Correlating with historical trends, the scarcity of Bitcoin bodes well for its long-term value, especially in light of the upcoming halving event in 2024.

It is prudent for current GBTC holders to consider transitioning to a lower-fee ETF, effectively capitalizing on the favorable conversion. While the long-term outlook for Bitcoin remains promising, potential price volatility necessitates a cautious and strategic approach to investment.

Modern portfolio theory advocates for a judicious allocation to Bitcoin, aligning with its market value within the investible global financial markets. As the market adapts to this pivotal juncture, allocating resources to the iShares Spot Bitcoin fund presents an opportunity to partake in Bitcoin’s potential to serve as a decentralized store of wealth.

Concluding Remarks

The SEC’s historic ruling marks a transformative moment for Bitcoin, signifying its integration as a mainstream asset class through spot Bitcoin ETFs. For GBTC investors, this juncture offers an opportune moment to capitalize on the conversion to a lower-fee ETF. Prospective investors are encouraged to exercise diligence, considering measured allocation to the iShares Spot Bitcoin fund to harness the enduring potential of Bitcoin in the evolving financial landscape.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.