Last year saw a seismic shift in technology as the generative AI boom rippled through the industry. The surge of interest in ChatGPT and related technologies not only buoyed AI software companies but also sparked a ripple effect that benefited hardware vendors as businesses increasingly explored utilizing generative AI to streamline operations.

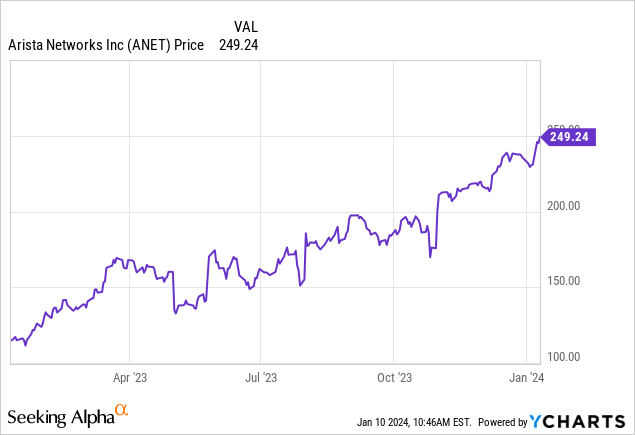

Arista Networks (NYSE:ANET), the preeminent cloud-based networking hardware vendor, has been riding high on this trend. With successful execution of double-digit revenue growth and efforts to overcome supply chain constraints, Arista’s stock has surged by over 2x in the past year:

The Driving Forces Behind Earnings Growth

Looking ahead to FY24, Arista continues to show promise, justifying a bullish stance despite its recent rapid ascent. In 2022, my outlook was cautiously neutral as the company grappled with declining margins, supply chain uncertainties, and tepid EPS growth. However, Arista has not only surmounted these challenges but has also capitalized on robust growth drivers.

For those new to Arista, here’s the long-term bullish case for the stock:

- Leadership in Cloud-Based Networking Technology. Arista has consistently outpaced its peers as the premier vendor of cloud-oriented networking hardware, steadily gaining market share from incumbents such as Cisco (CSCO) as major players, including Meta (META), gravitate to Arista’s products.

- AI Tailwinds. The surge in AI investments has led to heightened datacenter buildouts, driving demand for networking hardware – a tailwind for Arista’s growth trajectory.

- Improvement in Enterprise IT Budgets. A more favorable macroeconomic outlook for 2024 suggests a potential normalization of enterprise buying patterns, boding well for Arista, which relies heavily on revenue from large enterprises.

- Enhanced Supply Chain Position. Arista has streamlined lead times for customers, gaining cost efficiencies and reducing inventory reserves, thereby mitigating the risk of producing a mismatched product mix.

- Robust Gross Margin Profile. Despite selling hardware, Arista boasts software-like financials, evident in its 60%+ pro forma gross margins, providing ample scalability for earnings.

Risk Factors and Valuation Considerations

Notwithstanding these strengths, risks cannot be overlooked. Arista’s revenue heavily hinges on a handful of major customers, such as Meta and Microsoft (MSFT), termed as “cloud titans.” These customers, along with AI-related purchases, are expected to contribute 40% of overall revenue, posing a risk due to the lumpy nature of buying patterns and historical periods of demand contraction.

Moreover, while Arista’s improved supply chain position is a net positive, reduced customer-facing lead times may dampen revenue visibility in the short term. The current ~30% y/y revenue growth may potentially reflect a pull-forward of demand, leading to flatter prospects in 2024.

Another pivotal risk is the valuation. Wall Street analysts project Arista to achieve $7.28 of pro forma EPS (+11% y/y) on $6.56 billion of revenue, translating to a 34x P/E ratio at current share prices near $249 – a steep valuation when balanced against earnings growth. Nonetheless, Arista’s exceptional growth profile, with a PEG ratio of 0.7x based on current EPS growth rates, signifies opportunity.

Furthermore, Arista’s unencumbered $4.5 billion net cash, approximately 6% of its $77.5 billion market cap, contributes to its overall valuation, potentially reducing valuation multiples by 6% on an “ex-cash” basis.

Recent Trends Validate Margin Expansion and Sustained Growth

Recent financial releases from Arista substantiate the stock’s momentum. The company’s gross margins expanded by 190bps y/y to 63.1%, underpinned by higher enterprise shipments, improved supply chain costs, and a shift away from pandemic-induced supply constraints. Moreover, achieving a 430bps y/y expansion in pro forma operating margins to 46.1% places Arista among the industry’s top performers, driven by lower product introduction and demo costs, and operating leverage on sales/marketing and general/administrative costs.

Looking ahead to Q4, Arista’s $1.50-$1.55 billion revenue outlook represents 20% y/y top-line growth, sustaining 63% gross margins from Q3, further validating the company’s growth trajectory:

Key Takeaways

With aggressive earnings expansion, sustained growth tailwinds fueled by enterprise AI adoption, and a leading market position, Arista is primed for a promising 2024. It’s time to ride the upward wave.