After mostly mixed but favorable Q4 results from big banks last week, investors may want to keep their eye on the finance sector, as several financial industries are standing out.

At the moment, quite a few finance stocks currently hold spots on the Zacks Rank #1 (Strong Buy) list. In addition to making the case for being undervalued, these financial companies also offer dividend yields over 5%, making now an ideal time to invest.

Investment Management Firms

AllianceBernstein AB and Janus Henderson Group JHG are two wealth management players to watch as the Zacks Financial-Investment Management Industry is currently in the top 24% of over 250 Zacks industries. Notably, their dividend yields currently tower over the industry average of 2.78% and the S&P 500’s 1.39% average.

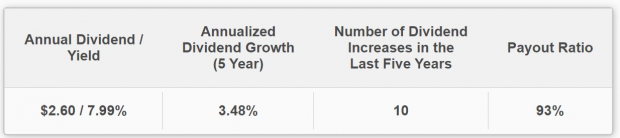

Private wealth management leader AllianceBernstein’s attractive 7.99% annual dividend yield looks more enticing with shares trading at 10.8X forward earnings and still at discounts to its decade-long high of 15.9X and the median of 12.3X. This comes as AllianceBernstein is now forecasted to round out FY23 with earnings down -13% but FY24 EPS is projected to rebound and climb 17% to $3.00 a share.

AllianceBernstein has remained a viable option for income investors with the company raising its dividend 10 times in the last five years.

Image Source: Zacks Investment Research

Also operating as a global asset manager, Janus Henderson’s stock trades at a reasonable 11.5X forward earnings multiple. This is a slight discount to its decade-long median and 45% below highs of 21.2X.

Janus Henderson’s 5.47% annual dividend yield is luring and JNH shares are up a respectable +11% over the last year despite the financial firm being expected to round out FY23 with earnings down -9% to $2.37 per share. With that being said, Janus Henderson’s EPS is forecasted to stabilize and rise 4% this year, and earnings estimate revisions have remained higher for both FY23 and FY24 over the last 60 days.

Image Source: Zacks Investment Research

Regional Banks

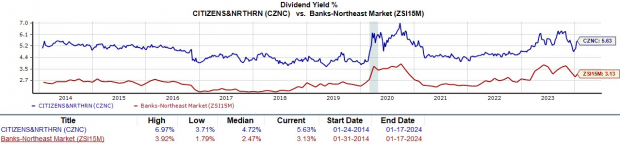

Several regional banks continue to stand out as well in terms of their attractive valuations and sizable dividend yields. Citizens & Northern Corp CZNC and Financial Institutions’ FISI stock fit the bill out of the Zacks Banks-Northeast Industry which is currently in the top 26% of all Zacks industries.

Citizens & Northern Bank has branches throughout Pennsylvania and CZNC shares trade at a reasonable 12.3X forward earnings multiple while offering a 5.63% annual dividend yield that nicely tops the industry average of 3.13%.

Image Source: Zacks Investment Research

Financial Institutions’ 5.61% dividend yield pleasantly tops the industry average as well with FISI shares trading at just 6.7X forward earnings. Operating through its banking subsidiary Five Star Bank, Financial Institutions’ presence expands through Western and Central New York.

Further making Financial Institutions a strong option for income investors, its dividend has increased five times in the last five years but is only at a 36% payout ratio which suggests much more hikes could be in store down the line.

Image Source: Zacks Investment Research

Bottom Line

Correlating with their Zacks Rank #1 (Strong Buy), these finance stocks are receiving positive earnings estimate revisions for fiscal 2024. Benefiting from the strengthened outlooks of their respective industries, this makes them even more attractive to income investors.

Zacks Reveals ChatGPT “Sleeper” Stock

One little-known company is at the heart of an especially brilliant Artificial Intelligence sector. By 2030, the AI industry is predicted to have an internet and iPhone-scale economic impact of $15.7 Trillion.

As a service to readers, Zacks is providing a bonus report that names and explains this explosive growth stock and 4 other “must buys.” Plus more.

Download Free ChatGPT Stock Report Right Now >>

AllianceBernstein Holding L.P. (AB) : Free Stock Analysis Report

Financial Institutions, Inc. (FISI) : Free Stock Analysis Report

Janus Henderson Group plc (JHG) : Free Stock Analysis Report

Citizens & Northern Corp (CZNC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.